Altcoins Liquidations Hit $260M as Solana and Dogecoin Spark a Surprise Rally

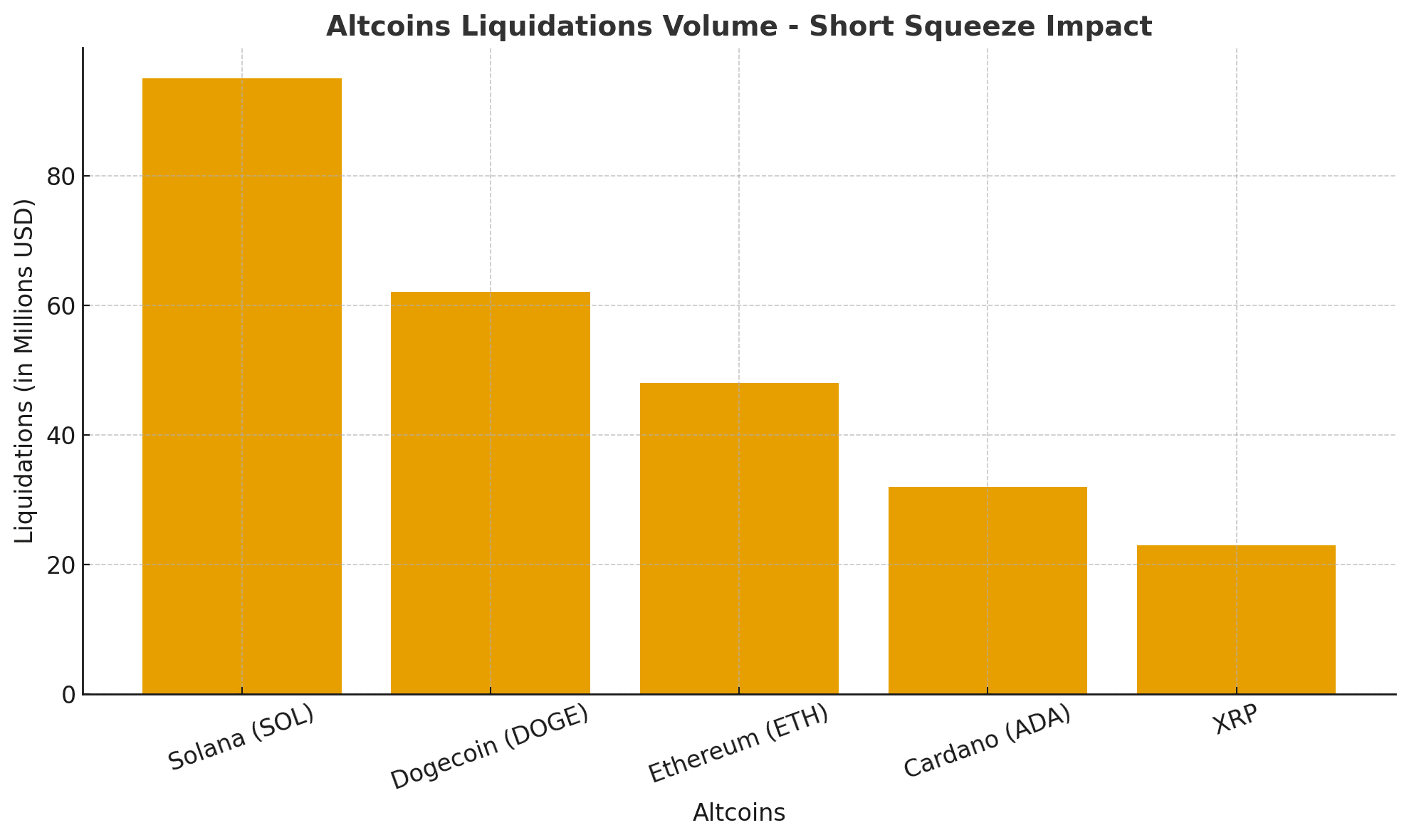

Altcoins liquidations played a starring role in driving market volatility. Solana and Dogecoin led gains, fueled by aggressive short squeezes, unraveling $260 million in short bets.

The move has traders on edge, because when so many leveraged positions get blown out, it often signals more than just a blip.

Short Squeezes Ignite Rally in Altcoins

Markets tilted upward after a wave of forced short liquidations. Traders who bet against the run found themselves scrambling to cover, adding upward pressure on select altcoins. Solana, fresh off a 4 % daily gain, saw short liquidation losses dwarf long ones, highlighting how bearish bets were unexpectedly crushed.

Meanwhile, general crypto markets are still licking wounds from earlier long-side flushes. Over $1.5 billion in leveraged bets, mostly longs, were wiped out in a single session not long ago.

This delicate dance of altcoins liquidations, first longs, now shorts, underscores how fragile sentiment remains.

Reading the Key Crypto Indicators

To make sense of this, one must track a few vital signals:

-

Liquidation volume (longs vs shorts): Large long liquidations traditionally mark panic exits; huge short liquidations often spark squeezes.

-

Open interest & funding rates: Rising open interest with steep funding can set traps. A crowded long or short side is one big catalyst away from collapse.

-

Relative Strength Index (RSI): When RSI dips below ~30 on high volume, markets often oversell. But when it races above 70 during short squeezes, the rebound may overextend.

-

Whale & institutional flows: Big wallets moving funds off exchanges or shifting holdings often foretell directional bias.

-

Sentiment gauges (Fear & Greed, social metrics): When crowd sentiment flips quickly, the trend may follow.

In the current stretch, altcoins liquidations have magnified price swings rather than establishing a clear direction.

altcoins liquidations

altcoins liquidations

Why This Liquidation Cycle Matters

This run isn’t just noise. The swing from liquidating overextended longs to now punishing short bets suggests a churny market. In plain terms: the bulls are cautious, the bears are vulnerable. That setup can lead to suspense, one more catalyst and direction could snap.

Also, this volatility serves as a brutal reminder: leverage is a double-edged sword. Traders piling on ETH or SOL with 20x or higher risk can get ejected just as fast as those riding short.

Finally, regulators and institutions are watching closely. When such violent moves happen in crypto, narratives around market stability, custody risks, and regulatory overreach tend to reemerge.

What to Watch for Next

-

Can the rebound in SOL and DOGE sustain above recent resistance zones?

-

Will further altcoins liquidations (especially in smaller assets) spark fresh jolts?

-

Does Bitcoin stabilize near key support (e.g., ~$112K)?

-

Will macro cues (Fed commentary, U.S. economic data) refresh momentum or dampen it?

In short: the next 48 hours may make or break this bounce.

Conclusion

This latest episode of altcoins liquidations is a microcosm of crypto’s volatile DNA. From forced short squeezes to the shadow of past long flushes, it’s a window into how sentiment, leverage, and positioning battle for control.

The smart move now is to stay nimble, monitor the indicators closely, and resist getting caught off guard in either direction.

Stay alert. The next trend shift might come out of left field.

FAQs about altcoins liquidations

1. What exactly are altcoins liquidations?

They are forced closures of leveraged derivative positions in altcoins, either long (bull bets) or short (bear bets), when margin thresholds are breached.

2. Why do short liquidations often spark rallies?

When short bets get liquidated, those traders must buy back the asset, creating demand and pushing prices higher temporarily.

3. How do liquidation events inform trader strategy?

They reveal crowded trades, potential inflection points, and which side (long or short) is under pressure, helping guide entries or exits.

4. Does heavy liquidation mean the trend will reverse?

Not always. It can mark temporary extremes or just a sharper continuation. Context matters (volume, broader trend, macro backdrop).

Glossary of Key Terms

Altcoins: Any cryptocurrency other than Bitcoin (e.g. SOL, DOGE).

Liquidation: Forced closure of a leveraged position when margin falls short.

Short squeeze: When short positions are squeezed, causing rapid price jumps.

Open interest: Total outstanding derivative contracts that are not yet closed.

Funding rate: Periodic payments between long/short traders to balance perpetual futures.

RSI (Relative Strength Index): Oscillator measuring overbought/oversold conditions.

Read More: Altcoins Liquidations Hit $260M as Solana and Dogecoin Spark a Surprise Rally">Altcoins Liquidations Hit $260M as Solana and Dogecoin Spark a Surprise Rally

You May Also Like

Momentous Grayscale ETF: GDLC Fund’s Historic Conversion Set to Trade Tomorrow

The UA Sprinkler Fitters Local 669 JATC – Notice of Privacy Incident