Canton (CC) Rockets Again by 17%, Bitcoin (BTC) Stalls Below $88K: Weekend Watch

Bitcoin’s sluggish price performance during the last weekend of 2025 continues, as the asset has remained sideways between $87,500 and $88,000.

Most altcoins are in a similar situation, with little to no volatility from the larger caps. ZEC, DOT, UNI, CC, and NEAR have marked substantial gains from the mid caps.

BTC Trades Sideways

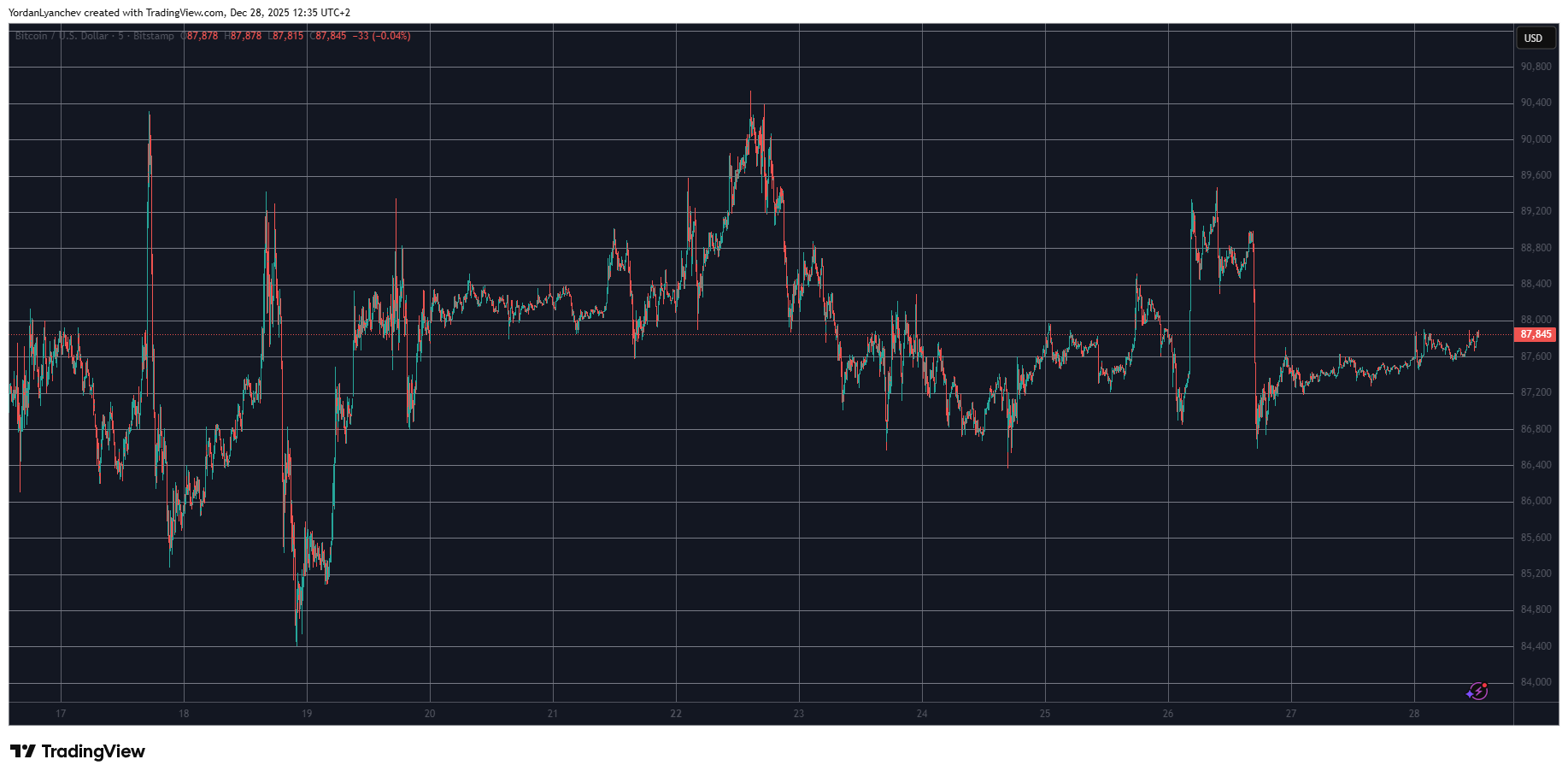

After a wild period that lasted for the past 10 days or so, BTC has expectedly calmed down during and after the Christmas holidays. In the past business week, it was rejected on a couple of occasions at $90,000, as the most violent one came after the US released the CPI numbers for November, which were much better than anticipated.

Bitcoin quickly spiked to the $90,000 resistance, where it faced immediate selling pressure and plunged to a multi-week low of $84,400. The bulls finally intercepted the move after this decline and began a notable recovery that culminated on December 22 with a surge to $90,400.

However, bitcoin’s inability to break through that level continued, and the asset dropped to $86,400 on Christmas Eve. It rebounded to $89,600 by Friday, where the bears resumed control and drove it to under $86,800 almost immediately. Since then, BTC has been rather calm in a tight range and now sits close to $88,000.

Its market cap remains around $1,750 trillion on CG, while its dominance over the altcoins sits at 57.3%.

BTCUSD Dec 28. Source: TradingView

BTCUSD Dec 28. Source: TradingView

CC on a Wild Run

As mentioned above, the larger-cap altcoins have shown little volatility since yesterday but are slightly in the green. ETH is close to $2,950, XRP has defended the $1.85 level, BNB is back at $850, while SOL, TRX, DOGE, BCH, and LINK are up by 1-2%. ADA has emerged as the top gainer here, surging by 5% to $0.37.

ZEC is up by over 5%, and so are UNI and NEAR. DOT and FIL have gained 8-9% each, while CC has skyrocketed by another 17%. As of press time, Canton’s token trades close to $0.12.

The total crypto market cap has added around $30 billion daily and is up to $3.060 trillion on CG.

Cryptocurrency Market Overview Daily Dec 28. Source: QuantifyCrypto

Cryptocurrency Market Overview Daily Dec 28. Source: QuantifyCrypto

The post Canton (CC) Rockets Again by 17%, Bitcoin (BTC) Stalls Below $88K: Weekend Watch appeared first on CryptoPotato.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Uniswap Burns $596M UNI as Vote Changes Tokenomics