Whales Are Suddenly Rushing to Bitcoin Hyper’s $19.4M Presale: Here’s Why It’s Time to Buy

The heyday of cheap $BTC is well and truly over – Bitcoin is now an industry-defining asset for crypto. It’s currently trading at around $116K after a recent all-time high of $124K, putting its market cap at around $2.3T. Bitcoin looks geared to only grow, but that comes with its own set of issues for the network.

That’s why the Bitcoin Hyper ($HYPER) developers are building a high-speed Layer-2 project to take the pressure off the Bitcoin network.

Why is Bitcoin so Slow?

Part of Bitcoin’s slow processing speed is by design. The quickest time frame for a Bitcoin transaction to process is around seven minutes, which is how long it takes for blocks to be added to the blockchain. Each block has a fixed cap on file size, so there’s a limit on how many transactions Bitcoin can process at once.

For long-term investors, BTC’s slow TPS isn’t an issue. If you intend to hold Bitcoin for months or years, an extra hour or so won’t make a difference in return for rock-solid security guarantees. You’re more interested in the transactions being fully authoritative, which is what Bitcoin offers.

Source: Serokell

But for Web3 adopters, it’s a very different story. The slow transaction speeds mean Bitcoin is unfeasible to use for web applications when Ethereum (119 TPS) and Solana (65K TPS) are more viable alternatives. It’s even worse for retail – let’s be real, nobody is going on a shopping spree with $BTC if every transaction takes close to 10 minutes.

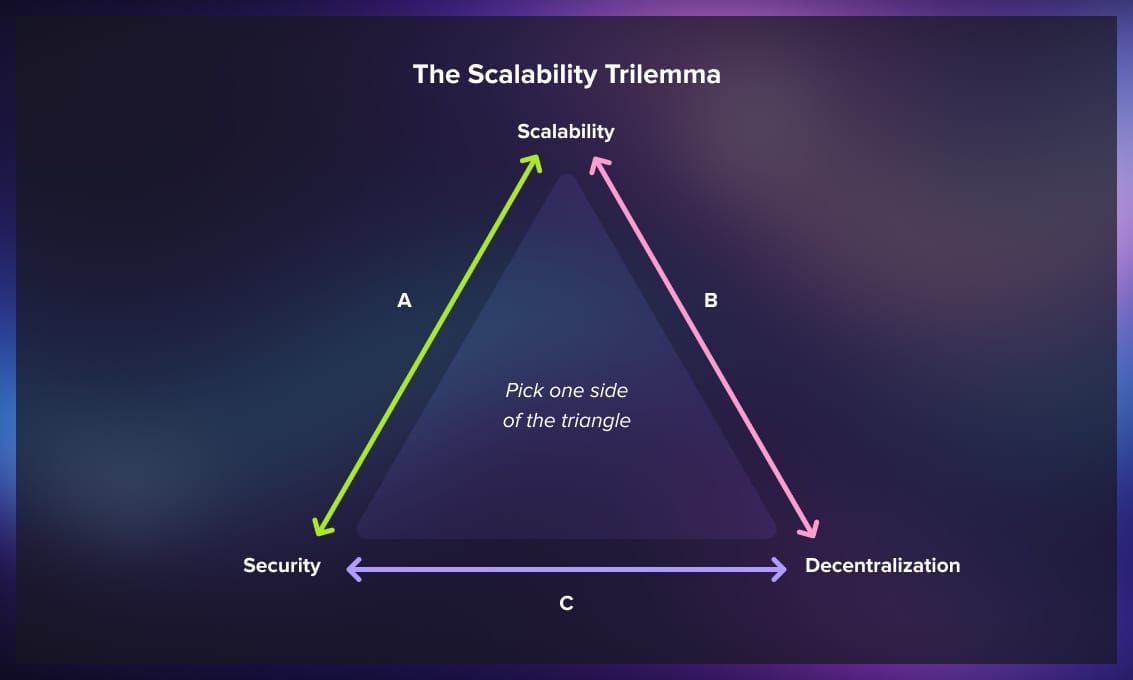

It’s widely agreed that highly secure decentralized blockchains do not scale well. As more users get into Bitcoin, transaction fees are only going to go up as traders compete to have their transactions processed first.

How does $HYPER solve these issues?

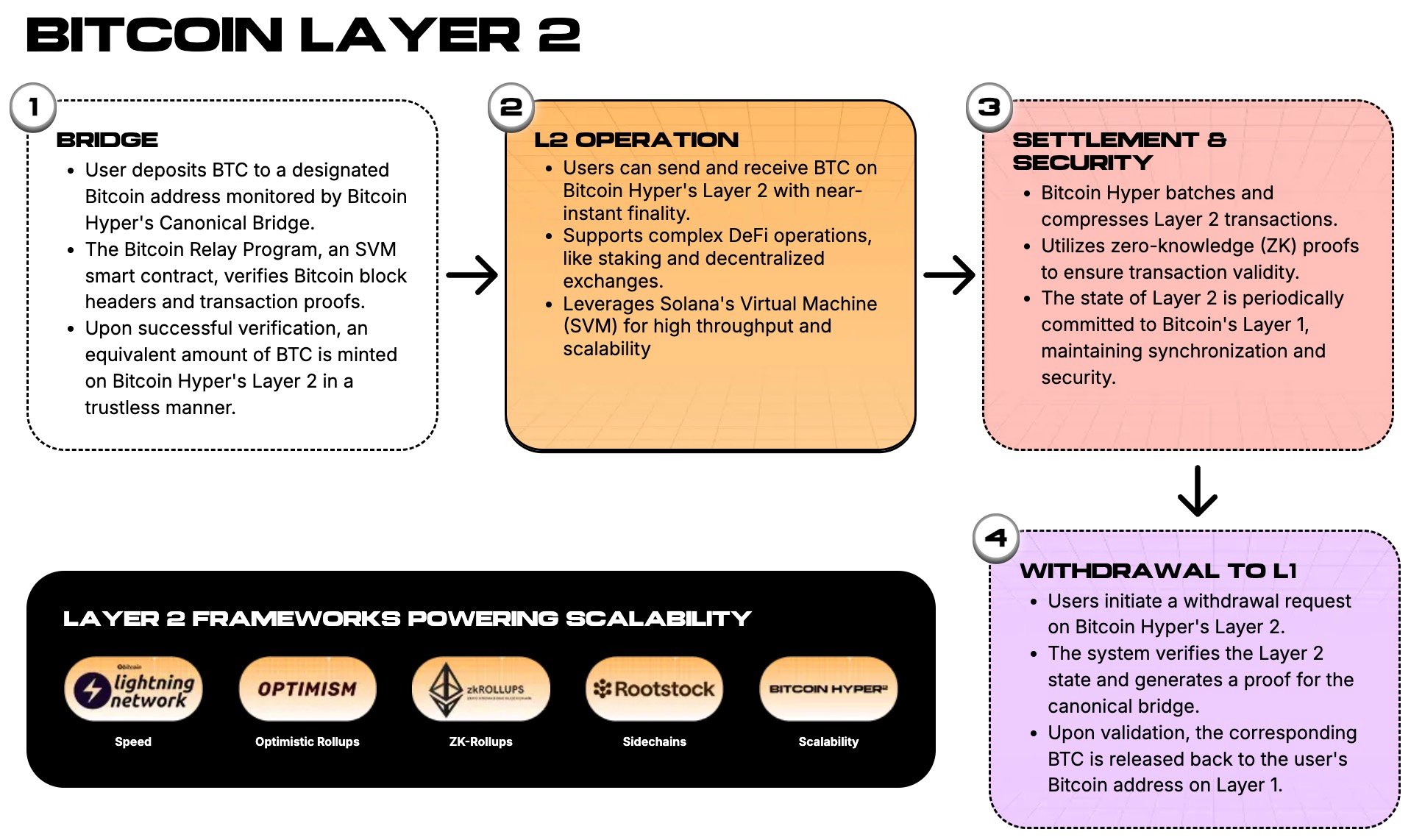

Bitcoin Hyper will integrate the Solana Virtual Machine’s parallel processing to massively increase the number of transactions the Bitcoin network can handle in the same time frame. It will run on a Layer-2 on top of the Bitcoin network, creating extra capabilities without adding strain to the underlying blockchain.

Bitcoin Hyper will track $BTC trades by recording all transactions that take place on the Layer-2 in a temporary ledger that is regularly settled back onto the Bitcoin Layer-1.

The two layers will be linked by a Canonical Bridge that handles custody of $BTC on the Layer-1, as well as minting and placing wrapped $BTC on the Layer-2.

For more details on how Bitcoin Hyper works, take a look at our Bitcoin Hyper review.

Why Are Whales Rushing To The $HYPER Presale?

As the native token of Bitcoin Hyper, $HYPER offers massive utility as a Layer-2 for $BTC. It will enable holders to access smart contracts, DeFi, dApps, swaps, and more – and faster and cheaper than the Bitcoin Layer-1 could ever deliver.

When Bitcoin Hyper goes live, developers will be able to create smart contracts with functionality that can only be fueled by $HYPER, creating additional demand for the token and encouraging existing development teams to port their Web3 infrastructure to the Bitcoin Hyper.

The whale buys of $12.3K and $10.9K in the past 24 hours are impressive, but they’re a drop in the bucket compared to the $19.5M $HYPER has already raised.

Right now you can buy $HYPER for $0.013005 and stake it for 60% APY. Our price prediction for $HYPER reckons this token has the potential to reach $0.20 by the end of 2025. That’s a return of 1.430% on today’s price. In the long-term, $HYPER has the potential to reach a high of $1.20 in 2030.

Much of $HYPER’s value comes from the inherent utility it has on the Bitcoin Hyper network, which we expect to be augmented by its ability to unlock exclusive features in Bitcoin Hyper’s dApps.

According to the Bitcoin Hyper whitepaper, however, the presale is due to end in Q4 2025, so you’ll need to act soon if you want to pick up $HYPER at its early-bird price.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

Outlook remains cautious – TD Securities