Google Integrates Polymarket, Kalshi Prediction Market Data into Search Results

Global tech giant Google has moved to integrate prediction market data from Polymarket and Kalshi directly into search results, marking a new step in the company’s AI-driven finance strategy.

Google’s November 5 press release revealed that the new AI-powered Google Finance will enable users to ask questions about future market events. The rollout begins with Labs users over the coming weeks before expanding globally.

The platform will now deliver real-time market probabilities and historical changes sourced from Polymarket and Kalshi, when users type in questions such as “What will GDP growth be for 2025?”

This feature is part of a revamp to Google Finance, which now includes Deep Search capabilities, AI-enhanced technical analysis tools, and corporate earnings tracking.

By integrating prediction markets data, Google aims to make financial insights more interactive, blending crowd-sourced probabilities with institutional-grade analytics.

The move could expose prediction markets to a wider global audience. Google handles over 8.5 billion search requests per day, according to December 2024 reports.

Polymarket Record Adoption Attracts Institutional Eyeballs

Since markets on the US presidential elections boosted its prominence in 2024, prediction markets have continued to gain popularity among crypto market enthusiasts and speculative traders.

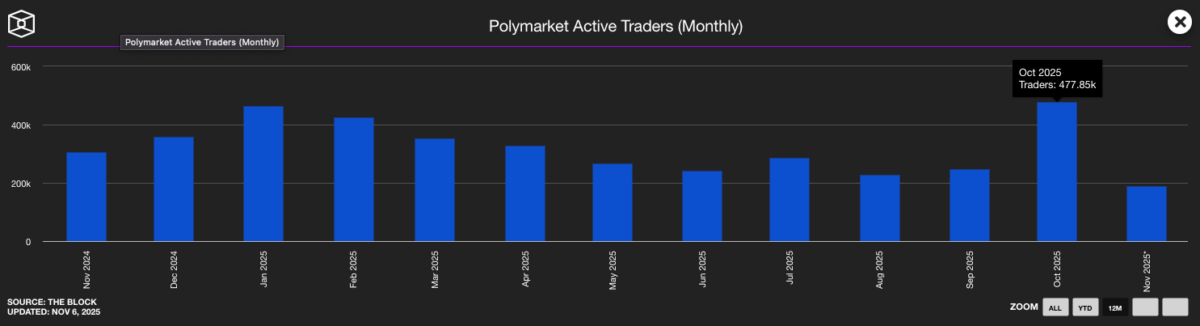

Data from The Block shows that in October, Polymarket recorded an all-time high of 477,850 active users and 38,270 new markets created. The surge coincided with intense speculation on Bitcoin BTC $101 075 24h volatility: 2.3% Market cap: $2.02 T Vol. 24h: $63.14 B and gold, both of which reached all-time highs above $124,500 and $4,200, respectively, during the month.

Polymarkets records all time high 477,850 active users in October 2025 | Source: TheBlock

Traders also wagered heavily on altcoin ETF approvals, which officially went live on October 28. The amplified engagement across decentralized prediction markets attracted significant institutional interest during the month.

Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, invested in Polymarket, valuing it at around $9 billion. Its main rival, Kalshi, also raised $300 million at a $5 billion valuation, emphasizing investor appetite for regulated prediction markets.

Google’s partnership announcement comes as Polymarkets prepared to launch formal operations in the United States. In September, the platform acquired QCEX, a CFTC-licensed derivatives exchange and clearinghouse, in a strategic $112 million deal that ensures compliance with US regulatory frameworks.

Bitcoin Hyper Presale Crosses $26 Million Top Projects Consolidate

As the crypto market consolidates under bearish pressure this week, investors are switching focus to early stage projects like Bitcoin Hyper.

Bitcoin Hyper (HYPER) promises lightning-fast and low-cost transactions aimed at expanding Bitcoin’s use-cases for payments, meme coins, and dApps.

Bitcoin Hyper Presale

HYPER has raised over $26.1 million, with its presale price set at $0.013235 per token. Prospective investors can visit Bitcoin Hyper’s official presale website to secure early allocations before the next price tier unlocks.

nextThe post Google Integrates Polymarket, Kalshi Prediction Market Data into Search Results appeared first on Coinspeaker.

You May Also Like

RFK Jr. may have perjured himself with key vaccines claim: newly revealed emails

ai.com Launches Autonomous AI Agents to Accelerate the Arrival of AGI