Beeg Blue Whale (BEEG) Staking & DAO Governance Complete Guide: Passive Income & Community Decisions

Executive Summary

Key Takeaways:

- BEEG plans to implement staking mechanisms allowing holders to lock tokens and earn passive income

- DAO governance achieved through NFT holders participating in major project decision voting

- Play-to-Earn games like Beeg Jump Game provide multiple token rewards

- Staking helps stabilize token economics and reduce speculative selling

- Governance participation requires understanding blockchain technology and smart contracts

Understanding Cryptocurrency Staking Basics

What is Token Staking?

- Additional token issuance

- Transaction fee sharing

- Increased governance weight

- Project special benefits

BEEG Staking Mechanism Overview

- Different lock periods offer different APY (Annual Percentage Yield)

- Short-term pool (30 days): Lower APY but high flexibility

- Medium-term pool (90 days): Balances yield with liquidity

- Long-term pool (180+ days): Highest APY rewards long-term holders

- Revenue generated from games like Beeg Jump Game

- Future NFT marketplace transaction fee sharing

- Ecosystem partner revenue sharing

- Possible token inflation rewards (requires community vote)

- Free withdrawal after predetermined lock period ends

- Early unstaking may incur penalty fees

- Rewards accumulate real-time, viewable anytime

BEEG DAO Governance Structure Explained

Decentralized Autonomous Organization (DAO) Principles

- No CEO or board of directors

- Decisions made through community voting

- Smart contracts automatically execute approved proposals

- All proposals and voting records publicly viewable

- Fund flows completely transparent on Sui blockchain

- Community can audit project finances real-time

- Holding BEEG tokens or governance NFTs grants voting rights

- Voting weight usually proportional to holdings or staked amount

- Avoids "one person one vote" leading to Sybil attacks

BEEG Governance Mechanism Implementation

- NFT holders enjoy voting rights

- NFTs potentially obtained by staking BEEG tokens

- Different tier NFTs may have different voting weights

- NFTs may also unlock special features and rewards

- Proposal Submission:

- Members holding certain amount of BEEG can submit proposals

- Proposals must clearly describe objectives, execution plans, and budgets

- Community discussion period typically 3-7 days

- Community Discussion:

- Public discussion on Discord/Telegram community

- Proposer answers community questions

- Modify and refine proposals when necessary

- Formal Voting:

- Voting period typically 7-14 days

- Requires minimum voting rate (e.g., 10% of total supply)

- Usually requires simple majority (>50%) or special majority (>67%) to pass

- Execution Implementation:

- Approved proposals executed by community volunteers or delegated teams

- Major proposals may trigger smart contract automatic execution

- Regular progress reports to community

- Staking reward distribution ratio adjustments

- New feature development priorities

- Marketing budget allocation

- Partnership establishment

- Token economics model parameter modifications

- Community fund usage

Play-to-Earn and Staking Rewards

Beeg Jump Game Ecosystem

- Free to play but requires wallet connection

- Players holding BEEG tokens receive bonuses

- Game performance (scores, rankings) determines reward share

- Weekly/monthly reward pool distribution

- BEEG tokens as primary rewards

- SUI native token rewards

- Partner project tokens

- Special NFT drops

- Staked BEEG boosts in-game earning multipliers

- Unlocks exclusive game content and characters

- Priority access to new game testing

- Additional daily login rewards

Staking Yield Estimation

- Stake amount: 1,000,000 BEEG (approximately $24)

- Stake period: 90 days

- Estimated APY: 15%

- Expected return: approximately 37,500 BEEG ($0.90)

- Stake amount: 50,000,000 BEEG (approximately $1,200)

- Stake period: 180 days

- Estimated APY: 25%

- Expected return: approximately 6,250,000 BEEG ($150)

- Plus game rewards: additional value potentially $50-100

- Stake amount: 500,000,000 BEEG (approximately $12,000)

- Stake period: 365 days

- Estimated APY: 40%

- Expected return: approximately 200,000,000 BEEG ($4,800)

- Plus governance NFT benefits and priority project opportunities

How to Start Staking BEEG

Pre-Staking Preparation

- Purchase BEEG on AscendEX or BlueMove DEX

- Prepare sufficient SUI for gas fees

- Recommend using Sui Wallet or Martian Wallet

- Ensure wallet supports Sui network

- Safeguard private keys and seed phrases

- Visit BEEG official staking DApp

- Connect wallet and authorize

- Verify contract address to avoid phishing

Staking Operation Steps

- Select Staking Pool: Choose lock period based on risk preference

- Enter Stake Amount: Recommend keeping some tokens unstaked for liquidity

- Confirm Transaction: Check gas fees and final stake amount

- Wait for Confirmation: Sui network typically confirms within seconds

- Track Rewards: View accumulated rewards through Dashboard

- Ladder Staking: Batch different maturity dates, balancing yield and liquidity

- Compound Strategy: Periodically withdraw rewards and restake

- Combined Strategy: Simultaneously participate in staking and Play-to-Earn

DAO Governance Best Practices

Effective Governance Participation

- Read complete content of all proposals

- Reference community discussions and expert opinions

- Understand proposal's long-term impact on crypto projects

- Review proposer's historical record and credibility

- Ask constructive questions on Discord/Telegram

- Share own analysis and perspectives

- Help new members understand complex proposals

- Maintain respectful and constructive attitude

- Don't blindly follow "whale" votes

- Consider proposal's impact on entire community

- Avoid short-term benefit temptations

- Vote for project long-term development

Governance Power and Responsibility

- Submit and vote for/against proposals

- Access project financial and operational information

- Participate in community discussions and decisions

- Benefit from ecosystem success

- Actively participate in governance rather than passive holding

- Make decisions based on adequate information

- Monitor proposal execution status

- Promote healthy community development

Staking and Governance Risks

Staking Risks

- Code vulnerabilities may cause fund loss

- Recommend staking only amounts you can afford to lose

- Check for third-party security audits

- Cannot trade tokens during staking period

- Miss market peak selling opportunities

- Early unlocking may lose rewards or pay penalties

- APY may adjust based on participant numbers

- BEEG price decline reduces reward dollar value

- Game revenue below expectations affects reward pool

Governance Participation Risks

- Poor proposals may harm project interests

- Malicious proposals may deplete funds

- Controversial proposals may divide community

- Whales may dominate voting outcomes

- Small holder voices may be ignored

- Mechanisms needed to prevent governance attacks

BEEG vs Other DAO Projects Comparison

Governance Model Comparison

- Governance token-based voting

- Requires large amounts of tokens to submit proposals

- Voting rates typically low (<10%)

- NFT-based governance lowers participation threshold

- Gamified staking increases participation

- Smaller community size easier to coordinate

Where to Trade and Stake

- BlueMove DEX (Sui ecosystem)

- Official staking DApp

- Enjoy 100% reserve guarantee (Proof of Reserve)

- Higher liquidity facilitates establishing staking positions

- Zero fees reduce trading costs

- View MEXC advantages for more information

Conclusion: Future of Staking and Governance

FAQs

Disclaimer

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact service@support.mexc.com for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Latest Updates on Bluefin

View More

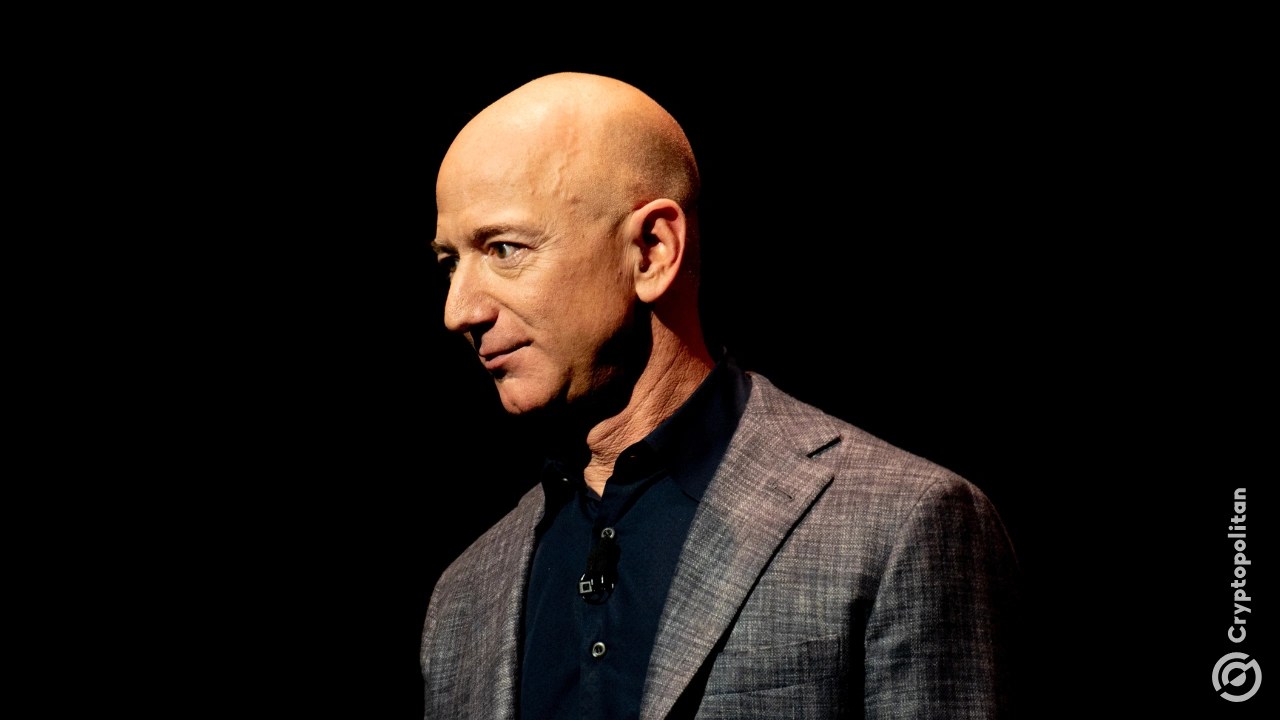

Bezos’ Blue Origin Announces Rival Satellite Network To Musk’s Starlink

Blue Origin to launch 5,408 satellites for its new TeraWave broadband network

Jeff Bezos’ Blue Origin launches TeraWave, a 6 Tbps satellite broadband network to take on Starlink

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading