HYPE Token Eyes $40 After Hyperliquid Approves Major Token Burn

This article was first published on The Bit Journal.

Hyperliquid has moved to settle long-running supply concerns surrounding its ecosystem. On Tuesday, validators and stakers approved a proposal to permanently remove tokens held in the protocol’s Assistance Fund.

The decision directly affects the HYPE token, which has faced sustained market pressure in recent weeks. The burn is intended to clarify supply metrics and strengthen confidence at a time of heightened volatility across the crypto market.

Governance Vote Removes Assistance Fund Tokens

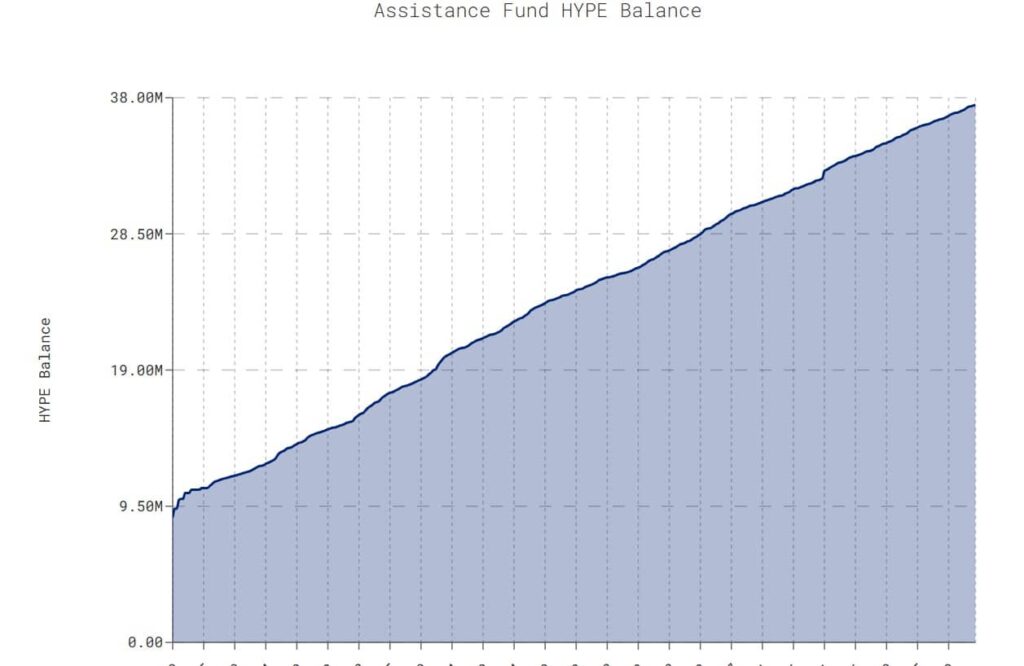

The governance vote passed with about 85% support. It authorized the permanent burn of tokens stored in the Assistance Fund. As a result, 37.5 million tokens, valued near $912 million, were removed from circulation.

The burned assets were held at a system address without a private key. This made them inaccessible by design. However, they were still included in total supply figures.

Source: ASXN

Source: ASXN

Their removal now resolves debates around valuation and supply transparency. For the HYPE token, the move represents one of the most significant tokenomic adjustments since launch.

Governance Vote Removes Uncertainty

The proposal ensured that no future protocol update could unlock the Assistance Fund tokens. Community approval created binding social consensus.

Also Read: Hyperliquid Unstakes $316M in HYPE Days Before Major Unlock

This step removed lingering doubts around supply treatment. It also aligned reported figures with economic reality for the HYPE token.

Assistance Fund and Buybacks Explained

The Assistance Fund accumulates tokens through a share of spot trading fees on Hyperliquid’s layer-1 perpetual futures network. In parallel, the Hyper Foundation has maintained steady buybacks.

On average, it has spent around $1.5 million per day. Over the past week, $12.4 million was used to acquire nearly 500,000 tokens. These actions reinforced long-term support for the HYPE token.

Supply Reduction and Tokenomics Impact

With the burn completed, an estimated 11 to 13% of circulating supply has been removed. This tightens overall tokenomics. Reduced supply can lower sell pressure during market downturns.

Source:ASXN

Source:ASXN

Historically, such deflationary moves have supported price stability. For the HYPE token, scarcity has now increased in a measurable way.

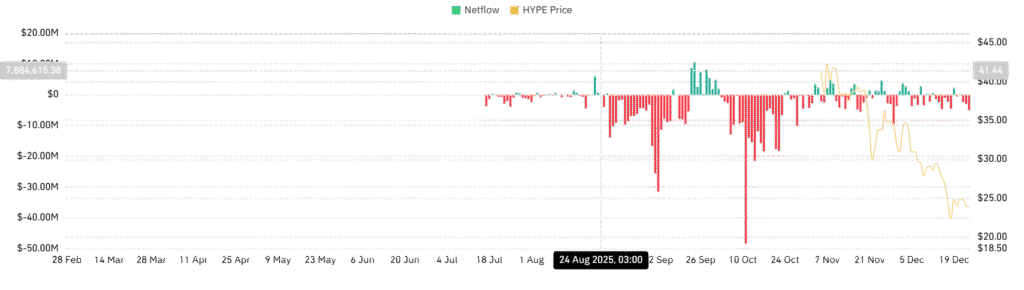

Spot Market Data Signals Cooling Pressure

Market data shows signs of easing distribution. Exchange outflows have exceeded inflows for several consecutive days. At the time of reporting, net outflows totaled about $5.1 million.

Lower exchange balances often suggest reduced immediate selling risk. This trend may benefit the HYPE token if sustained.

Source: CoinGlass

Source: CoinGlass

Buyer Momentum Begins to Improve

Short-term indicators show a shift in market behavior. Buyers have outpaced sellers for the first time in more than two weeks. Average bullish movement has risen, while bearish pressure has declined.

Sellers remain active, but momentum appears more balanced. These conditions could support a recovery phase for the HYPE token.

Price Performance and Key Levels

Despite the positive governance outcome, recent price action remains weak. The asset traded near $50 two months ago before entering a steady downtrend. It later touched lows around $22.

HYPE token is tradnig near $24.62, up by 3.1% over the past day. Analysts note that renewed demand could open a path toward $30 and $40. Failure to hold current levels could expose support near $20.

Source: TradingView

Source: TradingView

Conclusion

The token burn marks a structural shift for Hyperliquid. By permanently removing a large portion of supply, the protocol has improved transparency and reinforced deflationary mechanics. While broader market forces still apply, the HYPE token now operates under clearer supply rules.

Also Read: HYPE Price Analysis: Hyperliquid Nears All-Time High as Inflows and Trading Volume Surge

Appendix: Glossary of Key Terms

Token burn: The permanent removal of tokens from circulation to reduce total supply.

Assistance Fund: A protocol-controlled reserve that accumulates tokens from trading fees and buyback activity.

Governance vote: A stake-weighted decision process that allows validators and stakers to approve protocol changes.

Circulating supply: The number of tokens actively available for trading in the market.

Fully diluted valuation (FDV): The estimated market value of a token if all potential supply were in circulation.

Spot netflow: The net movement of tokens into or out of exchanges over a specific period.

Buyback program: A mechanism where a project repurchases its own tokens to manage supply and market pressure.

Frequently Asked Questions About HYPE Token

1- What is the HYPE token burn approved by governance?

It approved permanently burning tokens held in the Assistance Fund.

2- How many tokens were burned?

About 37.5 million tokens were removed from supply.

3- Why was this necessary?

The tokens were inaccessible but still counted in supply figures.

4- Does this guarantee a price increase?

No. Market demand remains the main driver of price.

Reference

AMB Crypto

Read More: HYPE Token Eyes $40 After Hyperliquid Approves Major Token Burn">HYPE Token Eyes $40 After Hyperliquid Approves Major Token Burn

You May Also Like

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim

MoneyGram Taps Stablecoins To Shield Colombians From Peso Weakness