“All Currency” Will Become Stablecoins By 2030, Says Tether Co-Founder Reeve Collins

Tether co-founder Reeve Collins says “all currency” will become stablecoins by 2030 as traditional finance begins to move on-chain.

“All currency will be a stablecoin,” he said during an interview at the Token2049 conference in singapore. “So even fiat currency will be a stablecoin,” he added. “It’ll just be called dollars, euros, or yen.”

Benefits Of Tokenization Are Too Compelling For TradFi To Ignore

Collins argued that stablecoins will become the transaction method of choice for anyone who wants to send money within the next five years.

According to the Tether co-founder, the benefits of tokenized assets have become too compelling for firms in the traditional finance sector to ignore.

Among the benefits that tokenized assets have to offer is a far greater level of transparency and efficiency compared to assets that have not been tokenized on the blockchain, Collins said. These assets can be moved quickly without the need for middlemen, which offers more upside than traditional assets.

“That is why the tokenization narrative is so big, because everyone realizes the increase in the utility that you get from a tokenized asset versus a non-tokenized asset is so significant,” Collins said.

US Crypto Embrace Was A Major Catalyst For The Industry

Collins went on to highlight that the pro-crypto Donald Trump Administration’s embrace of digital assets was a major catalyst for the industry.

Since entering the White House for a second term, US President Trump has delivered on a number of his election campaign promises to the crypto community.

He has appointed long-time advocates of crypto into key regulatory positions. The President has also created a White House working group for digital assets, which passed down a multi-page report to agencies including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) on how to better regulate cryptos.

Trump also signed the GENIUS stablecoin Act into law, which establishes regulatory guidelines for stablecoin firms looking to issue their tokens in the US.

Prior to the Trump Administration’s crypto embrace, many large traditional finance firms were too afraid to enter the industry out of fear of government scrutiny, according to Collins.

While there is still some gray area surrounding crypto, the Tether co-founder stated that the US government’s “shift in stance” has opened the “floodgates.”

“Every large institution, every bank, everyone wants to create their own stablecoin, because it’s lucrative and it’s just a better way to transact,” Collins said.

He then predicted that there will no longer be a divide between decentralized finance (DeFi) and centralized finance (CeFi).

“There’ll be applications that do things, move money, give loans, do investments, and it will be a mix of the kind of the old, traditional style investments, and then the DeFi types of investments,” he said.

Stablecoin Market Cap Soars As Big Banks Rush To Launch Stablecoins

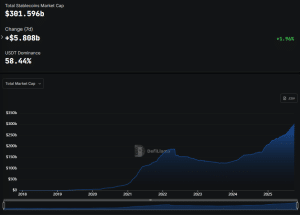

The stablecoin market cap has been in an upward trend ever since President Trump signed the GENIUS Act into law. Over the past seven days, the stablecoin market cap has continued rising. During this period, the capitalization for the tokens increased more than $5.808 billion to stand at $301.596 billion, according to DefiLlama data.

Stablecoin market cap (Source: DefiLlama)

Tether still dominates the market. Data from CoinMarketCap puts the token’s market cap at more than $176.33 billion. The next-biggest stablecoin is Circle’s USD Coin (USDC), which has a capitalization of around $74.32 billion.

As the capitalization for stablecoins continues to rise, large US banks are actively exploring blockchain and stablecoin technology. These include banks like Bank of America, Citigroup, and others.

According to a July 16 Reuters report, Bank of America’s CEO has confirmed that the bank is actively working on launching a stablecoin. Meanwhile, large US lenders such as Citigroup are also exploring stablecoin issuance to adapt to the more crypto-friendly environment in the US.

Wall Street giant JPMorgan, on the other hand, already operates an internal blockchain-based token called JPM Coin. It’s used for settlement in institutional contexts, and is not available to the retail market.

In related news, the interbank messaging platform SWIFT announced that it is collaborating with Ethereum ecosystem developer Consensys and 30 global banks to develop a blockchain-based ledger.

Related Articles

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

XRPL Validator Reveals Why He Just Vetoed New Amendment