Banks Cover Up Mistakes, Crypto Platforms Keep Errors in Plain Sight

A recent incident involving the accidental minting of $300 trillion worth of stablecoins highlights both the potential and the vulnerabilities of blockchain technology in traditional finance. While such a massive error could cause chaos in conventional banking systems, it was swiftly identified and corrected on the blockchain, underscoring the transparency and real-time accountability that digital assets can offer.

- Paxos mistakenly minted $300 trillion of PYUSD stablecoins, flagging the importance of operational controls.

- The blockchain’s transparency allowed for rapid detection and removal of the erroneous tokens within minutes.

- This incident exemplifies how blockchain’s openness could improve oversight in finance.

- Traditional banks have a history of costly “fat-finger” errors, often unnoticed for months.

- Experts see blockchain as a tool to enhance transparency and trust in financial transactions.

On October 15, Paxos issued an internal error that resulted in the creation of an unprecedented amount of PYUSD stablecoins—equivalent to approximately $300 trillion. The company quickly flagged the mistake, and the entire supply was burned within 22 minutes, demonstrating blockchain’s ability to provide immediate visibility and swift corrective action.

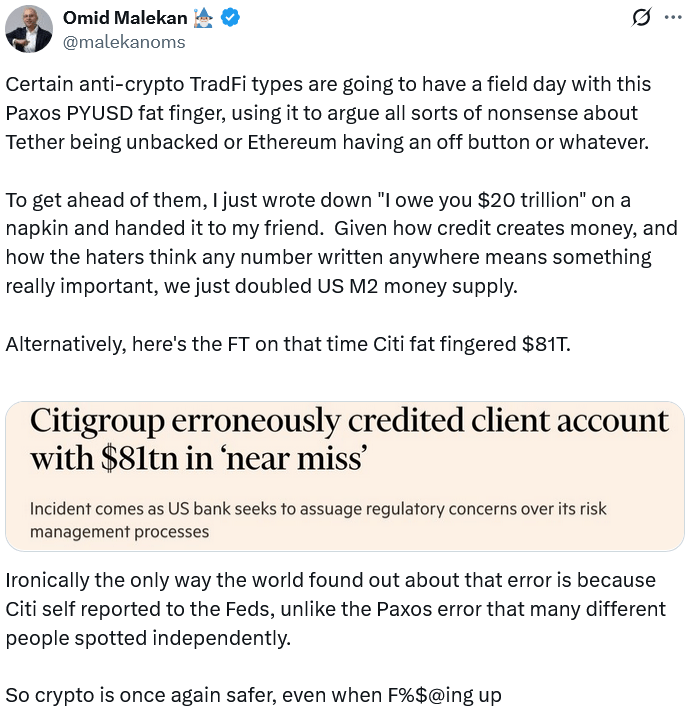

Source: Ted PillowsThis incident starkly contrasts with traditional banking, where errors such as multi-billion dollar transfers can go unnoticed for months. For instance, in April 2024, Citigroup mistakenly credited $81 trillion to a client’s account—a sum almost impossible to reconcile, which was only discovered and reversed after nearly 10 months. Similarly, other institutions have experienced multi-billion dollar errors with delayed disclosure, emphasizing the opacity and sluggish oversight in conventional finance.

Source: Omid Malekan

Source: Omid Malekan

A level of accountability “unheard of” in traditional banking

Blockchain advocates argue that this accident underscores one of the technology’s greatest strengths: accountability. Ryne Saxe, CEO of the cross-chain stablecoin liquidity platform Eco, explains that the transparency demanded by blockchain creates a governance environment where mistakes can be not only identified in real time but also mitigate risks more effectively.

Lessons from banking’s history of fat-finger errors

These errors are not new; traditional banks have long been plagued with costly “fat-finger” mistakes. Deutsche Bank, for example, transferred €28 billion ($32.66 billion) to the wrong account in 2015, an error that took months to rectify. Citigroup’s near-miss of transferring $6 billion to a wealth client also went unnoticed for a long period, illustrating the slow and opaque nature of the current system.

Such incidents, often only revealed long after they occur, demonstrate the limited accountability in conventional banking but stand in stark contrast to blockchain’s instant visibility.

The Paxos incident as a “preventable mistake”

Industry experts argue that Paxos’ mistake, while significant, could have been avoided with tighter operational controls. Shahar Madar, VP of security at Fireblocks, emphasizes the importance of rigorous risk management and strict enforcement of token issuance policies for stablecoin providers.

“Minting $300 trillion is a preventable mistake. As stablecoins gain traction, issuers should ensure that security policies cover the entire token lifecycle—from minting to burning—and minimize manual interventions,” Madar said.

Given the rising importance of stablecoins and their growing role in the crypto economy, this event highlights the need for enhanced security measures that harness blockchain’s transparency for better oversight and risk mitigation.

This article was originally published as Banks Cover Up Mistakes, Crypto Platforms Keep Errors in Plain Sight on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

REX Shares’ Solana staking ETF sees $10M inflows, AUM tops $289M for first time

The Best Router to Game and Stream 2025: Game and Stream Fast, Stable, and Lag-Free