Hyperliquid Price Prediction 2026, 2027 – 2030: Will HYPE Price Hit A New ATH?

The post Hyperliquid Price Prediction 2026, 2027 – 2030: Will HYPE Price Hit A New ATH? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of the Hyperliquid crypto is $ 24.39697798.

- The 2025 HYPE price suggests it could hit $40-$105 in 2026.

- Forecasts suggest that HYPE could reach a potential average price by 2030 of around $125, with highs up to $185.

The crypto market is buzzing with excitement over Hyperliquid and its native token, HYPE. As a decentralized, paperless alternative to platforms like Binance and Coinbase, Hyperliquid is quickly gaining traction, prompting investors to look closely at the HYPE price prediction for 2026 and beyond.

With its unique “HyperBFT” consensus mechanism, lightning-fast transactions, and zero KYC hurdles, Hyperliquid is rewriting the rules of perpetual trading. Beyond its consensus mechanism, Hyperliquid also allows users to trade crypto perpetual futures, including major assets like BTC, ETH, SOL, AVAX, and SUI, even without owning the underlying asset.

As the platform gains traction for its streamlined trading experience, many investors are now turning to analyze the HYPE token price outlook. But does its innovative model signal long-term growth for HYPE Token Price?

In this article, we dive deep into market sentiment and Hyperliquid price projections from 2026 to 2030.

Table of Contents

- HYPE Price Targets December 2025

- Hyperliquid Price Analysis

- Hyperliquid Price Prediction 2026

- HYPE On-Chain Outlook

- Hyperliquid Coin Price Targets 2026 – 2030

- HYPE Price Projection 2026

- Hyperliquid Coin Price Prediction 2027

- HYPE Crypto Price Action 2028

- Hyperliquid Price Analysis 2029

- HYPE Price Prediction 2030

- Market Analysis

- CoinPedia’s HYPE Price Projection

- FAQs

Hyperliquid Price Today

| Cryptocurrency | Hyperliquid |

| Token | HYPE |

| Price | $24.3970 |

| Market Cap | $ 8,214,101,875.73 |

| 24h Volume | $ 230,963,280.1980 |

| Circulating Supply | 336,685,219.00 |

| Total Supply | 999,533,278.00 |

| All-Time High | $ 59.3926 on 18 September 2025 |

| All-Time Low | $ 3.2003 on 29 November 2024 |

HYPE Price Targets December 2025

The decline of 62% to $22.50 from the all-time high of $59 represents a significant downturn, with $22.50 now serving as an important demand level. In December, we have observed some initial signs of stabilization; however, given the limited timeframe remaining this month, a close near this demand area is most likely the upcoming outcome. It may be more reasonable to anticipate that by 2025, if the price stabilizes around this level, it could establish a solid support foundation for a potential reversal in the future.

| Month | Potential Low | Potential Average | Potential High |

| HYPE December 2025 | $24 | $39 | $50+ |

Hyperliquid Price Analysis

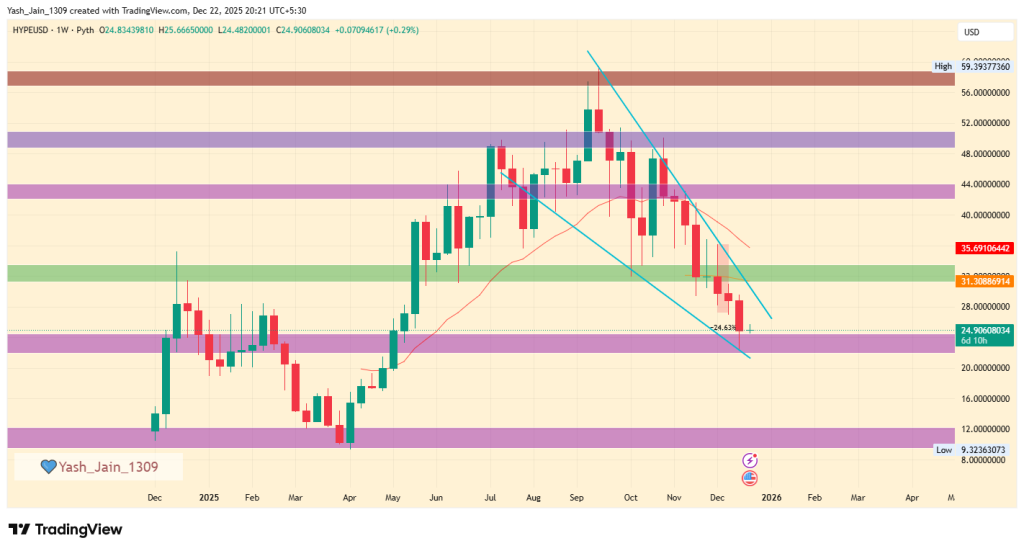

The HYPE price commenced its journey in 2025 under bearish conditions, experiencing a decline from $35 to $9.32 by April. However, trading activity on the Hyperliquid platform increased significantly, particularly with major assets like BTC. This uptick in volume contributed to a turnaround for HYPE in mid-April, leading to a notable parabolic move.

From May onward, HYPE managed to surpass its previous high of around $35 and entered an upward trend, reaching $59 by September. However, geopolitical developments and broader macroeconomic factors introduced market-wide volatility and caution, which have deterred new liquidity and unsettled many long-term holders. As a result, a substantial sell-off occurred, leading to a decline of 62% to $22.50, an area recognized as a demand zone.

In December, there have been small signs of stabilization. However, it may be prudent to temper expectations for significant movements given the limited days remaining in the month. If 2025 can conclude with consolidation around this level, it could establish a robust support base for potential reversals moving forward.

Hyperliquid Price Prediction 2026

A falling wedge pattern has emerged on the chart, and its lower boundary aligns perfectly with the current horizontal demand area. This convergence creates an optimal setup that suggests a potential rally in Q1 2026. For this upward movement to materialize, a stable footing is essential, allowing sufficient demand to enter the market.

If demand begins to increase, a decisive break above the resistance level of $32.50 could act as a catalyst, triggering a significant rally that may propel prices toward the $42 mark. This key breakout would likely attract additional buying interest, reinforcing the bullish sentiment and paving the way for further gains.

| Year | Potential Low | Potential Average | Potential High |

| 2026 (conservative) | $15 | $35 | $80 |

HYPE On-Chain Outlook

The Dune analytics dashboard provided an quick on-chain overview of the utility metrics of the Hyperliquid token (HYPE), which appears to be improving significantly with each passing month.

HyperEVM total transaction fees have surpassed 150K and are at an ATH, and total trading volume has crossed $3 trillion and is at an ATH. Even its revenue has reached an ATH, crossing $800 million.

All the major metrics suggest that it is experiencing great adoption among peers, and its on-chain metrics are proof of that, suggesting that if the rally occurs, then 2025 might end on very good numbers.

Hyperliquid Coin Price Targets 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 25 | 50 | 90 |

| 2027 | 40 | 75 | 105 |

| 2028 | 55 | 95 | 130 |

| 2029 | 85 | 110 | 155 |

| 2030 | 105 | 125 | 185 |

HYPE Price Projection 2026

By 2026, the value of a single Hyperliquid token price could reach a maximum value of $90 with a potential low of $25. With this, the average price could land at around the $50 level.

Hyperliquid Coin Price Prediction 2027

During 2027, the HYPE could reach a maximum value of $105 with a potential low of $40. Considering this, the average price of this altcoin could settle at around $75.

HYPE Crypto Price Action 2028

The Hyperliquid price could achieve the $130 milestone by the year 2028. On the flip side, the altcoin could record a low of $55 and an average price of $95.

Hyperliquid Price Analysis 2029

The HYPE crypto prediction for the year 2029 could range between $85 to $155 and the average price could be around $110.

HYPE Price Prediction 2030

Looking forward to 2030, the Hyperliquid Price may range between $105 and $185, and a potential average value of around $125.

Market Analysis

| Firm Name | 2025 | 2026 | 2030 |

| Binance | $37 | $63 | $164 |

| DigitalCoinPrice | $76 | $54 | $97 |

*The aforementioned targets are the average targets set by the respective firms.

CoinPedia’s HYPE Price Projection

This Layer-1 project has taken the crypto market by storm within a short time frame. With a market cap of over $7 billion, this altcoin has successfully secured a position in the top 25. Moreover, with the mass adoption, this altcoin could claim a spot in the top 10 during the upcoming bull run.

If the bullish sentiment intensifies, the Hyperliquid price will reach a high of $41.39 this year. On the flip side, if the market experiences unfavorable events, this could result in this altcoin settling at a low of $14.65.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $14.65 | $28.02 | $41.39 |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Hyperliquid is a fast, decentralized trading platform with no KYC and low fees, making HYPE popular among traders seeking speed and independence.

Analysts expect HYPE could trade between $15 and $80 in 2025, depending on market momentum, platform growth, and overall crypto conditions.

HYPE price in 2026 is projected to range between $25 and $90, with an average near $60 if adoption and trading volumes keep rising.

Long-term projections suggest HYPE might reach an average of $125 by 2030, with possible highs near $185 if platform usage keeps expanding.

HYPE may appeal to long-term investors due to strong platform growth, but like all crypto, it carries risk and requires careful research.

You May Also Like

Urgent Analysis: Altcoins Oversold, Signaling a Potential Reversal

Wall Street Bets on XRP: Adoption-Driven Peak by 2026