Despite BOJ Concerns, Can SOL Price Hold Its Long-Term Support Zone?

The post Despite BOJ Concerns, Can SOL Price Hold Its Long-Term Support Zone? appeared first on Coinpedia Fintech News

The SOL price is once again under pressure, but not without context. After slipping from $134 earlier this week, Solana now hovers near a long-term support range that has historically defined its most of the broader trend since 2024. As macro risks rise with BOJ in picture, traders are weighing whether this SOL/USD zone marks accumulation or vulnerability.

SOL Price Today Sits on a Crucial Support Range

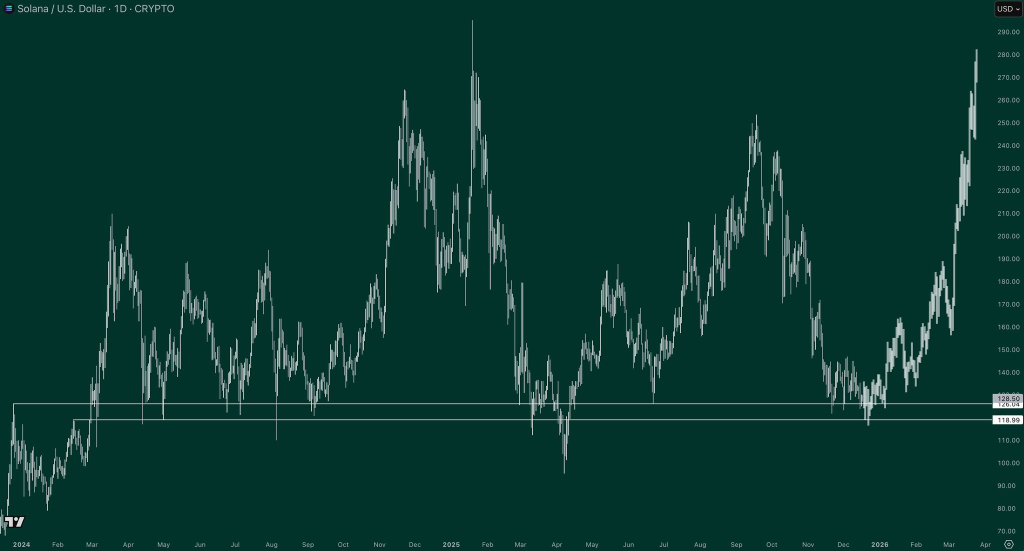

The Solana price chart spanning from 2024 to the present highlights a a demand zone between $119 and $126, which has proved resilient all this time.

Now, when writing, the SOL price today is once again hovering near $127, which is only marginally above this key support area.

While short-term volatility has shaken confidence at least for now, the broader structure suggests differently. Solana has sustained for many months above a long-term base. It has repeatedly acted as a stabilizing zone, and as long as the price sustains above it, a deeper breakdown is not yet confirmed.

Also, if this week’s turbulence is absorbed without major damage, short-term conditions could improve, while the long-term SOL price forecast remains structurally intact.

Macro Pressure Puts Solana at a Crossroads

That said, macro conditions are now driving the narrative more than charts alone. The upcoming Bank of Japan rate decision on December 19 has become a pivotal risk event for all risk assets, including Solana crypto.

Since, Japan has long been a source of ultra-cheap liquidity through the process of yen carry trade. Now, at this vulnerable financial state globally, a rate hike would likely force all those carry traders to immediately unwind their positions, and if they do unwind, it will trigger an immense selling pressure across global markets. If we take crypto market specifically, then its evident that in previous BoJ hikes during 2024 and 2025, Bitcoin USD experienced sharp drawdowns of 20–30%, and Solana followed closely.

If such a scenario unfolds again, the SOL price USD may struggle to defend current levels. Conversely, a pause or dovish stance is what market needs that could relieve pressure and allow price to stabilize.

Similarly, despite near-term uncertainty, Solana crypto’s fundamentals remain intact. Whatever the short-term result may be, the Network usage, developer activity, and ecosystem growth are undeniably strong, which continues to support its long-term narrative. If macro conditions stabilize even modestly, the current setup could favor recovery rather than continuation lower.

Regulation and 2026 Outlook Shape SOL Price Prediction

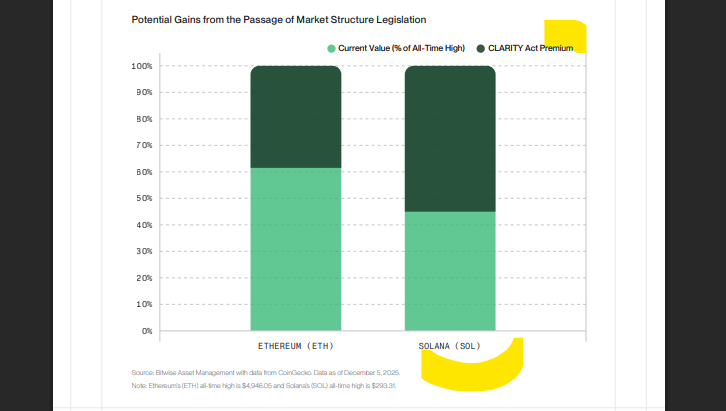

Looking further ahead, forward predictions for 2026 highlight that regulatory progress could be a decisive catalyst, per the latest Bitwise report. The CLARITY Act in U.S. is seen as essential for unlocking the next growth phase in crypto.

Report also added that Stablecoins and tokenization are widely viewed as megatrends, and Solana is positioned as one of the major beneficiary if adoption accelerates.

If regulatory momentum continues and broader conditions remain constructive, the SOL price prediction 2026 becomes increasingly optimistic.

You May Also Like

Pepeto vs Blockdag Vs Layer Brett Vs Remittix and Little Pepe

Ethereum Name Service price prediction 2025-2031: Is ENS a good investment?