Netflix (NFLX) Stock: Gains Almost 1% After Refinancing $25 Billion Loan

TLDRs;

- Netflix refinances $25 billion loan to strengthen Warner Bros. acquisition bid.

- Paramount launches hostile $77.9 billion bid, intensifying competition for Warner Bros.

- Warner Bros. board backs Netflix, urging shareholders to reject rival offer.

- Regulatory and antitrust scrutiny likely to influence final outcome of deal.

Netflix Inc. made headlines this week after refinancing part of its $59 billion bridge loan in preparation for acquiring Warner Bros. Discovery Inc. The streaming giant secured a $5 billion revolving credit facility and two $10 billion delayed-draw term loans, leaving $34 billion available for syndication.

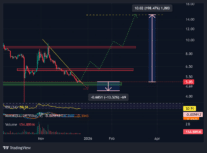

This strategic move has fueled investor confidence, pushing Netflix shares up nearly 1%. The refinancing gives Netflix a stronger capital structure to support its $82.7 billion bid for Warner Bros.’ studios and streaming assets.

Netflix, Inc., NFLX

Hostile Bid Intensifies Bidding War

The competition escalated when Paramount Skydance Corp. launched a hostile takeover bid valued at $77.9 billion. Unlike Netflix, Paramount’s offer includes all of Warner Bros., including cable networks such as CNN, TNT, and HBO.

The move caught Wall Street by surprise, raising the stakes in what has become one of the largest media bidding contests in recent years. Analysts note that the differing structures of the deals make direct comparison complex, as Netflix focuses on studios and streaming, while Paramount targets the entire company.

Warner Bros. Board Supports Netflix Offer

Despite Paramount’s aggressive approach, Warner Bros.’ board of directors has recommended shareholders reject the rival bid in favor of Netflix’s proposal. The board described Paramount’s cash offer as “inferior and inadequate,” citing financing risks.

This endorsement strengthens Netflix’s position and signals confidence in its ability to complete the acquisition. Warner Bros.’ shareholders will receive $23.25 per share in cash plus $4.50 in Netflix stock under the current agreement. Netflix’s offer also plans for the spin-off of Warner’s cable channels into a separate entity, Discovery Global.

Regulatory and Political Hurdles Ahead

While Netflix now enjoys board support, challenges remain. Both deals will undergo intense regulatory and antitrust scrutiny. Democratic Senator Elizabeth Warren has publicly labeled the acquisition an “anti-monopoly nightmare,” prompting Netflix to reassure employees that the transaction will not result in studio closures.

Observers predict that approval could take months, with market dynamics, stock price fluctuations, and investor sentiment likely influencing the final outcome. The company plans to tap capital markets further to reduce the bridge facility and potentially secure investment-grade debt ratings, reflecting its strengthened financial position.

Conclusion: Strategic Positioning in Streaming Wars

Netflix’s refinancing and strengthened bid underscore its determination to consolidate a dominant position in the entertainment and streaming industry. Although Paramount’s counteroffer introduces uncertainty, Netflix’s board-backed strategy, combined with sound financing, positions the company favorably.

Investors and market watchers will now focus on regulatory developments and potential responses from Paramount, which could reshape the Hollywood landscape. The streaming wars are entering a critical phase, with Netflix’s strategic financial moves and corporate backing setting the stage for potential industry-wide transformation.

The post Netflix (NFLX) Stock: Gains Almost 1% After Refinancing $25 Billion Loan appeared first on CoinCentral.

You May Also Like

Sandbrook Capital Announces Acquisition of United Utility Services from Bernhard Capital Partners

TRUMP Struggles Below $5 as Unlock Adds Downside Pressure