Steak ’n Shake Adds $10 Million in Bitcoin to Corporate Treasury

Bitcoin Magazine

Steak ’n Shake Adds $10 Million in Bitcoin to Corporate Treasury

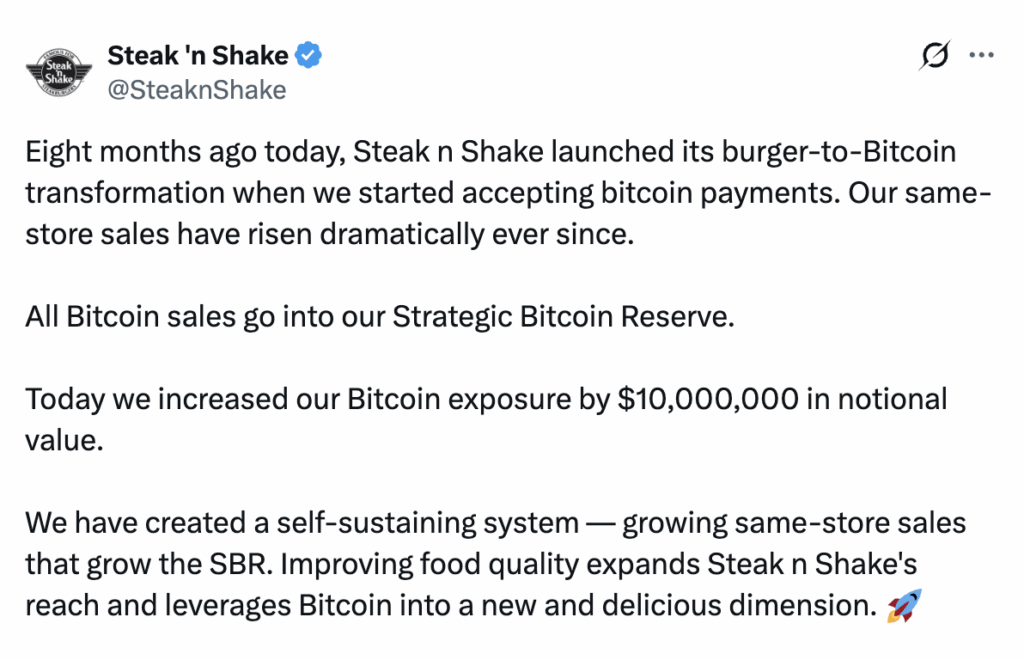

Popular fast-food chain Steak ’n Shake added $10 million worth of bitcoin to its corporate treasury, deepening its commitment to bitcoin eight months after rolling out BTC payments across all U.S. locations.

The company said on social media that the move follows a “self-reinforcing cycle” driven by bitcoin adoption, where customers paying in BTC help generate incremental revenue that is then recycled into business improvements.

According to Steak ’n Shake, all bitcoin-denominated revenue flows directly into what it calls its strategic bitcoin reserve, which is used to fund restaurant upgrades, ingredient improvements, and remodeling initiatives—without raising menu prices.

“Eight months ago today, Steak ’n Shake launched its burger-to-bitcoin transformation when we started accepting bitcoin payments,” the company wrote on social media. “Our same-store sales have risen dramatically ever since.”

Steak ’n Shake began accepting bitcoin payments in May 2025 using the Lightning Network, positioning the rollout as a way to cut card processing fees while attracting a younger, crypto-native customer base. The strategy is working.

Same-store sales rose more than 10% in the second quarter of 2025, according to the company.

Chief Operating Officer Dan Edwards previously said Steak ’n Shake saves roughly 50% in processing fees when customers choose to pay with bitcoin rather than traditional card networks.

Bitcoin is driving revenue for Steak ’n Shake

The chain has leaned into its bitcoin branding over the past year, introducing a Bitcoin-themed burger in October and pledging to donate a small portion of revenue from its “Bitcoin Meal” to support open-source Bitcoin development.

The recent $10 million purchase—roughly 105 BTC at current prices—marks Steak ’n Shake’s most direct treasury allocation to bitcoin to date.

While the position is modest compared with major corporate holders such as Strategy, which holds more than 687,000 BTC worth over $65 billion, it underscores a broader trend of corporate bitcoin accumulation.

According to data from Bitcointreasuries, total bitcoin held in treasuries—including public companies, private firms, governments, and exchange-traded funds—has now surpassed 4 million BTC.

Last fall, the company ran a poll on X over the weekend asking its 468,800 followers whether it should expand its crypto options to include Ethereum.

Nearly 49,000 votes were cast, with 53% in favor.

However, just four hours later, the company suspended the poll, declaring its allegiance to Bitcoiners. “Poll suspended. Our allegiance is with Bitcoiners. You have spoken,” Steak ‘n Shake posted.

This post Steak ’n Shake Adds $10 Million in Bitcoin to Corporate Treasury first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

Shiba Inu Down 37% YTD, Is There Hope for Bulls?