VivoPower To Load Up On XRP At 65% Discount: Here’s How

VivoPower International, a Nasdaq-listed B-Corp now pivoting to an XRP-centric treasury, said on September 16 it has structured its mining and treasury operations so that it can acquire the token “at up to a 65% discount” to prevailing market prices—by mining other proof-of-work assets and swapping those mined tokens.

VivoPower Doubles Down On XRP

The company’s digital-asset arm, Caret Digital, has secured bulk-purchase discounts for additional mining rigs and plans to expand operations, a move it says further improves its unit economics and lowers the effective cost basis of the tokens obtained via token swaps. “Mined tokens will be exchanged into XRP, delivering an effective 65% discount, based on current market prices,” the release states.

The mechanics, as described by VivoPower, hinge on a dual-pronged treasury program: first, produce mined tokens through an expanded fleet acquired at negotiated bulk discounts; second, convert those mined tokens into XRP rather than buying it directly in the open market.

In parallel, the company says it will continue to seek exposure to Ripple Labs’ equity as part of its strategy to secure XRP-linked assets “at the lowest average cost possible.” VivoPower did not publish a detailed formula for the “effective 65%” figure, but tied the claim to current prices and the economics of mining and procurement.

The discount-driven swap strategy is part of a broader corporate transformation in which VivoPower describes itself as “the world’s first XRP-focused digital asset enterprise,” with a mandate to acquire, manage, and hold the token over the long term while supporting ecosystem-based infrastructure and real-world applications. The group operates two business units: Tembo, which develops electric utility vehicles and associated energy solutions, and Caret Digital, which is tasked with power-to-X initiatives including mining.

Not Just Purchases

VivoPower has layered other initiatives onto this treasury pivot. On September 2, the company announced a definitive agreement with Doppler Finance—a native yield platform backed by ReForge, DCG and other Ripple-affiliated entities—to deploy an initial $30 million of XRP in staged tranches.

The program is positioned as a “regenerative loop,” with yields reinvested back into reserves to compound the treasury over time. “By harnessing Doppler Finance’s programmable infrastructure, we can put reserves to work while retaining XRP as our cornerstone treasury asset,” Executive Chairman and CEO Kevin Chin said in the statement.

A week later, on September 8, VivoPower’s Tembo subsidiary said it would accept Ripple USD (RLUSD) for customer and partner payments—citing near-instant settlement and lower costs versus traditional cross-border bank transfers. The company framed RLUSD acceptance as both operationally pragmatic for its global footprint and strategically aligned with its treasury plan, noting RLUSD’s issuance on both the XRP Ledger and Ethereum.

Taken together, the mining-to-swap channel, the Doppler yield deployment, and RLUSD integration sketch a cohesive playbook: reduce the acquisition cost via mining and procurement discounts, generate yield on held tokens within an institutional framework, and deepen real-economy ties to the ecosystem through stablecoin-based payments. While the “up to 65%” effective discount claim is explicitly forward-looking and contingent on market conditions, VivoPower intends to load up on XRP—by producing and swapping rather than simply buying.

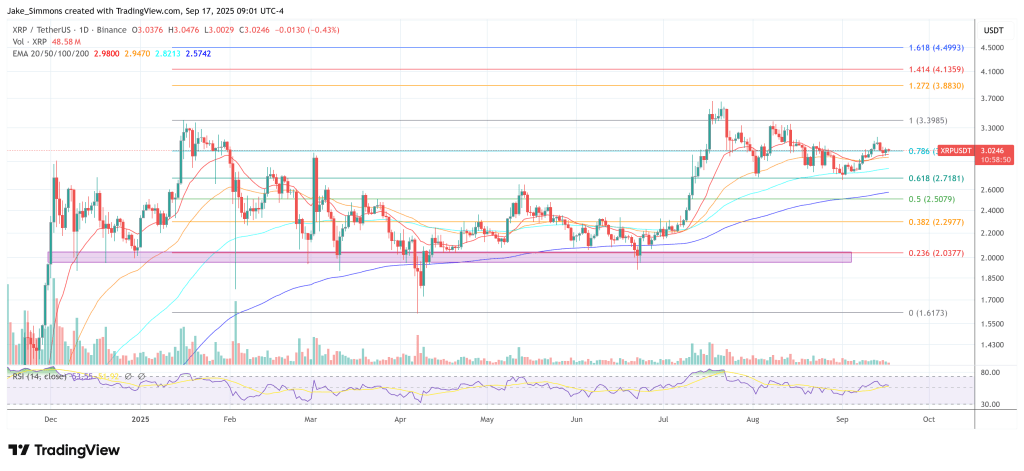

At press time, XRP traded at $3.02.

You May Also Like

SEC Approves Generic ETF Standards for Digital Assets Market

MemeCon 2025: A Gala Night for Web3 Culture & Creativity in Singapore