Why Gold Is Resurgent Over Bitcoin, and Why Bitcoin Hyper Could Help Bitcoin Catch Up

KEY POINTS: Ed Yardeni calls gold ‘physical Bitcoin’ and highlights gold’s resurgence as the preferred safe-haven asset.

Ed Yardeni calls gold ‘physical Bitcoin’ and highlights gold’s resurgence as the preferred safe-haven asset. The Federal Reserve’s ‘beige book’ highlights a stalled economy.

The Federal Reserve’s ‘beige book’ highlights a stalled economy. Bitcoin Hyper’s much-needed upgrade could unlock the original vision of Bitcoin as a digital cash equivalent, reenergizing Bitcoin’s momentum.

Bitcoin Hyper’s much-needed upgrade could unlock the original vision of Bitcoin as a digital cash equivalent, reenergizing Bitcoin’s momentum.

Recent analysis by Ed Yardeni suggests that gold’s stability and long-standing credibility are giving it the upper hand at a time when market participants are prioritizing security over speculative upside.

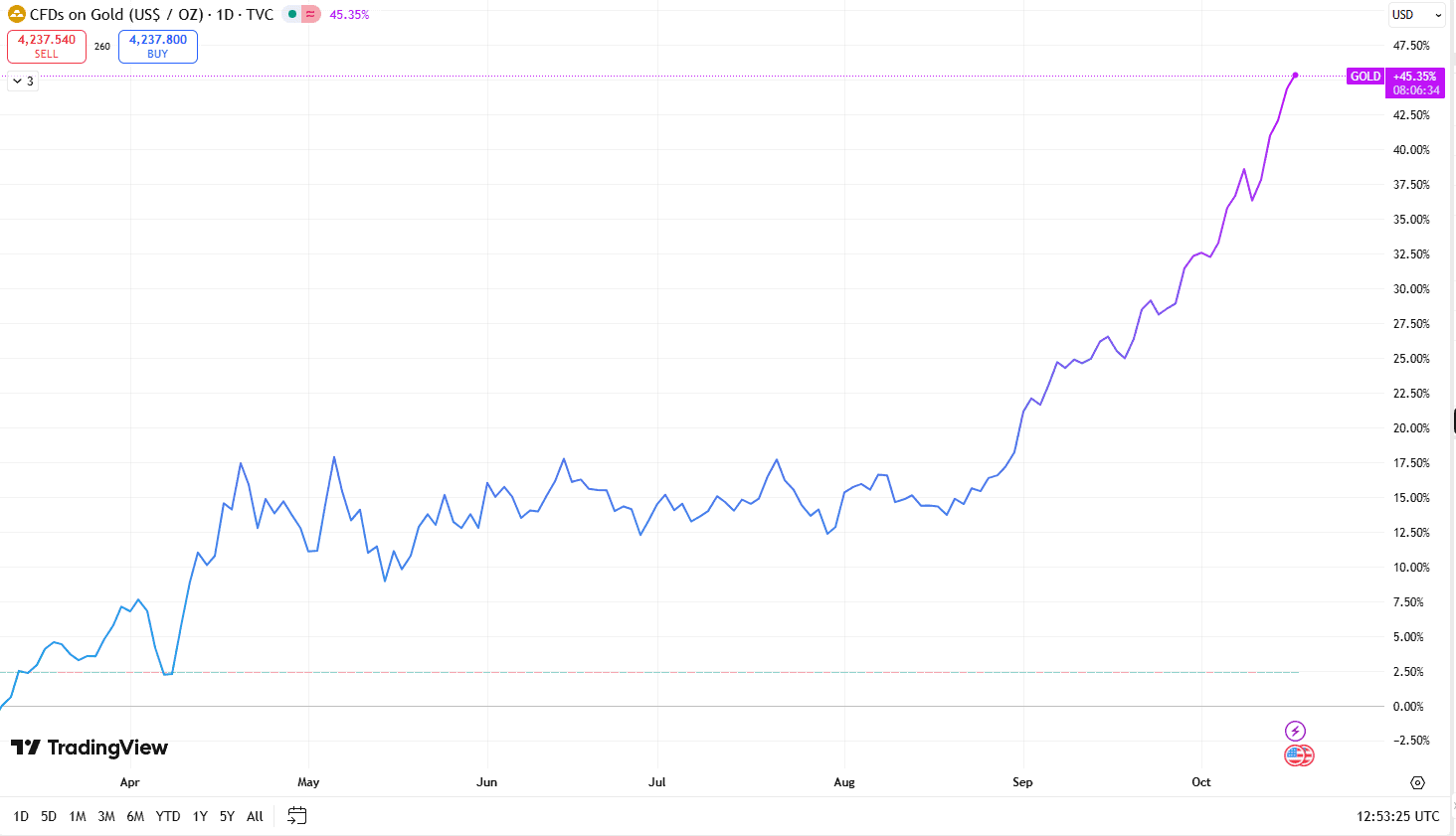

That’s reflected in the performance of gold over the past year.

As gold’s value relative to Bitcoin climbs, there’s more and more evidence that investors are seeking refuge from the broader crypto turmoil. But will that last? Or is Bitcoin poised to regain ground and make a comeback of its own – thanks in part to Bitcoin Hyper’s much-needed upgrade?

Geopolitical Turmoil Drives Demand for Stability

Gold is often viewed as a bulwark against chaos, and benefits from a perceived ‘flight to safety.’ In contrast, Bitcoin – although digital and decentralized – still appears highly volatile and risky.

Recent reports from the Federal Reserve highlight that most districts (and the people in them) continue ‘to expect elevated uncertainty to weigh down activity.’ That expectation limits enthusiasm for perceived ‘high-risk’ assets, such as Bitcoin.

On the other hand, gold’s intrinsic strength lies in its legacy. For centuries, it served as a store of value across civilizations and market cycles. Its long history imbues it with psychological and institutional credibility that Bitcoin, only in existence for a decade and a half, has yet to earn.

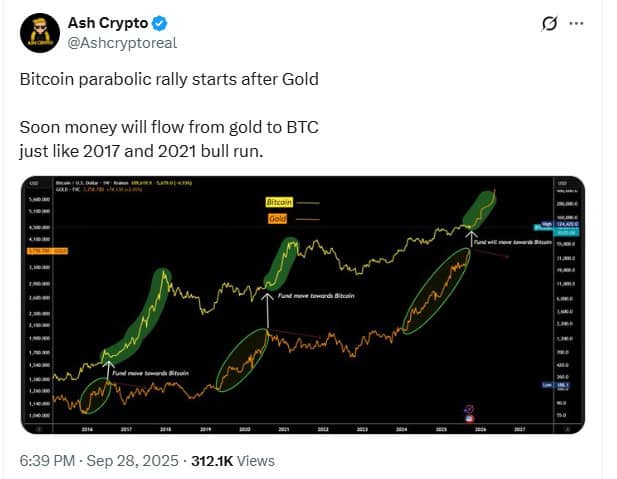

However, that doesn’t mean all is lost for Bitcoin’s long-running attempt to challenge gold’s lead as the world’s largest asset. $BTC’s $2.2T isn’t anywhere near gold’s $29.7T, but analysts can look at earlier patterns where Bitcoin lost ground, only to surge back upwards.

Gold markets tend to see less speculative fervor than crypto markets – a factor that helps limit extreme swings during times of stress.

Bitcoin’s outlook improves even further with the prospect of key upgrades – notably Bitcoin Hyper’s Layer 2.

Bitcoin Hyper ($HYPER) – The Critical Upgrade for Bitcoin to Unlock Fast, Cheap $BTC

Payments were the original vision for Bitcoin. However, as investors recognized the effectiveness of Bitcoin as a store of value, the utility of the blockchain evolved.

That’s great – until broader uncertainty pushes investors away from a digital store of value like Bitcoin and back to a physical one, such as gold.

However, Bitcoin Hyper ($HYPER) aims to revive some of that original vision – utilizing a Layer 2 constructed on the Solana Virtual Machine (SVM) and a Canonical Bridge to achieve vastly improved transaction speeds and lower costs.

That’s what makes Bitcoin Hyper what it is – the next big upgrade to expand Bitcoin’s utility. Learn how to buy Bitcoin Hyper, and see why our price prediction shows that $HYPER could reach $0.2 by the end of the year, up 1423% from its current level of $0.013125.

Don’t delay – learn more about the project at the Bitcoin Hyper presale page.

Even as gold reasserts itself as a leading safe haven, Bitcoin remains poised to launch its own comeback.

As always, do your own research – this isn’t financial advice.

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

BlackRock boosts AI and US equity exposure in $185 billion models