Crypto Liquidations Hit $1.4 Billion in 24 Hours, Fourth-Largest 90-Day Flush

The cryptocurrency market is in a downfall and crypto liquidations have already surpassed $1.45 billion in the last 24 hours, making it the fourth-worst day in the past three months by 24-hour liquidation size.

As of this writing, over 311,000 traders saw their positions being flushed out, with the largest single liquidation coming from the BTC/USDT pair on Hyperliquid’s competitor, Aster, for $11.36 million in nominal value. Coinspeaker retrieved this data from CoinGlass on February 5 at 5:30 p.m. UTC.

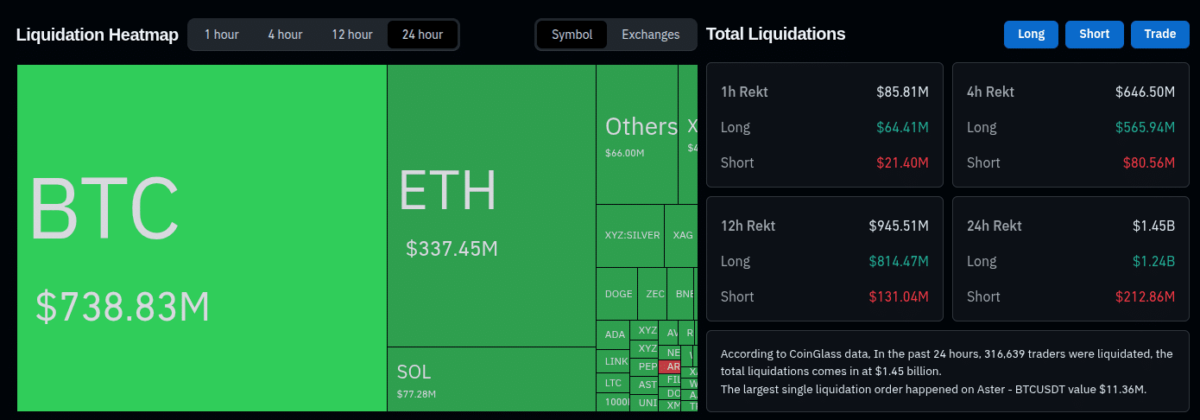

Liquidation heatmap and total liquidations as of February 5, 2026 | Source: CoinGlass

Long positions were the most affected ones, accounting for $1.24 billion out of the $1.45 billion recorded so far. Bitcoin BTC $65 626 24h volatility: 11.1% Market cap: $1.31 T Vol. 24h: $116.21 B leads the liquidations by a large margin, totaling $738.83 million—two times more than Ethereum ETH $1 932 24h volatility: 10.2% Market cap: $232.78 B Vol. 24h: $55.06 B at $337.45 million in second place. Solana SOL $81.47 24h volatility: 11.3% Market cap: $46.27 B Vol. 24h: $9.88 B has the third-largest liquidations at $77.28 million.

Notably, most of the liquidation events happened in the last 12 hours as this data approaches $1 billion. $646 million were liquidated in the last 4 hours alone and $85 million in the past hour of this data collection.

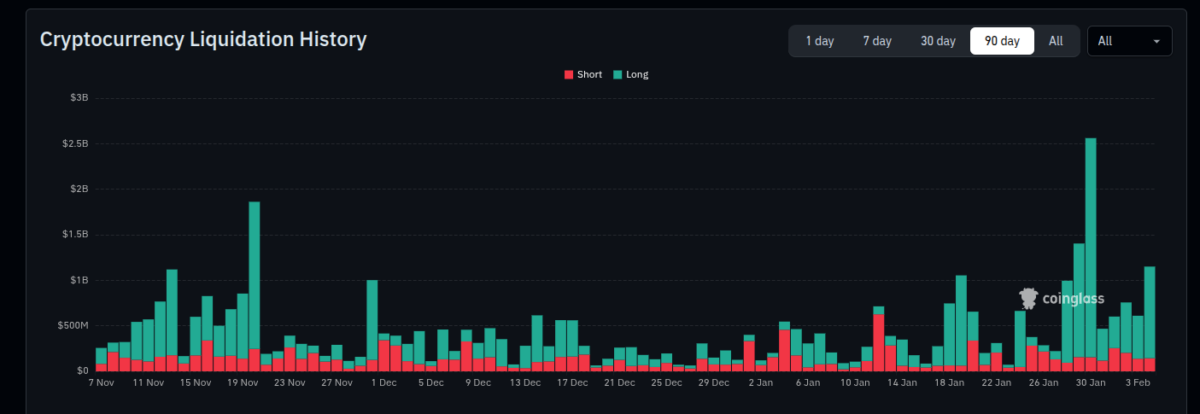

A historical chart from CoinGlass shows this as the fourth-largest daily liquidation event in the last 90 days, only losing to data from January 29, November 20 (2025), and January 30, in order.

Cryptocurrency liquidation history (90D), as of Feb. 5, 2026 | Source: CoinGlass

Analysts Warn of Further Downside as BTC, ETH, SOL Plunge

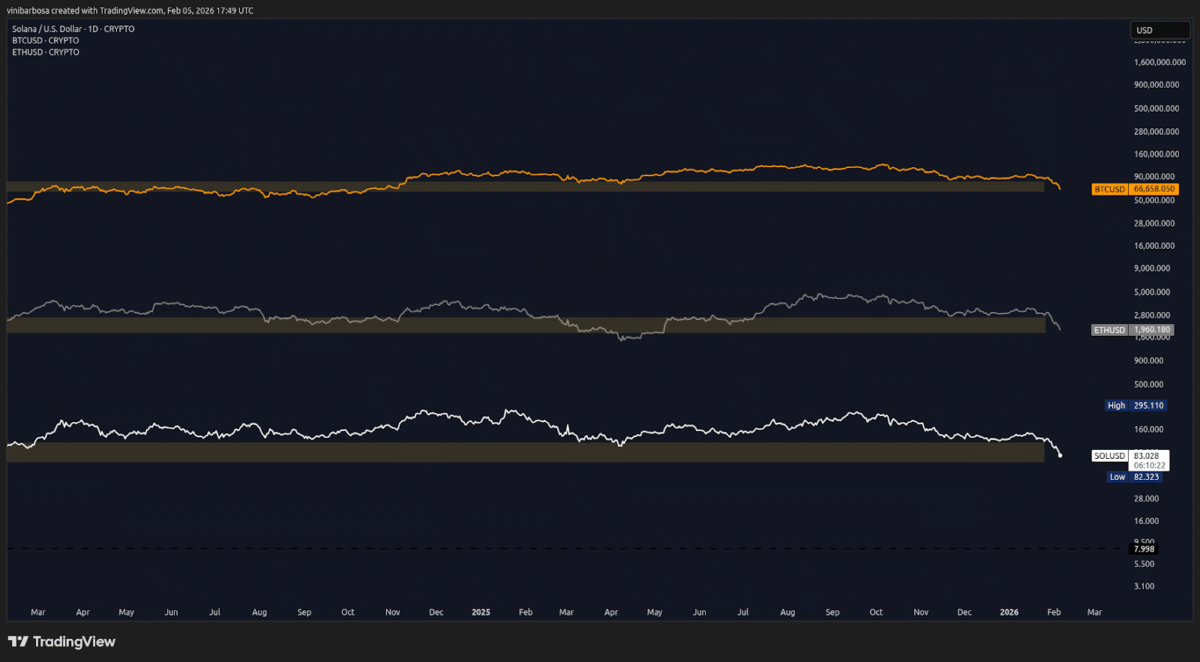

All three cryptocurrencies with the largest recorded liquidations today have lost important price support levels during this crash caused by a long squeeze. They have now entered bear market territory and could visit lower levels in the following days and weeks if they do not recover from this fall. A recovery would mark a chart deviation and invalidate the bearish landscape.

Precisely, BTC was trading at $66,650, ETH at $1,960, and SOL at $83 per coin and tokens.

Bitcoin, Ethereum, and Solana 1D price charts, as of February 5, 2026 | Source: TradingView

Michael Burry, known for predicting the 2008 crisis, warns Bitcoin could replicate its 2021-2022 collapse pattern, potentially dropping to $50,000 or lower, as Coinspeaker reported. Meanwhile, the Bitcoin analyst known as PlanB highlighted four possible bear market scenarios that could play out in the following days.

nextThe post Crypto Liquidations Hit $1.4 Billion in 24 Hours, Fourth-Largest 90-Day Flush appeared first on Coinspeaker.

You May Also Like

$683M to Nscale for 60,000 GPUs by 2026

Gold continues to hit new highs. How to invest in gold in the crypto market?