Optimism Coin Faces Heavy Sell Pressure as Traders Watch Key Support Zone

Despite the pessimism, some analysts believe the token may be approaching a technical inflection point, a zone where short-term buyers could test the resilience of support before any sustained recovery attempt.

Key Support Zone Faces Test After Sharp Breakdown

Analyst Blasto recently shared a detailed technical breakdown on X, noting that OP has entered a crucial support zone after its latest fall. The chart highlights a potential short-term recovery attempt, with a likely retest of the upper resistance area before continuation lower — a textbook example of support-turned-resistance price behavior.

Source: X

Blasto emphasized that while a brief relief rally could develop, sellers remain firmly in control as long as the token stays below the red resistance zone. The blue area beneath signals the next probable target should the market extend its losses. In his words, discipline and patience remain vital, “wait for confirmation before any new entries,” as volatile reversals and false breakouts could still occur under current market conditions.

Price Down 8.09%, Market Cap Shrinks to $816 Million

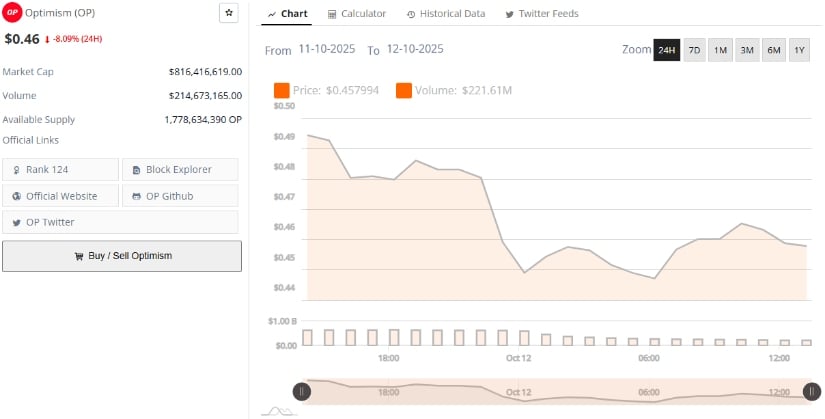

On one hand, data from BraveNewCoin confirms that Optimism is trading at $0.46, marking a daily decline of 8.09%, with a market capitalization of $816.4 million. The token’s 24-hour volume sits at $214.67 million, reflecting the high turnover typical of panic-driven markets. The token’s available supply stands at 1.77 billion tokens, ranking it #124 among global cryptocurrencies.

Source: BraveNewCoin

This selloff extends the coin’s recent downtrend, deepening losses that began earlier in the week after repeated failures to hold above $0.50. Despite the price weakness, on-chain data still shows stable development activity and a growing network footprint.

However, these fundamentals have so far failed to offset the technical damage caused by persistent selling pressure and broader market risk aversion.

Open Interest Data Shows Liquidations Trigger Market Washout

On the other hand, the open interest data paints a clear picture of capitulation. As of October 12, 2025, open interest in OP derivatives has dropped sharply, suggesting that traders are rapidly exiting positions amid thinning market liquidity. This contraction typically signals a leverage flush, as overexposed long positions are liquidated during steep declines.

Source: Open Interest

The candlestick patterns on the current chart indicate oversold conditions, yet analysts caution that a true reversal will require confirmation from both volume and momentum indicators.

The combination of declining open interest and sustained price weakness suggests a panic-driven phase rather than a natural correction. Until clear stabilization or accumulation emerges, the crypto remains vulnerable to another test of lower supports near $0.42–$0.44.

In summary, the asset’s near-term outlook remains fragile. While some relief could occur if buyers defend the $0.46 zone, the broader structure points to sustained bearish sentiment. Traders are advised to proceed cautiously, monitor open interest trends, and wait for confirmation before anticipating any major recovery.

You May Also Like

‘Love Island Games’ Season 2 Release Schedule—When Do New Episodes Come Out?

Trend Research has liquidated its ETH holdings and currently has only 0.165 coins remaining.