Bitfarms Ltd. (BITF) Stock Rises as AI Data Center Plans Accelerate with $50M Drawdown

TLDR

- Bitfarms fuels U.S. AI growth with $300M facility revamp and $50M drawdown

- Bitfarms boosts AI push, tapping $50M for Pennsylvania data center build

- Bitfarms converts $300M debt to drive 350 MW AI campus in Pennsylvania

- Bitfarms accelerates U.S. AI expansion with new project-focused financing

- Bitfarms powers ahead—$50M drawdown advances 350 MW AI data campus build

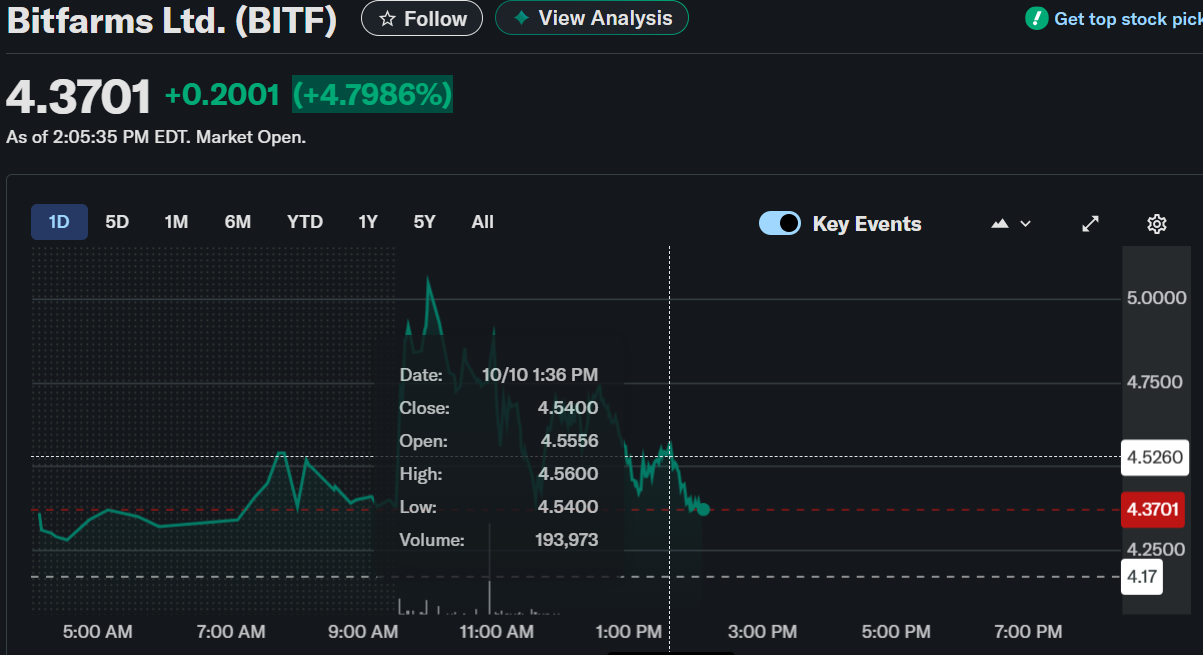

Bitfarms Ltd. recorded a strong intraday surge before easing back to close at $4.37, up approximately 4.8% on the day.

Bitfarms Ltd. (BITF)

The positive momentum followed the company’s strategic announcement regarding the expansion of its Pennsylvania data center. Market participants responded positively to the $50 million funding drawdown and long-term infrastructure plans.

$300M Financing Facility Converted to Accelerate AI Campus Buildout

Bitfarms Ltd. finalized the conversion of its previously disclosed $300 million private debt facility with Macquarie Group into a project-specific financing arrangement. The restructured facility will now directly support the development of Bitfarms’ 350 MW high-performance computing (HPC) and AI-focused data center campus in Panther Creek, Pennsylvania. This shift enables the company to optimize capital deployment and streamline development workflows.

The company confirmed that an additional $50 million will be drawn from the restructured facility, bringing the total to $100 million utilized to date. These funds will enable Bitfarms to advance civil works and initiate substation construction at Panther Creek, scheduled to begin in Q4 2025. This targeted drawdown is expected to accelerate procurement of essential long-lead equipment for the AI infrastructure build.

Macquarie continues to support Bitfarms through this strategic financing alignment as the company scales operations in the emerging AI infrastructure hub. The capital structure shift allows Bitfarms to match financing with the pace of project milestones. The agreement strengthens Bitfarms’ ability to secure and build cutting-edge facilities in a high-demand market.

Panther Creek Campus Positioned in Strategic Infrastructure Corridor

Located in eastern Pennsylvania, the Panther Creek site benefits from its proximity to robust power and fiber infrastructure, which is critical to meeting the demands of HPC and AI. Bitfarms selected the site based on its connectivity advantages, which align with the company’s vertically integrated approach to data center development. This regional advantage positions Bitfarms to deliver performance and uptime critical for AI and computing clients.

The upcoming construction phase at Panther Creek includes groundwork and energy infrastructure to support large-scale operations. With project-level financing secured, Bitfarms aims to avoid delays and align project timelines with market readiness. The site’s 350 MW scale marks it as a major entry in the U.S. AI data center market.

The company plans to use this early-stage funding for substation construction and equipment orders, which often have long procurement timelines. These steps ensure Bitfarms remains competitive as demand for U.S.-based AI infrastructure grows. The project pipeline reflects a strategic pivot toward AI and data services beyond Bitcoin mining.

Bitfarms Maintains Strong U.S. Expansion Focus in Digital Infrastructure

Bitfarms operates state-of-the-art digital and energy infrastructure across the Americas, with headquarters in New York and Toronto. The company’s 1.3 GW energy pipeline is now over 80% concentrated in the U.S., aligning its long-term strategy with the growing demand for American data centers. This focus reflects the company’s intent to lead in both Bitcoin mining and AI infrastructure.

As Bitfarms increases its investment in AI-ready facilities, it positions itself to serve enterprise clients seeking scalable and secure data processing capabilities. Its vertically integrated operations allow tight control over power usage, infrastructure, and uptime. These capabilities are key differentiators in the evolving digital infrastructure sector.

With Northland Capital Markets providing advisory services and top-tier firms offering legal support, Bitfarms has structured its funding for sustainable and scalable growth. The firm’s positioning within U.S. data center hotspots allows it to capitalize on market shifts in computing and AI. This facility conversion marks a pivotal move in that broader expansion effort.

The post Bitfarms Ltd. (BITF) Stock Rises as AI Data Center Plans Accelerate with $50M Drawdown appeared first on CoinCentral.

You May Also Like

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus

Why The Bitcoin Crash To $85,000 Is Actually Good News: Jeff Park