How One Trader Made $160 Million Shorting Crypto Before Trump’s China Tariff Bombshell

TLDR

- A crypto whale made over $160 million in profit by shorting Bitcoin and Ethereum on Hyperliquid ahead of Trump’s 100% China tariff announcement

- The trader closed all ETH short positions for $72.33 million profit and still holds $92.84 million in BTC shorts with 5.38x leverage

- Trump announced a 100% tariff on China starting November 1 due to China’s “aggressive position” on trade

- The crypto market lost $17 billion in leveraged positions within four hours following the tariff announcement

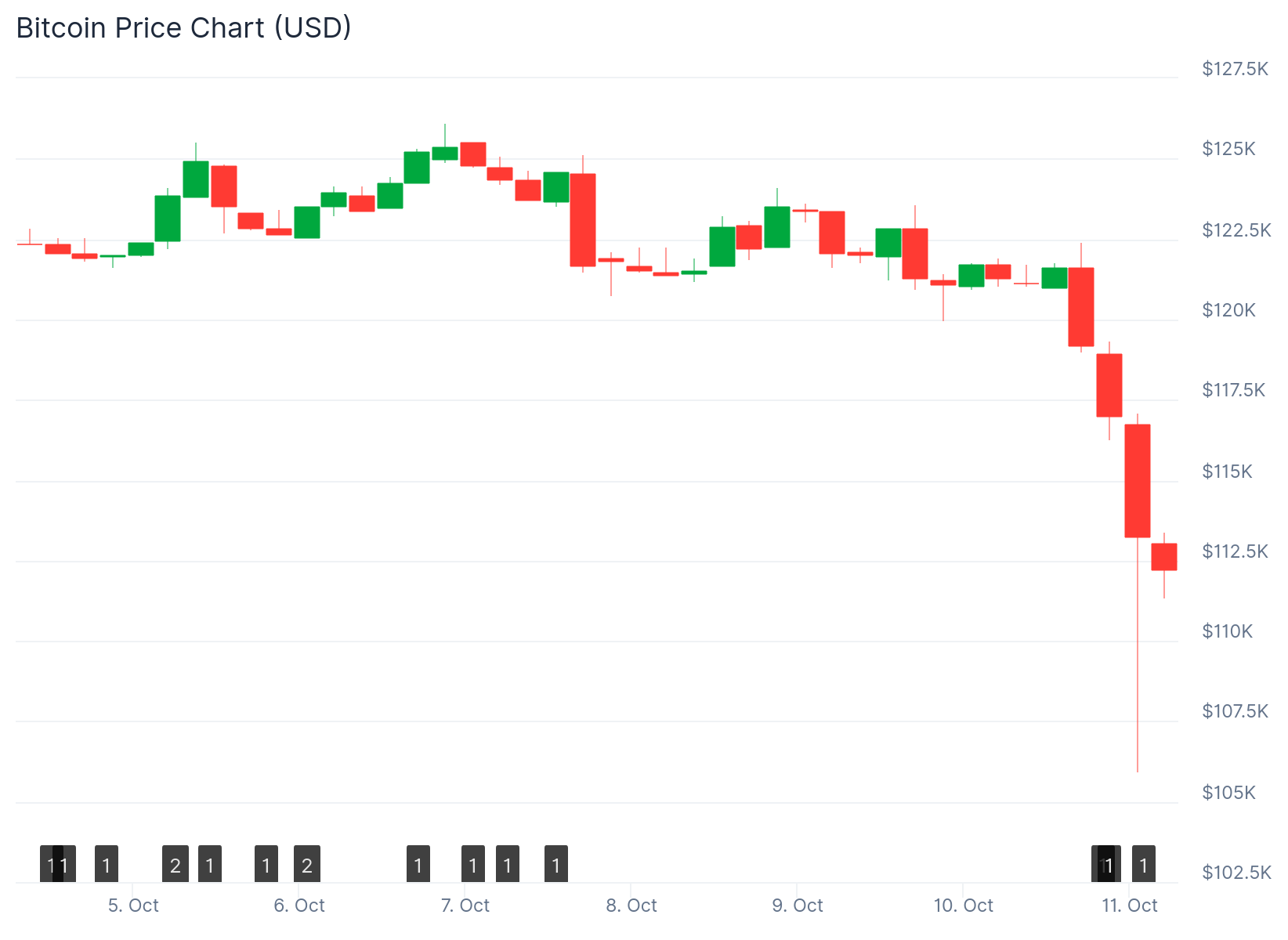

- Bitcoin fell 7.5% to $112,505.92 and Ethereum dropped 12.5% to $3,837.57 in 24 hours

One crypto trader turned market chaos into massive profit. A whale made over $160 million by shorting Bitcoin and Ethereum just before President Trump announced a 100% tariff on China.

The trader executed their positions on Hyperliquid, a decentralized crypto exchange. On-chain analytics account @mlmabc shared the details on X.

The timing of these trades has raised questions. The positions were opened just before the tariff announcement sent crypto markets tumbling.

Bitcoin Short Position Details

The whale’s Bitcoin short position remains partially open. They currently hold $92.84 million in open positions with 5.38x leverage.

Within 24 hours, the BTC shorts generated over $90 million in profit. The trader opened these positions ahead of the price decline.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Bitcoin dropped 7.5% to $112,505.92 following the tariff news. The whale appears to have predicted this market movement.

Ethereum Trades Closed

The trader’s Ethereum strategy was different. They closed all ETH short positions after the price drop.

The ETH shorts netted $72.33 million in profit within 24 hours. These positions were also opened before the tariff announcement.

Ethereum fell 12.5% to $3,837.57 in the same period. The trader captured the entire downward move.

@mlmabc suggested the whale may have traded on other platforms too. “This was just publicly on Hyperliquid imagine what he did on CEXs or elsewhere,” they wrote.

The analyst believes this trader played a major role in the market decline. However, this connection remains speculation.

Market Impact

The broader crypto market suffered heavy losses. Over $17 billion in leveraged positions were liquidated within four hours.

The total crypto market cap fell more than 10% in 24 hours. It dropped to $3.73 trillion.

President Trump made his tariff announcement on October 10. He stated the U.S. will impose a 100% tariff on China beginning November 1 or earlier.

Trump cited China’s “aggressive position” on trade as the reason. The tariff represents a major escalation in trade tensions between the two countries.

The crypto whale’s trades on Hyperliquid are publicly visible due to the platform’s transparency. Total profits exceeded $160 million from both Bitcoin and Ethereum positions combined.

The post How One Trader Made $160 Million Shorting Crypto Before Trump’s China Tariff Bombshell appeared first on CoinCentral.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

United States Building Permits Change dipped from previous -2.8% to -3.7% in August