Dogecoin price: DOGE struggles to break out, meanwhile RTX growth curve turns parabolic

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Traders are rethinking meme coins like Dogecoin and quietly rotating into payment-focused projects such as Remittix, where real usage and capital flow are starting to diverge sharply.

- Dogecoin price remains range-bound under key resistance, with price action driven more by sentiment than fundamentals despite solid trading volume.

- Remittix is drawing attention for its real-world payments use case, CertiK verification, and live wallet already being tested by users.

- With RTX still priced under $1 and its presale showing accelerating uptake, some investors see a clearer growth path compared to waiting for a meme-driven DOGE breakout.

The market has slipped back into risk caution and traders are once again asking hard questions about memecoins. Dogecoin price is stuck under nearby resistance, liquidity is choppy, and many portfolios are now tilting toward projects that can actually move money, not just social feeds.

That is why conversations about the best crypto to buy now keep circling back to one comparison. On one side is Dogecoin price action that needs a perfect risk rally. On the other side is RTX, a payments-focused token whose growth curve is starting to look genuinely parabolic.

This article breaks down why Dogecoin price has struggled to break out, then explains why Remittix (RTX) is quietly pulling capital away from the meme coin crowd. Readers will see the key levels on DOGE, the real numbers behind RTX, and a simple list of reasons serious buyers are watching the Remittix wallet, the CertiK verification, and the current sub $1 entry window so closely.

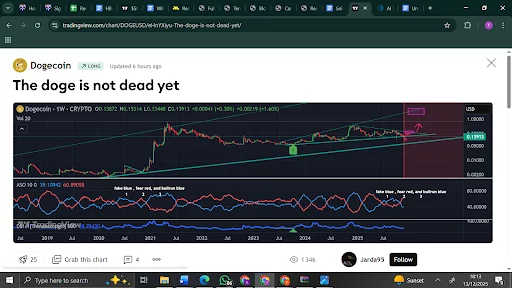

Dogecoin price keeps stalling under nearby resistance

Right now, Dogecoin price is trading around $0.139 with roughly $700 million in daily volume, which shows that liquidity is still strong even without a breakout. The problem is the structure on the chart. Sellers continue to defend the $0.14 region, while support has been clustering closer to the mid $0.13 area, which keeps Dogecoin price trapped in a fairly tight band.

The recent Federal Reserve cut did not deliver the full risk on surge that memecoins usually feed on. Instead, the move left appetite uneven, so Dogecoin price is still behaving more like a sentiment gauge than a serious payments network. In simple terms, DOGE can still jump fast when the whole market flips green, but it remains heavily dependent on crowd mood rather than clear fundamental progress.

A realistic near term roadmap is easy to sketch. If the Dogecoin price can reclaim and hold the $0.14 to $0.15 zone on rising volume, momentum traders will have a reason to push toward a higher range. If that move fails, the more likely path is another slow grind back to the next support cluster.

Why RTX growth curve is turning parabolic while Dogecoin price waits

Remittix (RTX) is attracting that attention because it sells a completely different story. Instead of chasing the next Dogecoin price spike, the project is focused on real-world payments, letting people move crypto directly into bank accounts in many countries. That PayFi angle has started to resonate with investors who are tired of hoping that social media hype will rescue their bags.

The security story is also different. The Remittix smart contract and team have passed full verification on CertiK, a firm widely treated as the gold standard in blockchain security checks and RTX currently sits at the very top of its leaderboard for upcoming token launches.

On the numbers side, the curve is already steep. RTX tokens are currently offered at around $0.119, with the dashboard showing over $28.5 million collected so far, roughly 693 million tokens already taken and more than 30,000 buyers involved. Each funding milestone has brought planned price increases, which means every new round leaves latecomers paying more for the same asset.

Product progress is reinforcing that move. The Remittix wallet is now live on the Apple App Store and beta testing isn’t theory anymore, it is in the hands of real community users who are already trialing crypto to bank flows. For investors, that is a very different signal from a memecoin roadmap slide. It shows that the project is shipping, not just promising.

Key reasons serious buyers are watching RTX right now:

- Remittix is built around cross border payments, so the token is designed to move real money rather than relying on a fresh Dogecoin price spike to create exit liquidity.

- The project has full contract and team verification on CertiK with a top ranking for upcoming launches, which reduces unknowns for investors who normally wait for centralized exchanges to list a token before joining.

- The Remittix wallet is already listed on the Apple App Store and is being tested in live beta by real community users, which proves the product exists and can process transactions today.

- RTX still trades for well under $1, which means early buyers get far more units per dollar than they would with many large caps, a structure that can amplify upside if the growth curve keeps steepening.

None of this means Dogecoin price is finished. DOGE can still rally fast if the entire market flips risk on and memecoins are back in fashion. The difference is that Remittix is already moving along a separate track, one that blends a real payments use case and visible product progress. Missing that combination now is the kind of decision that investors often look back on with regret.

To learn more about Remittix, visit the official website, socials, and the $250,000 Giveaway.

FAQs

Why is the Dogecoin price struggling to break out right now?

Dogecoin price is stuck because sellers keep defending the $0.14 region while support sits lower, which traps the token in a range. The recent Fed cut also failed to deliver a full risk rally, so there has not been enough fresh capital to push Dogecoin price cleanly above resistance. Until volume expands and the $0.14 to $0.15 zone breaks convincingly, the structure will stay heavy.

What makes Remittix more attractive than Dogecoin for some investors?

Dogecoin is still driven mainly by sentiment and social media, while Remittix is built around a payments use case that moves crypto into bank accounts. RTX has full CertiK verification with a number one ranking for upcoming launches, a live wallet on the Apple App Store and a current price near $0.119 with over $28.5 million already raised.

Is RTX a good choice for investors who want a top crypto under $1?

For investors who want a top crypto under $1 with real world usage, RTX is being seen as a serious contender. The token still trades below the one dollar mark, has more than 30,000 buyers already involved, and sits inside an ecosystem where the wallet is live and the payment rails are in active testing. If the parabolic growth curve continues, the current sub $1 range may not last.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

The Channel Factories We’ve Been Waiting For

SOLANA NETWORK Withstands 6 Tbps DDoS Without Downtime