XRP Price at $126? CNBC Mistakes XRP for Solana

Ripple’s native cryptocurrency XRP XRP $1.76 24h volatility: 5.8% Market cap: $107.23 B Vol. 24h: $5.02 B was seen trading at $126 on the CNBC “Crypto World” show. This led many investors to be confused as to what caused this 6,500% upside in XRP price. However, CNBC seems to have confused XRP with Solana SOL $116.2 24h volatility: 5.4% Market cap: $65.78 B Vol. 24h: $8.41 B , in what seems to be an error with wrong ticker usage.

CNBC Error Showed XRP Price Surging to Three-Digits

A brief on-air graphics error on CNBC this week momentarily showed XRP trading at $126.01. This was enough to trigger major discussions within the trader community.

The mistake occurred during a Jan. 28 segment of Crypto World covering the Senate Agriculture Committee hearing on crypto market structure. At the time, the program correctly displayed Bitcoin BTC $82 647 24h volatility: 5.8% Market cap: $1.65 T Vol. 24h: $91.59 B at $89,532, down 0.39% on the week, and Ethereum ETH $2 741 24h volatility: 6.4% Market cap: $330.81 B Vol. 24h: $46.77 B at $2,996, off 0.77%.

However, when the broadcast showed XRP, the on-screen ticker listed “$126.01, -3.8% (7D).” This meant that the XRP price was trading 6,500% higher than its actual market price at $1.90 back then.

However, confirming this glitch, CNBC producers noted that the show had mistakenly inserted Solana’s spot price, which was trading at $126 back then. “On Jan. 28, the show mispriced XRP by using Solana’s value in its place,” the report explains.

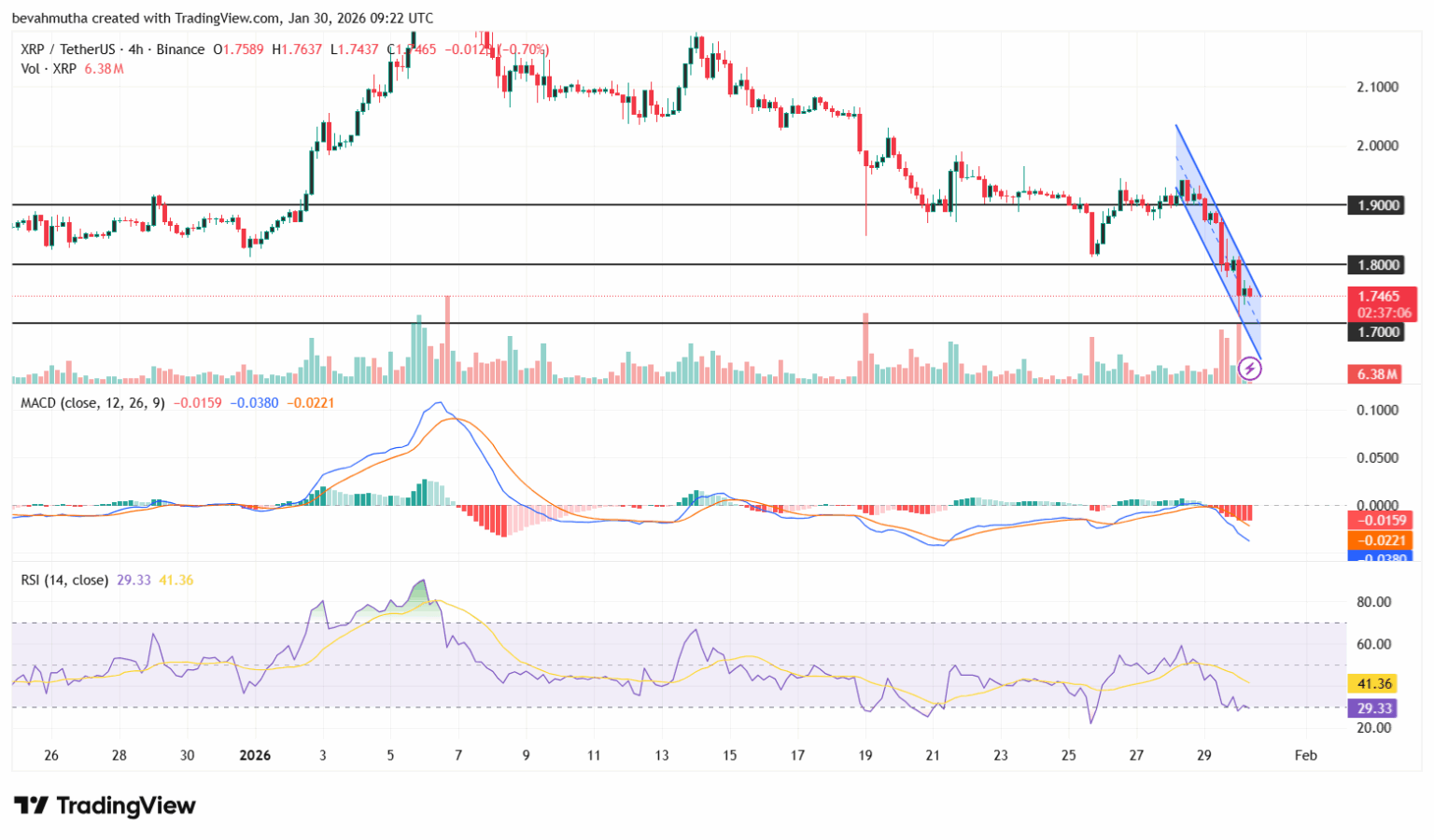

During the broader crypto market selloff in the last 24-hours, XRP price is down by an additional 7%, falling under the crucial support of $1.80. Technical indicators show that XRP is trading within a descending channel, marked by a series of lower highs and lower lows. It shows that XRP is currently in strong bearish momentum.

XRP Price descending channel | Source: TradingView

For now, $1.70 remains a critical support zone for the XRP price. On the upside, $1.90 remains a significant resistance area, where selling pressure is likely to stop further upside.

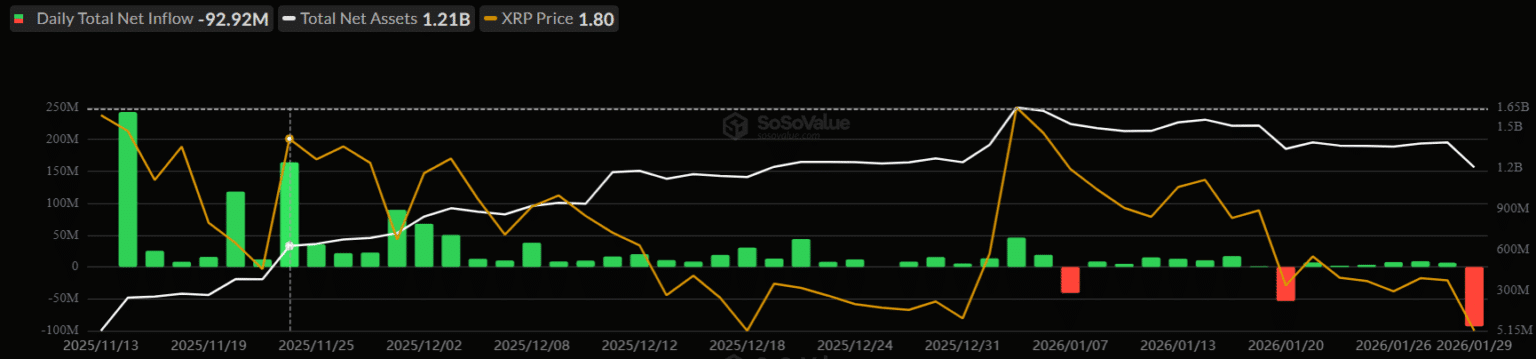

Spot XRP ETF Bleeds by $92 Million

Amid the market-wide correction, crypto ETFs saw major outflows on Jan. 29 trading sessions. Outflows from Bitcoin and Ethereum ETFs nearly stood at $1 billion. Similarly, spot XRP ETFs registered $92 million outflows during yesterday’s trading session, as per data from SoSoValue.

Spot XRP ETF outflows | SoSoValue

As per the on-chain data, most of the outflows were led by the Grayscale XRP ETF (GXRP). The total assets across all ETFs currently stand at $1.2 billion.

AI Platform SUBBD Grabs Limelight

SUBBD, an AI-based creator platform, is getting major limelight in a major push to decetralized creator economy. The platform aims to reshape creator–fan relationships through a tokenized model powered by its native SUBBD token.

SUBBD targets the $191 billion global content creator market and is marketing itself as a Web2-friendly, on-chain solution for non-crypto users. As a result, this platform is close to reaching the $1.5 million milestone in presale fundraising.

SUBBD offers staking rewards of up to 20% APY. This feature has helped it stand out among current crypto presale projects. The platform focuses on enabling influencers and AI-driven personalities to build and monetize communities using on-chain loyalty and engagement tools. Want to learn more? On Coinspeaker, you can read about how to buy SUBBD.

nextThe post XRP Price at $126? CNBC Mistakes XRP for Solana appeared first on Coinspeaker.

You May Also Like

Zcash (ZEC) Price Prediction: ZEC Defends $300 Support as Bullish Structures and Privacy Narrative Return to Focus

The 5000x Potential: BlockDAG Enters Its Final Hours at $0.0005 Before the Presale Ends