How Swypt turns M-PESA payments into stablecoins without changing how Kenyans pay

In September, I met the Swypt team at ETHSafari in Kenya, a week-long Ethereum conference organised by Lisk, a blockchain platform that builds and supports decentralised applications, particularly in emerging markets. The event brings together developers, startups, and investors working on blockchain infrastructure across Africa.

ETHSafari is usually loud with many product demos competing for attention from throngs of visitors. One of the booths by Swypt, a Kenyan fintech that connects merchants to stablecoin rails, was easy to miss because it did not have a lot of people around it. At the booth, co-founder and chief product officer, Stephen Gachanja, told me that Kenyan businesses were already using Swypt to sidestep shilling volatility by converting M-PESA payments into dollar-pegged stablecoins.

A few days earlier, just before we left Nairobi for Kilifi, where ETHSafari was held, I had already seen what he meant.

At Nairobi’s Westlands Mall, inside a small jewellery and fashion boutique, a customer made a payment that looked ordinary. The customer scanned an M-PESA paybill. On the phone, the transaction showed up in Kenyan shillings, but on the merchant’s end, though, the settlement arrived as USDT (Tether) in a self-custodial wallet.

That gap between what the customer sees and what the merchant receives is Swypt’s entire product.

Much of the blockchain industry tries to change user behaviour with new wallets and a promise of new rails. Swypt takes a different route because it leaves M-PESA untouched and moves the complexity underneath. Kenyans keep paying the way they already do, but stablecoins appear only after the payment clears. For now, the product spreads less through marketing and more through merchants, explaining it to each other across different towns.

The mechanics of the Swypt

Say a car rental business in Kenya, which handles local and international customers, wants to use digital assets to bypass local currency volatility. The business can convert mobile money or bank receipts into USDT, a dollar-pegged stablecoin, by routing payments through a specialised financial interface.

The car rental payment system may choose to rely on an M-PESA paybill, a central feature of Kenya’s mobile money economy.

In this context, a paybill is an M-PESA-linked business-to-business (B2B) or customer-to-business (C2B) cash collection service. Unlike a personal “send money” transaction, a paybill allows an entity to collect funds on a massive scale via a unique business number.

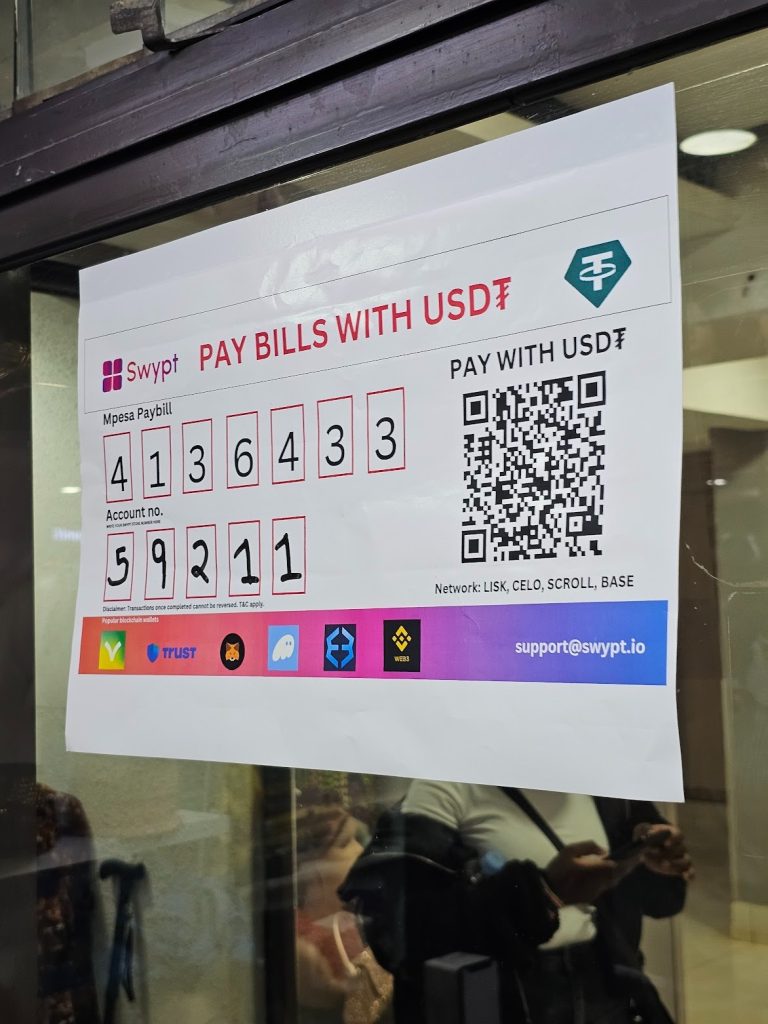

Swypt merchant paybill

Swypt merchant paybill

Customers enter this business number and a specific “account number” to identify the transaction, such as a rental agreement ID or a car registration. This will then allow the business to automate reconciliation and track which customer paid for which service.

Assuming the rental business operates across three national locations, managed through a central data module (Swypt issues a free virtual POS (point of sale) terminal that allows the merchant to manage these multiple branches from a single dashboard without the need for physical card readers), the financial flow moves through four steps.

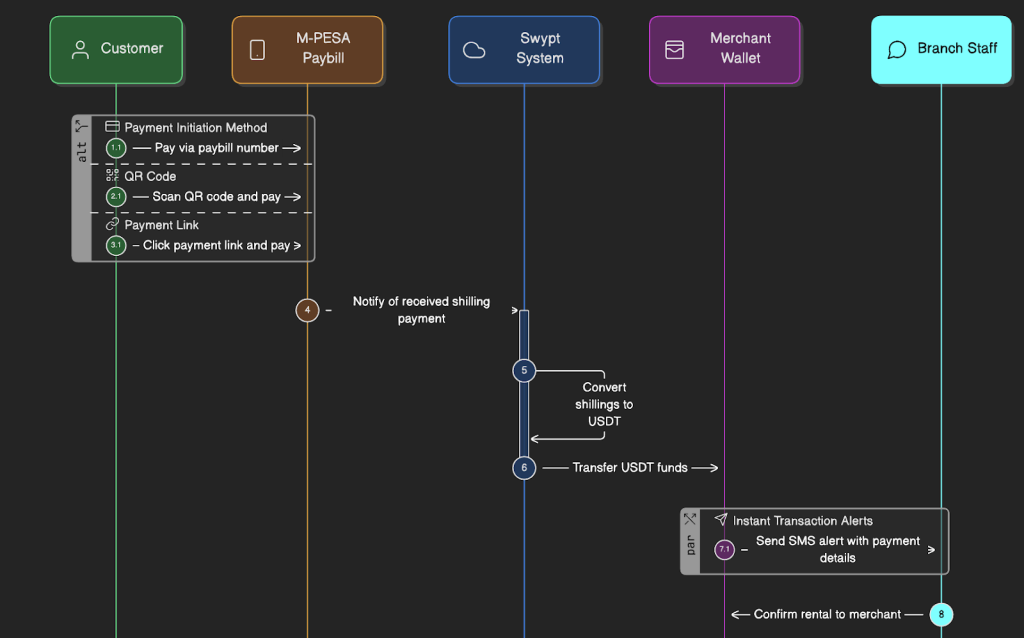

- Customers pay via M-PESA using a provided paybill, QR code, or payment link.

- The Swypt software automatically converts the shilling-denominated payment into USDT.

- Funds are pushed to a self-custodial wallet owned by the business. This ensures the service provider does not hold the merchant’s capital to cut counterparty risk.

- Staff at each respective branch receive instant transaction alerts to confirm the rental.

Once settled in digital dollars, the business can then use the liquidity for operational expenses.

Swypt supports outbound payments back into the M-PESA ecosystem, including tills (retail payment numbers) and bank accounts, to settle payroll and supplier invoices.

Customer journey from payment to reconciliation

Customer journey from payment to reconciliation

However, the lack of a traditional chargeback mechanism shifts risk. Only a merchant can initiate a reversal, which eliminates the “friendly fraud” that plagues online retail but demands higher consumer trust.

The cheapest route for the business is “peer-to-peer” settlement with other merchants on the same network. Because the underlying assets are on-chain, the business can also settle international obligations with any supplier capable of receiving USDT, effectively removing the friction of traditional cross-border banking.

Swypt is stripping the complexity from self-custody by offering a decentralised bridge between USDT and KES without the traditional friction of blockchain. The platform is strictly non-custodial, meaning it never holds user keys or funds. Instead, it only interacts with a user’s wallet when authorised to settle a specific transaction.

To make the experience feel like a standard banking app, Swypt uses account abstraction that allows users to bypass the headache of seed phrases (the master key to your digital assets), accessing their wallets via email and 2FA across any device.

Why is bypassing the shilling so important?

For Kenyan merchants, the primary incentive is currency preservation. After two years of the shilling’s volatility against the US dollar, holding local currency has become a balance-sheet risk for anyone importing raw materials or finished goods.

Once funds arrive as stablecoins, merchants can move money quickly across multiple channels. They can pay international invoices in USDT, transfer assets to external wallets like Trust Wallet, or convert back to KES for local use.

Swypt claims to remove its own exposure to currency fluctuations by eliminating an “internal float” or the idle cash reserves traditional processors hold.

Lean operations

Swypt’s commercial model is aggressive since there are no upfront fees for accepting payments. Rather, costs are concentrated on the payout side. According to Gachanja, off-ramp fees typically sit below 1%, comfortably beating the spreads of black market FX exchanges or traditional wire fees. For high-volume enterprises, an over-the-counter desk handles liquidity via API.

“Swypt only applies fees on payouts and has no direct upfront fees for pay-ins (M-PESA to paybill charges apply). In comparison to market standards, our fees are majorly below 1% for all transactions,” Gachanja said.

In an era of renewed venture rounds, Swypt is an outlier. The 12-person team is entirely bootstrapped. Gachanja claims that the business has processed over $10 million in volume across 1,000 merchants.

The model is not without its dependencies because Swypt relies on the stability of third-party stablecoins and the continued openness of the M-PESA API (Daraja 3.0). Compliance is handled through providers like Sumsub to navigate Kenya’s shifting regulatory landscape.

Swypt’s edge is its cultural literacy. Most fintechs in Kenya recognise they cannot operate without integrating M-PESA, so Swypt takes advantage of that reality and addresses liquidity challenges without asking business owners to understand smart contracts.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

‘Love Island Games’ Season 2 Release Schedule—When Do New Episodes Come Out?