Trading time: After the CPI cooled down, Trump called for the stock market to rise again. Ethereum's market value accounted for nearly 10% and filled the gap in CME. The popularity of Meme coins on th

1. Market observation

Keywords: SOL, ETH, BTC

Trump spoke again this morning, predicting that the stock market will rise sharply and putting pressure on Federal Reserve Chairman Powell to cut interest rates as soon as possible. At the same time, the US inflation data for April released yesterday unexpectedly cooled down, with the CPI annual rate falling to 2.3%, the lowest since February 2021, and the core CPI annual rate remaining at 2.8%. Affected by this, the prices of US short-term interest rate futures rose, and traders' expectations for the Fed's interest rate cuts increased significantly. The market generally expects the Fed to cut interest rates for the first time in September. However, major Wall Street investment banks are more cautious in their predictions of the time window for interest rate cuts. Goldman Sachs and Barclays have postponed the Fed's next interest rate cut to December. JPMorgan Chase holds the same view, while Citigroup has adjusted its expectations from June to July. Despite the optimism brought by inflation data, Trump's tariff policy still arouses market concerns. Analysts pointed out that the full impact of tariffs on inflation has not yet fully emerged because retailers are still digesting previously stockpiled inventory. However, as the US-China tariffs enter a truce, Goldman Sachs lowered the probability of a US recession from 45% to 35%. Goldman Sachs said in the report that the shift in trade policy has reduced the risk of economic recession to a certain extent, but the economic pressure brought by high tariffs and continued uncertainty still pose major challenges to U.S. investors and corporate management, which may affect investment decisions and market confidence, and thus have a potential impact on economic growth.

Bitcoin is currently in a range, while Ethereum has broken through $2,700, accounting for nearly 10% of the market value. According to QCP Capital analysis, BTC may continue to fluctuate in a range as the macro narrative shifts from protectionism to trade optimism. In contrast, ETH's trend is clearer. Its breakthrough of $2,400 is synchronized with the Pectra upgrade, and the reappearance of long-term option flows may indicate that ETH is becoming the next major configuration object in the market. Investment institution Abraxas Capital has purchased a large amount of Ethereum, purchasing 242,652 ETH in the past week, worth about $561 million. It is worth noting that according to Rekt Capital analysis, Ethereum has completely filled the CME daily gap of about $2,530 and $2,630 (green area), and the next CME daily gap may be between about $2,892 and $3,033.5. If the price of Ethereum continues to rise and breaks through the current support area, the market may focus on this area as a potential target price.

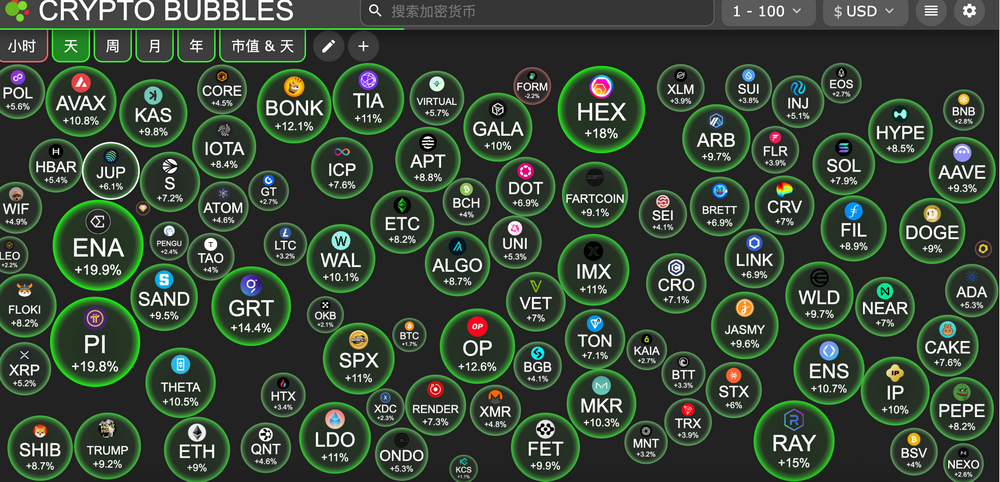

Altcoins collectively rose, AI and mainstream MEME coins became the first choice for funds, and the on-chain market continued to be hot. Glonk has a competitive landscape between multiple platforms and multiple chains. The letsbonk.fun version has a market value of up to 18 million US dollars, while the Pump.fun version has a market value of up to 15 million US dollars. The founders of both platforms have spoken out for their respective versions of Glonk, which has focused the market's attention. Currently, the letsbonk.fun version seems to be more popular. At the same time, crypto KOL Pata van Goon launched Gooncoin (GOONC) on the Believe platform. After Moonshot was announced to be launched, the market value once exceeded 70 million US dollars. In addition, Believe's platform coin LAUNCHCOIN (formerly PASTERNAK) has soared from a market value of 2.7 million US dollars on May 9 to 280 million US dollars today, an increase of more than 100 times in the past week.

2. Key data (as of 12:00 HKT on May 14)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

-

Bitcoin: $103,564 (+10.92% YTD), daily spot volume $32.876 billion

-

Ethereum: $2,638.26 (-20.2% YTD), with $35.33 billion in daily spot volume

-

Fear of Greed Index: 74 (Greed)

-

Average GAS: BTC 1.07 sat/vB, ETH 0.95 Gwei

-

Market share: BTC 61.3%, ETH 9.5%

-

Upbit 24-hour trading volume ranking: XRP, ETH, KAITO, DOGE, BTC

-

24-hour BTC long-short ratio: 1.0141

-

Sector gains and losses: Launchpad sector rose 15.15%, Meme sector rose 8.51%

-

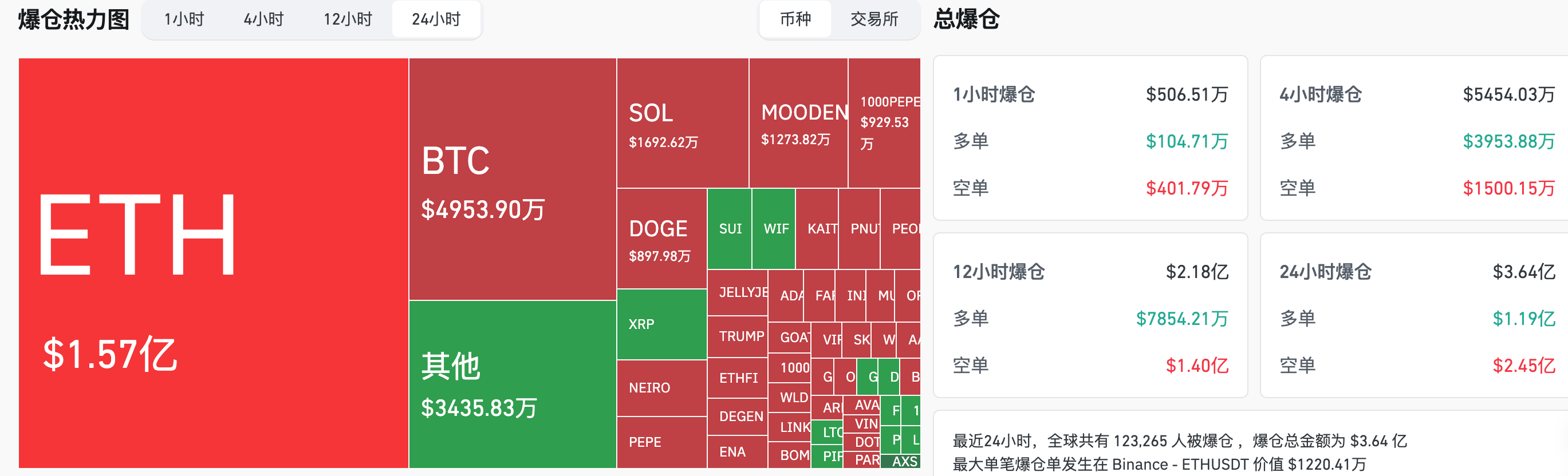

24-hour liquidation data: A total of 123,265 people were liquidated worldwide, with a total liquidation amount of US$364 million, including BTC liquidation of US$49.539 million, ETH liquidation of US$157 million, and SOL liquidation of US$16.926 million

-

BTC medium and long-term trend channel: upper channel line ($100,716.05), lower channel line ($98,721.68)

-

ETH medium and long-term trend channel: upper channel line ($2287.28), lower channel line ($2241.99)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of May 13)

-

Bitcoin ETF: -$96,142,500

-

Ethereum ETF: +$13,372,800

4. Today’s Outlook

-

Binance Wallet will launch the 16th TGE project on May 14: Privasea (PRAI)

-

Web3 Bank Vaulta (formerly EOS) changes EOS tokens to A tokens with a 1:1 exchange ratio

-

Metis launches Andromeda upgrade, introducing two breakthrough innovations: fraud proof mechanism and data availability migration to Ethereum mainnet

-

BlockFi creditors need to claim bankruptcy compensation as soon as possible, with May 15 as the deadline

-

Distributed validator technology project Obol Collective plans to launch its token $OBOL on May 15

-

If the new proposal of "Sky replaces MKR as the only governance token" is passed, governance rights will be moved to the new contract starting on May 15

-

Sei (SEI) unlocked approximately 55.56 million tokens, accounting for 1.09% of the current circulation, worth approximately $14.5 million

-

Starknet (STRK) unlocked approximately 127 million tokens, accounting for 4.09% of the current circulation, worth approximately $23 million

Number of initial jobless claims in the United States as of the week ending May 10 (10,000 people) (May 15, 20:30)

-

Actual: To be announced / Previous value: 22.8 / Expected: 23

The stocks with the largest increases in the top 500 by market value today: PEOPLE up 57.55%, SATS up 45.08%, BOME up 40.14%, GODS up 38.79%, and NEIRO up 37.94%.

5. Hot News

-

The LAUNCHCOIN that a trader bought for $9,075 a month ago is now worth $4.7 million

-

Abraxas Capital's ETH holdings in the past week have reached $561 million

-

Pudgy Penguin CEO: Abstract Chain's TGE is expected to be held in Q4

-

An investor/institutional address transferred 11.652 million UNI to Coinbase Prime, equivalent to approximately US$82.38 million

-

The Uniswap Foundation transferred $3.12 million worth of UNI to Binance via FalconX in the past 28 hours

-

A whale deposited another 11.9 million USDC into HyperLiquid, increasing its short positions on BTC, ETH, and SOL

-

DeFi Development Corp. spent $23.6 million to increase its SOL holdings, bringing its total holdings to 595,988

-

Twenty One Capital has purchased $458.7 million worth of Bitcoin

-

DWF Labs purchased 3 million SIREN and withdrew the tokens on the chain

-

Moonshot launches FITCOIN , NOODLE, and GOONC

-

Binance Alpha launches NAVX , SCA , and RDAC

-

The whale that hoarded more than 120,000 ETH in 2022 completed the liquidation and made a profit of more than US$131 million

-

The U.S. April unadjusted CPI annual rate was 2.3%, and the seasonally adjusted CPI monthly rate was 0.2%

-

The Alpha score requirement for the RDAC airdrop on Binance is 205 points. Claiming it will consume 15 Alpha points

-

Four wallets withdrew approximately $23.82 million of NEIRO from CEX in 4 days, accounting for 24.2% of the total supply

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates