Bitcoin Hyper Survives the Market Crash and Regains Strength as the $23.3M Presale Soars

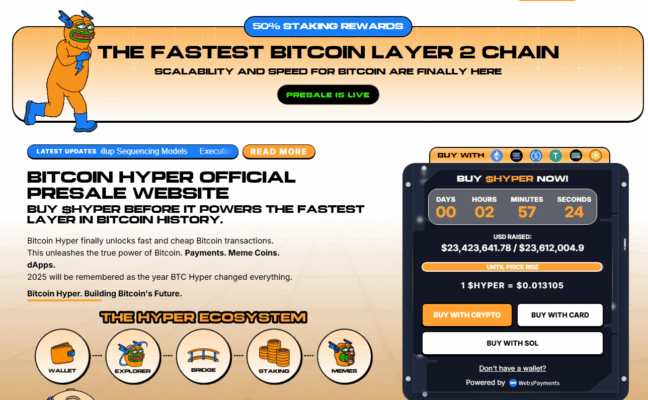

Qualifying as one of the hottest presales of 2025, Bitcoin Hyper ($HYPER) racked in impressive numbers, with a token price of just $0.013105.

The fact that the project survived the recent market crash is a testament to its reputation among investors and feeds into the official mantra: ‘2025 will be remembered as the year BTC Hyper changed everything’.

But let’s start with the beginning.

Bitcoin’s Problem

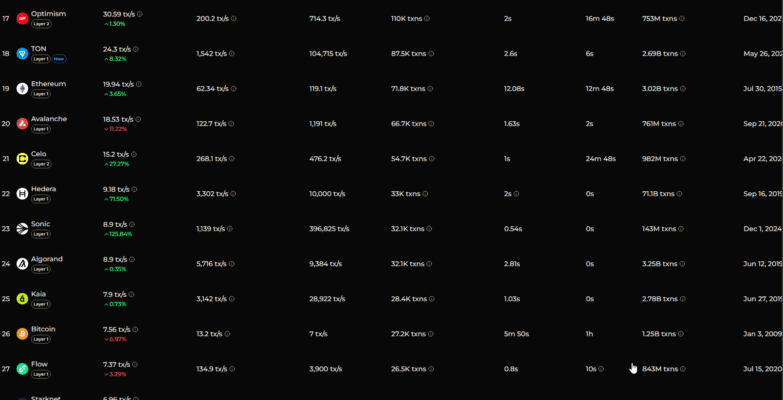

Bitcoin’s main problem is its limited performance, natively capped at seven transactions per second (TPS). This issue ranks Bitcoin 26th on the list of the fastest blockchains by TPS.

With Solana in the first spot, boasting over 1,000 practical TPS, BNB Chain ranking 4th, and Ethereum at 19th, it’s evident that Bitcoin is in dire need of an upgrade.

But why does TPS matter? It matters because it directly represents the chain’s overall performance. For reference, Bitcoin’s limited performance translates to several core issues:

- Lack of scalability: With such a low TPS, the Bitcoin network lacks the scalability it needs to process multiple transactions per second, which makes it unfeasible for large-scale investors.

- Long confirmation times: The lack of scalability is responsible for creating long queue times, with some transactions often taking hours to confirm.

- High fees: The larger the transactions, the higher the fees. This creates a system that’s hostile to large investors, who may need to process large transactions frequently.

On top of everything, it’s the fee-based priority system – the direct consequence of Bitcoin’s capped performance and what’s keeping the network from reaching global status.

The fee-based priority system works just as it sounds: it prioritizes large-fee transactions during the confirmation queue to the detriment of the smaller ones. During rush hours, this can vastly increase confirmation times for small, cheap transactions.

The Lightning Network Layer 2 attempted to change this detrimental system, but ultimately failed due to a range of problems, including high fees, centralization, and overly complex technical aspects.

Then there are problems like Lightning Network’s capacity of only 5,000 $BTC and its security issues, which eventually lead to the emergence of the Fraudulent Channel Close scam.

A change is needed, and Hyper promises to bring it.

Hyper’s Solution

Bitcoin Hyper promises to solve all these problems with the help of tools like the Solana Virtual Machine (SVM) and the Canonical Bridge.

SVM is already a massive performance upgrade, enabling the ultra-fast execution of DeFi apps and smart contracts. However, it’s the Canonical Bridge that addresses most of Bitcoin’s performance problems.

The Bridge connects Bitcoin’s Layer 1 to Hyper’s Layer 2 with the help of the Bitcoin Relay Program, which confirms incoming transactions near instantly.

The Canonical Bridge then mints the tokens into the Hyper layer, allowing users to either use them there or withdraw them to the native layer at will.

Together with SVM, the Canonical Bridge enhances the Bitcoin network by making it faster, cheaper, more scalable, and more performant across the board.

The Hyper ecosystem is also compatible with a variety of apps and tools, including lending, swaps, staking, NFT platforms, gaming dApps, and developer tools such as SDKs and APIs.

With such promises, a clear-cut whitepaper, and a development map, it’s no wonder that the presale has garnered so much attention.

$HYPER’s Presale Numbers

The $HYPER presale raised over $23.4M so far, and it’s growing at a steady pace, with only a small stagnation period during the 24-hour market crash.

With $HYPER valued at $0.013105, the presale appears to be the perfect investment opportunity for those seeking to diversify their portfolios. The 50% dynamic staking APY only adds to that appeal.

Plus, the token’s price increases every three days as the presale reaches new milestones, which incentivises early participation. For reference, $HYPER’s starting price was $0.011500, which marks an almost 14% growth based on today’s price.

If you want to invest, visit the official presale page and purchase your $HYPER today.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Bitcoin Hyper Survives the Market Crash and Regains Strength as the $23.3M Presale Soars appeared first on Coindoo.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse