ICP Extends Rally to 35% as Mission 70 White Paper Targets 70% Inflation Cut

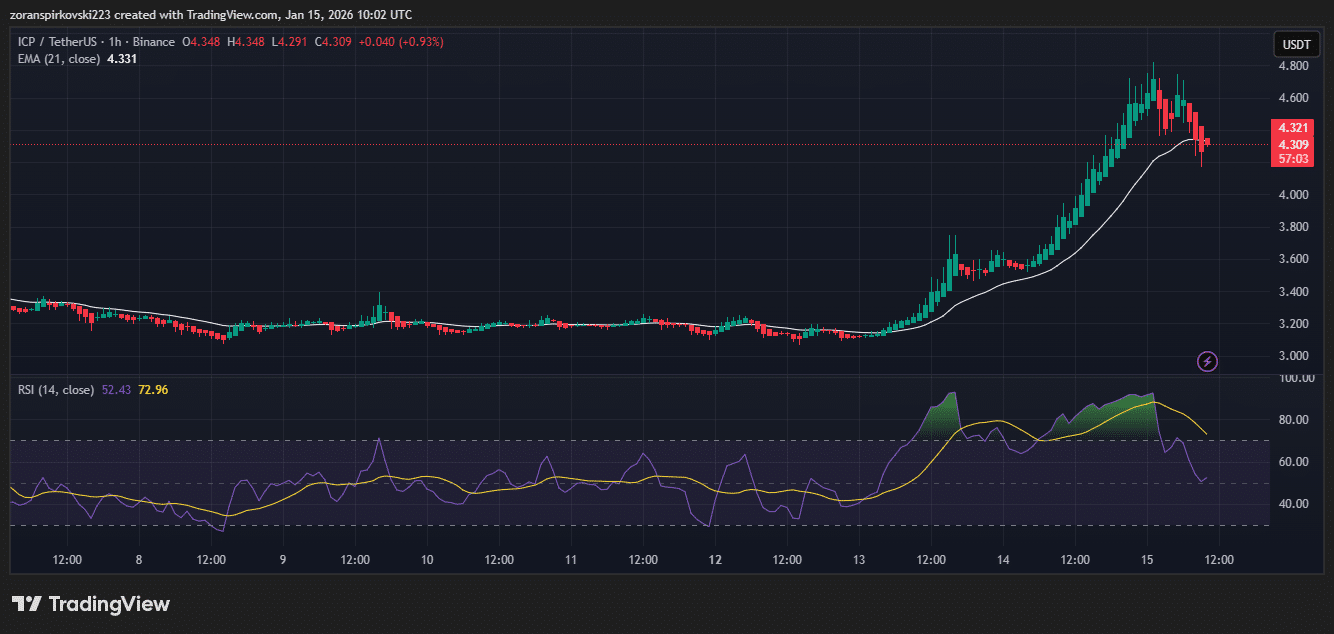

Internet Computer ICP $4.28 24h volatility: 9.6% Market cap: $2.35 B Vol. 24h: $777.59 M extended its rally with a 35.20% gain over seven days. The token climbed from $3.09 to a weekly high of $4.71 before settling at $4.25.

Trading volume reached $797 million over 24 hours, up 150% from the previous day, according to CoinGecko data. The gains follow a 17% rally on Jan. 13 ahead of the white paper release.

ICP/USDT 1-hour chart showing the rally from $3.20 to $4.70 between Jan. 13-15. RSI reached overbought territory above 70. | Source: TradingView

Mission 70 White Paper Released

Dfinity founder Dominic Williams published the Mission 70 white paper on Jan. 13. The document proposes reducing ICP inflation by at least 70% by the end of 2026.

In practical terms, fewer new tokens would enter circulation, which could benefit existing holders by limiting supply growth.

The white paper estimates that proposed changes would cut annual token creation from 9.72% to 5.42%, a 44% reduction.

Additional platform usage through Dfinity’s cloud services and its Caffeine.ai application would drive the remaining reduction by increasing the rate at which ICP tokens are permanently removed from supply.

Williams also responded to Ethereum ETH $3 351 24h volatility: 1.8% Market cap: $404.03 B Vol. 24h: $30.90 B co-founder Vitalik Buterin on Jan. 14.

Buterin had declared Web3 infrastructure ready for mainstream use. Williams positioned Internet Computer as a working implementation of that vision, stating that its cloud platform would reach mass market adoption in 2026.

Market Context

Community tracker @DfinityToday reported that ICP overtook NEAR NEAR $1.80 24h volatility: 1.3% Market cap: $2.32 B Vol. 24h: $238.45 M for second position among AI and big data tokens by market cap on CoinMarketCap. The account noted the token had gained over 40% year-to-date.

The Fear & Greed Index climbed to 61, indicating greed. This marks a sharp shift from the 26 reading two days earlier, when sentiment registered as fear. Total crypto market capitalization added 0.56% to reach $3.35 trillion.

24-hour liquidation heatmap showing $185.91 million in BTC and $92.28 million in ETH forced closures. Red indicates long positions liquidated. | Source: Coinglass

Derivatives data from Coinglass showed bearish bets accounted for $260.53 million in forced closures over 24 hours, compared to $196.17 million for bullish positions.

Total market liquidations reached $456.68 million, down 38% from the prior day.

ICP ranks 56th by market cap at $2.31 billion. The token is listed on major exchanges, including Binance and Coinbase.

nextThe post ICP Extends Rally to 35% as Mission 70 White Paper Targets 70% Inflation Cut appeared first on Coinspeaker.

You May Also Like

XRPL Validator Reveals Why He Just Vetoed New Amendment

Philippines grants visa-free entry to Chinese | The wRap