Trading time: As Bitcoin hits the 106,000 resistance, some BTC and ETH whales start shorting before the results of the China-US negotiations and the announcement of CPI

1. Market observation

Keywords: SOL, ETH, BTC

Global financial markets are welcoming positive changes. China and the United States reached important consensus in the talks held in Geneva, Switzerland over the weekend. Both sides agreed to establish a trade consultation mechanism to lay the foundation for resolving differences. Trump praised the negotiations on social media as "making great progress", and his Treasury Secretary Bessant and Trade Representative Greer also said that they would share more details today. In addition, the United States will release April CPI data on May 13. Previously, the CPI fell by 0.1% month-on-month in March, a new low in nearly five years, and the core CPI increased by 2.8% year-on-year, the lowest level in four years. However, analysts expect that this easing of inflationary pressure may be difficult to sustain, especially after the Trump administration implements a comprehensive tariff policy. David Kelly, chief global strategist at JPMorgan Asset Management, said this may be the calm before the inflation storm. Observers pointed out that the US government's move to increase tariffs may push up inflation levels in the coming months, which may have an impact on the Federal Reserve's monetary policy path. The market is closely watching the upcoming CPI data to assess the specific impact of the tariff transmission effect on the US economy.

Ethereum is replacing Bitcoin to lead the recent crypto market. The price of Bitcoin was almost the same as Friday over the weekend, with no significant fluctuations. The market expects that today's opening of the US stock market and the results of the Sino-US negotiations will affect the direction of Bitcoin. Analyst Rekt Capital pointed out that market data shows that the current liquidity is mainly concentrated around $104,000, and $106,000 has become the next key resistance level, but some traders are cautious about the short-term trend, worrying that a "false breakthrough" may occur and then fall back to $102,000 or lower. Ethereum performed particularly well after the successful implementation of the Pectra upgrade, breaking through $2,600 over the weekend, with a weekly increase of nearly 40%, driving the recovery of the entire crypto ecosystem. The market has begun to look forward to the next major upgrade Fusaka before the end of the year. Although some institutions have recently begun to purchase Ethereum and Bitcoin, such as Abraxas Capital withdrew 185,309 Ethereum (currently worth about $470 million) from Binance within 3 days, this part of ETH has been deposited in Aave and Compound. The institution also purchased more than $250 million in Bitcoin in mid-April. But it is worth noting that many whales and smart money began shorting and selling BTC, ETH and SOL today.

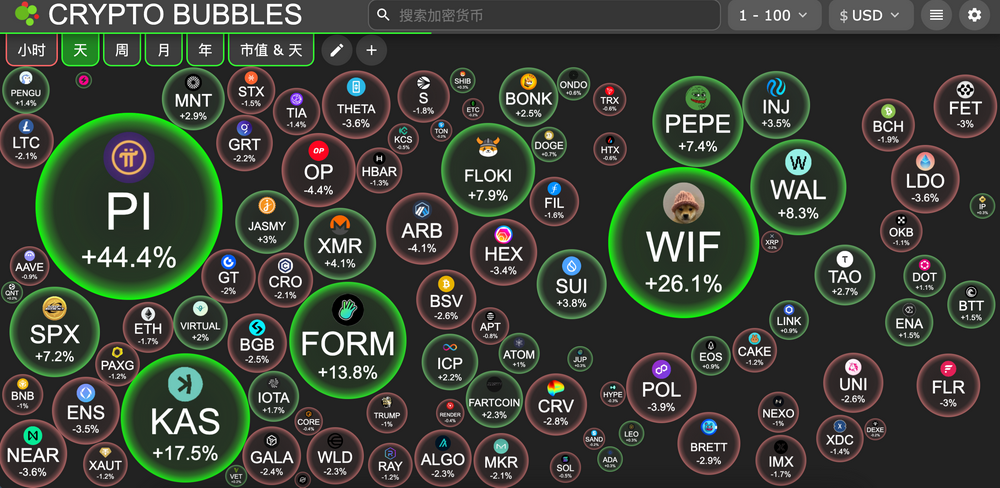

The altcoin market has recently shown signs of recovery, with a slight correction today. DWF Labs partner Andrei Grachev revealed last Friday that they are buying a large number of various small currencies and considering establishing strategic reserves. However, analysts are divided on the sustainability of the market. Among them, 2Lambroz believes that the peak season of altcoins may have arrived, but the market lacks a strong story and retail investors are not obvious; while technical experts point out that the current market structure is similar to that in 2016 and 2020, and small currencies may usher in explosive growth after the accumulation period. Two popular meme coins also appeared on the chain over the weekend: one is the $USELESS token, which focuses on "uselessness" and is supported by the founder of Bonk; the other is the new character mouse frog $RATO created by the father of Pepe. MOODENG and GOAT launched on Binance Alpha have also performed well recently. Since May 8, MOODENG has risen from $0.0396 to $0.294 (up 642%), and GOAT has risen from $0.07 to $0.2428 (up 247%). In addition, the TRUMP dinner leaderboard will be closed at 1:30 am on May 13, when the top 220 dinner qualifications will be determined. Some traders are betting on TRUMP's future, and a new wallet withdrew $7.6 million of TRUMP from Binance and OKX today.

2. Key data (as of 12:00 HKT on May 12)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

-

Bitcoin: $104,008 (+11.2% YTD), daily spot volume $27.02 billion

-

Ethereum: $2,517.00 (-24.26% YTD), with daily spot volume of $23.22 billion

-

Fear of Greed Index: 70 (greed)

-

Average GAS: BTC 1. sat/vB, ETH 1.02 Gwei

-

Market share: BTC 61.8%, ETH 9.1%

-

Upbit 24-hour trading volume ranking: XRP, DOGE, BTC, MOVE, PUNDIX

-

24-hour BTC long-short ratio: 1.0342

-

Sector gains and losses: Meme sector rose 3.52%, AI sector rose 1.28%

-

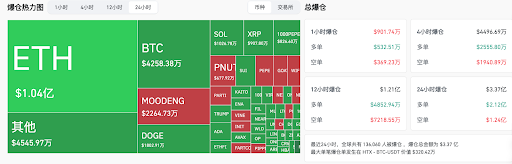

24-hour liquidation data: A total of 136,060 people were liquidated worldwide, with a total liquidation amount of US$337 million, including BTC liquidation of US$42.58 million, ETH liquidation of US$104 million, and MOODENG liquidation of US$22.64 million

-

BTC medium and long-term trend channel: upper channel line ($100,217.67), lower channel line ($98,233.16)

-

ETH medium and long-term trend channel: upper channel line ($2151.34), lower channel line ($2108.74)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of May 9)

-

Bitcoin ETFs: +$321.46 million

-

Ethereum ETF: +$17.61 million (3 consecutive days of net outflow)

4. Today’s Outlook

-

U.S. SEC Chairman Paul Atkins will deliver a keynote speech on asset tokenization on the 12th

-

The US SEC plans to hold the fourth crypto roundtable meeting, and executives from BlackRock, Fidelity, Nasdaq and others will attend

-

sns.sol will airdrop SNS tokens on May 13th. Users will have 90 days to claim their token allocations.

-

Binance will launch an Alpha points consumption mechanism on May 13. If a user successfully participates in TGE or receives an airdrop, the system will deduct a certain amount of Alpha points.

-

Aptos (APT) will unlock approximately 11.31 million tokens at 2 a.m. on May 13, accounting for 1.82% of the current circulation and worth approximately $67.5 million.

U.S. April unadjusted CPI annual rate (May 13, 20:30)

-

Actual: To be announced / Previous value: 2.4% / Expected: 2.4%

U.S. April seasonally adjusted CPI monthly rate (May 13, 20:30)

-

Actual: To be announced / Previous value: -0.1% / Expected: 0.3%

The biggest increases in the top 500 stocks by market value today : MOODENG up 118.78%, GOAT up 56.18%, CHILLGUY up 54.54%, FWOG up 52.13%, and TOSHI up 37.56%.

5. Hot News

-

Data: APT, ARB, AVAX and other tokens will usher in large amounts of unlocking, of which APT unlocking value is about 67.5 million US dollars

-

This week's preview | US April CPI data will be released; VanEck plans to launch a new crypto-related ETF

-

Macro Outlook This Week: CPI data may trigger stagflation trading script, BTC may face $100,000 support test

-

FTX/Alameda address unstaked 187,625 SOL 8 hours ago, equivalent to 32.24 million US dollars

-

Another whale shorted BTC worth $44 million with 40x leverage, and the liquidation price was $112,660

-

Irish Presidential Candidate Conor McGregor to Meet with El Salvador’s President to Discuss Strategic Bitcoin Reserves

-

A whale deposited another 5 million USDC into Hyperliquid, shorting BTC, ETH, and SOL with 5x leverage

-

Crypto KOL Patricio Worthalter sold 2,000 ETH for 5.01 million USDC

-

“Hyperliquid 50x Whale” shorted BTC again after 35 days

-

A new wallet withdrew $7.6 million worth of TRUMP from Binance and OKX

-

BlackRock Bitcoin ETF has seen net inflows for 20 consecutive days, setting a record for the longest inflow this year, with Goldman Sachs' IBIT holdings increasing by 28% in Q1

-

Canadian technology company Matador plans to raise $3 million CAD, with part of the net proceeds to be used to increase Bitcoin holdings

-

Guotai Junan International plans to develop tokenized securities business

-

The topic "What happened to Ethereum after it surged 40% in 3 days" topped the Douyin hot list

-

Ethereum's market value surpasses Coca-Cola and rises to 40th place in global asset market value ranking

-

Binance Alpha Launches MOODENG and GOAT

-

ether.fi Foundation: 437,000 ETHFIs have been repurchased this week, spending 137 ETH

-

DWF Labs partner: We are buying a large number of different altcoins and considering establishing a strategic reserve

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse