Find NMT Breakouts in Sideways Markets

Understanding Sideways Markets

- Definition and characteristics of sideways markets in cryptocurrency trading

- How to identify when NMT is trading within a range-bound pattern

- Psychological factors that contribute to sideways markets

- Typical duration and historical patterns of NMT consolidation phases

In cryptocurrency trading, NMT frequently enters sideways movements where price becomes confined within a specific range. These NMT consolidation phases are characterized by reduced volatility between defined support and resistance levels. For traders, identifying these patterns is crucial as they often precede significant NMT breakout moves offering profitable opportunities. You can identify when NMT is trading in a range-bound pattern by observing consistent bounces between support and resistance levels, typically with decreasing volume. During February-March 2025, NMT demonstrated classic sideways movement between $1.75 and $2.10 for nearly three weeks before a significant upward breakout.

Key Technical Indicators for Breakout Detection

- Volume analysis as a leading indicator for potential NMT breakouts

- Using Bollinger Bands to identify compression before breakouts

- RSI divergence patterns that precede directional moves

- The importance of support and resistance levels in identifying NMT breakout zones

- Setting up price alerts to catch breakouts early

Volume serves as a critical breakout indicator for NMT. A sustained volume decrease during NMT consolidation followed by a significant spike often signals an imminent breakout. For instance, NMT's April 2025 sideways trading showed a 50% decrease in average volume followed by a 3x surge that preceded a 15% upward movement. Bollinger Bands compression (or "squeeze") indicates decreased volatility and often precedes explosive NMT price movements. Meanwhile, RSI divergence patterns can predict NMT breakout directions - bullish divergence occurs when price forms lower lows while RSI forms higher lows, suggesting underlying buying pressure despite apparent weakness.

Chart Patterns That Signal Potential Breakouts

- Triangle patterns (ascending, descending, and symmetrical) in NMT charts

- Rectangle and flag formations as continuation patterns

- Head and shoulders patterns as reversal indicators

- Cup and handle patterns in longer timeframes

- The significance of double tops and double bottoms

Triangle patterns on NMT charts offer valuable breakout signals. Ascending triangles typically signal bullish NMT breakouts, while descending triangles suggest bearish moves. During June 2025, NMT formed a textbook ascending triangle before breaking upward for a 20% gain. Rectangle formations appear as horizontal NMT trading ranges with parallel support/resistance lines, while cup and handle patterns form a rounded bottom followed by a short downward drift before breaking upward. Double tops and bottoms occur when NMT price tests a level twice without breaking through, creating either an "M" or "W" shape that often precedes significant moves.

Trading Strategies for NMT Breakouts

- The NMT breakout confirmation strategy: waiting for volume and candle closure

- The false breakout avoidance strategy: using time filters and multiple timeframe analysis

- Risk management techniques specific to NMT breakout trading

- Setting appropriate stop-loss and take-profit levels

- Position sizing considerations for NMT breakout trades

For reliable NMT breakout trading, wait for confirmation through a strong volume surge, decisive candle close beyond the breakout level, and price holding position for at least 4 hours. To avoid false NMT breakouts, use time filters and multiple timeframe analysis to ensure the breakout is significant across various chart intervals. Risk management is crucial when trading NMT breakouts. Implement strict stop-losses 1-2% below breakout levels, position sizing risking only 1-2% of capital per NMT trade, and taking partial profits while moving stops to breakeven. For take-profit targets, measure the NMT consolidation pattern's height and project it from the breakout point.

Practical Tools and Platforms for Breakout Trading

- Setting up effective NMT chart layouts on MEXC

- Configuring scanner tools to identify potential NMT breakout candidates

- Using the MEXC mobile app for on-the-go NMT breakout monitoring

- Creating custom indicators and alerts to catch NMT breakouts early

- Analyzing order book data to validate NMT breakout strength

MEXC provides excellent tools for NMT breakout trading. Configure charts to display multiple timeframes, volume indicators with moving averages, and Bollinger Bands. Use the platform's scanner tools to identify potential NMT breakout candidates by detecting low volatility levels, decreasing volume patterns, and price approaching key resistance. The MEXC mobile app enables on-the-go monitoring with real-time NMT alerts, customizable watchlists, and full-featured charting. Create custom alerts for NMT volume surges, price breaks at key levels, and Bollinger Band contractions. Additionally, MEXC's order book data helps validate NMT breakout strength by revealing the depth of orders near potential breakout levels.

Conclusion

Effective NMT breakout trading combines technical analysis with strict risk management. Monitor key indicators while using appropriate stop-losses to protect your capital during volatile NMT market conditions. For current NMT analysis and breakout opportunities, visit MEXC's NMT Price page and trade with confidence using our comprehensive toolset designed for crypto traders.

Popular Articles

What is Solana Mobile (SKR)?A Blockchain-Native Smartphone Platform Bridging Hardware, dApps, and Tokenized Governance

Key Takeaways1)Solana Mobile is a hardware-first Web3 platform, integrating self-custody and blockchain security directly into smartphones.2)Saga and Seeker phones function as on-chain access devices,

What is Immunefi(IMU)? A Complete Guide to Web3's Leading Security Platform

Key Takeaways1) Immunefi focuses on continuous Web3 security coordination, not one-time audits.2) Bug bounties and audit competitions form the core of its security model.3) Magnus serves as an operati

What Is VOOI ($VOOI)? A Non-Custodial Perpetual DEX Aggregator Explained

Key Takeaways1)VOOI is a non-custodial perpetual DEX aggregator that routes trades across multiple DEXs without holding user funds.2)The platform leverages chain abstraction and intent-based execution

Balancing Security and Accuracy: Dynamic Logic of Risk Control Systems

As crypto markets evolve, so do the tactics used by fraudsters and market manipulators. To keep users safe and preserve market integrity, crypto exchanges must constantly enhance their risk control an

Hot Crypto Updates

hadtotakeprofits sir (HTTPS) Spot Trading Platform Comparison: Why MEXC Leads the Market

Choosing the right hadtotakeprofits sir (HTTPS) spot trading platform can significantly impact your trading success. MEXC stands out among cryptocurrency exchanges with superior features, competitive

Hadtotakeprofits sir (HTTPS) MEXC Spot Trading App: Your Gateway to Mobile Trading

The MEXC spot trading app revolutionizes how you trade hadtotakeprofits sir (HTTPS) with industry-leading zero maker fees and access to over 3,000 trading pairs. As one of the world's most trusted cry

hadtotakeprofits sir (HTTPS) Spot Trading Strategies: A Beginner's Guide

Spot trading involves buying and selling cryptocurrencies for immediate delivery at current market prices. For beginners looking to trade hadtotakeprofits sir (HTTPS), understanding effective spot tra

hadtotakeprofits sir (HTTPS) MEXC Spot Trading Fee: Complete Guide for Beginners

Understanding MEXC spot trading fees is crucial when trading hadtotakeprofits sir (HTTPS). MEXC operates on a maker–taker fee structure with 0% fees for makers and 0.05% fees for takers on spot market

Trending News

Qatar pushes tokenization with launch of QCD money market fund

QNB Group (Qatar National Bank), along with other partners have officially launched a tokenized money market fund, called the QCD Money Market Fund (QCDT).

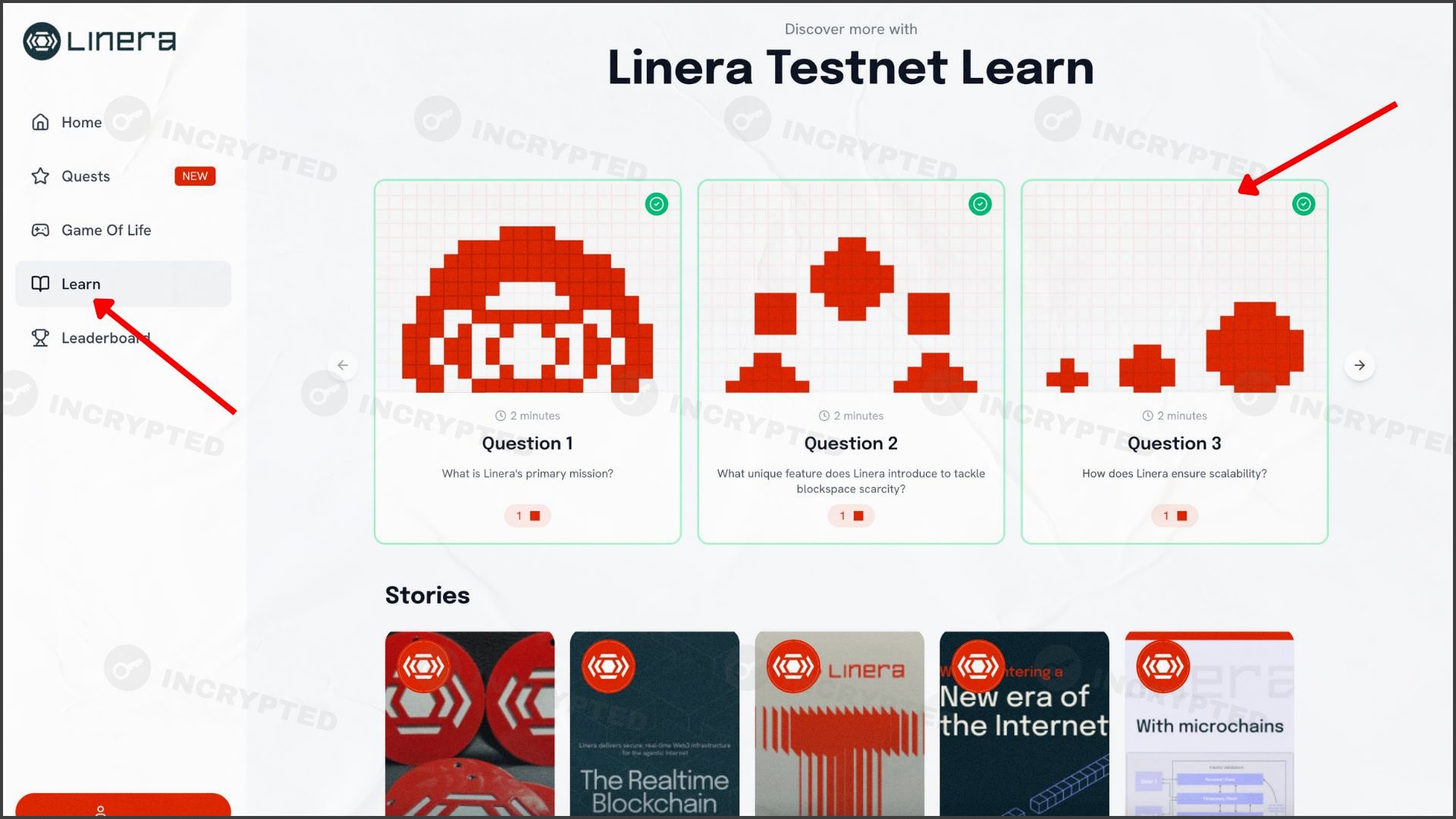

Linera — Testnet Conway

Linera is an L1 blockchain developed in the Rust programming language. Like many similar projects, it aims to address scalability, transaction speed, and security. The project has attracted investment

Resolve AI’s Stunning $1 Billion Valuation: How Ex-Splunk Execs Built the Future of Autonomous SRE

BitcoinWorld Resolve AI’s Stunning $1 Billion Valuation: How Ex-Splunk Execs Built the Future of Autonomous SRE In a remarkable development that’s shaking up the

NEAR Protocol Eyes Potential Reversal After Solana Trading Debut Amid Selling Pressure

The post NEAR Protocol Eyes Potential Reversal After Solana Trading Debut Amid Selling Pressure appeared on BitcoinEthereumNews.com. NEAR Protocol’s recent listing

Related Articles

What is Solana Mobile (SKR)?A Blockchain-Native Smartphone Platform Bridging Hardware, dApps, and Tokenized Governance

Key Takeaways1)Solana Mobile is a hardware-first Web3 platform, integrating self-custody and blockchain security directly into smartphones.2)Saga and Seeker phones function as on-chain access devices,

What is Immunefi(IMU)? A Complete Guide to Web3's Leading Security Platform

Key Takeaways1) Immunefi focuses on continuous Web3 security coordination, not one-time audits.2) Bug bounties and audit competitions form the core of its security model.3) Magnus serves as an operati

What Is VOOI ($VOOI)? A Non-Custodial Perpetual DEX Aggregator Explained

Key Takeaways1)VOOI is a non-custodial perpetual DEX aggregator that routes trades across multiple DEXs without holding user funds.2)The platform leverages chain abstraction and intent-based execution

Balancing Security and Accuracy: Dynamic Logic of Risk Control Systems

As crypto markets evolve, so do the tactics used by fraudsters and market manipulators. To keep users safe and preserve market integrity, crypto exchanges must constantly enhance their risk control an