LINK Eyes $50 as Chainlink Sees Massive Adoption Across Major Blockchains

- 52 different blockchain projects integrated with Chainlink in just one week, highlighting its growing real-world utility.

- Analysts set high targets for LINK as high as $50 amid massive retail and institutional adoption.

LINK, the native token of the Chainlink ecosystem, is currently targeting new prices as high as the $50 psychological level. This potential rally comes as Chainlink integrates with some top chains within the blockchain space.

New Chainlink Integrations Spotlighted

Chainlink, a leading decentralized oracle platform, has announced new blockchain integrations with its platform via its official X account.

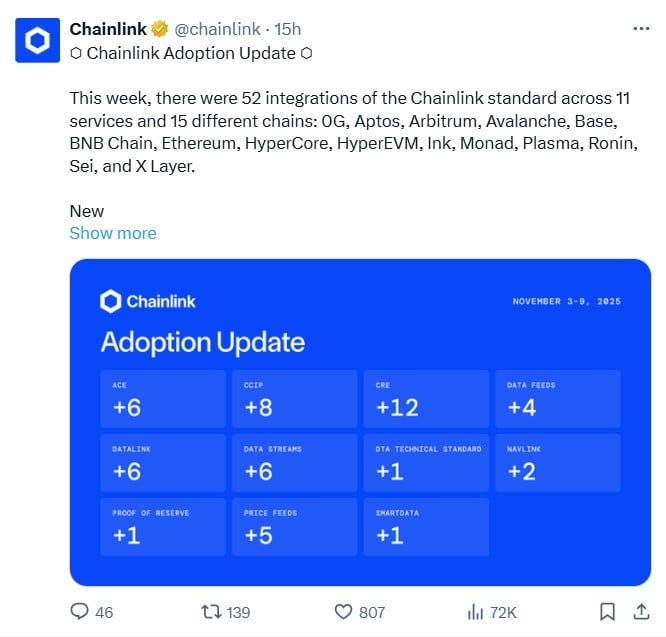

According to Chainlink, 52 different blockchain projects added support for its technology in just one week. This highlights growing real-world usage of the Chainlink decentralized oracle network and related infrastructure.

For emphasis, Chainlink offers a suite of tools, including Price Feeds, Cross-Chain Interoperability Protocol (CCIP), Data Streams, Automations, Proof of Reserve, and others.

According to the announcement, the new integrations saw usage across 11 of these and 15 different blockchains. The blockchains highlighted include Ethereum, Arbitrum, Avalanche, Base, BNB Chain, 0G, Aptos, HyperCore, HyperEVM, Ink, Monad, Plasma, Ronin, Sei, and X Layer.

Chainlink Adoption Outlook | Source: Chainlink

Chainlink Adoption Outlook | Source: Chainlink

Notably, the projects that went live with Chainlink this week range from DeFi protocols to major traditional finance (TradFi) players. The big institutions include UBS, Tradeweb, WisdomTree, FTSE Russell, SBI Digital Markets, and Securitize.

For crypto and DeFi projects, Aave Horizon, Lido Finance, Enzyme Finance, Lista DAO, Hyperdrive, Hyperlend, Hyperunit, The Graph Protocol, all integrated Chainlink’s solutions.

Others include Chainalysis, Kiln Finance, Validation Cloud, Aptos, Sentient AGI, Dinari Global, and Giza Tech.

The adoption of Chainlink by traditional finance giants like UBS and Tradeweb signals a massive institutional push into blockchain.

As we discussed earlier, WisdomTree integrated with Chainlink to enhance its tokenized infrastructure, providing transparency, auditability, and interoperability for institutional investors.

Furthermore, S&P Dow Jones Indices and Dinari recently selected Chainlink as the oracle provider. As noted in our earlier post, the integration aims to deliver real-time pricing data on Avalanche for the S&P Digital Markets 50 Index.

Implications for LINK Price

The surging integrations mean more demand for Chainlink services, which often requires paying fees in LINK or staking it for security. Typically, this playbook drives the long-term value and price of the LINK token.

At press time, LINK was priced at $16.49, up 8.4% over the past 24 hours. The daily trading volume also increased by 22.9% to $723.9 million, suggesting increased market activity.

Analysts James Easton and Ali Martinez highlighted that LINK is consolidating near $15.13 after testing key support zones.

In an X post, Easton shared a long-term LINK chart, revealing a large symmetrical triangle formation that has been forming since 2020. The pattern indicates a tightening price range between an ascending support line and a descending resistance trendline.

According to Easton’s analysis, LINK is approaching the end of its multi-year consolidation phase. The analyst, therefore, suggested a potential upward breakout, initially toward $30–$35, and potentially beyond $50.

Chainlink Price Analysis | Source: Ali Martinez

Chainlink Price Analysis | Source: Ali Martinez

Analyst Ali Martinez also shared a detailed technical chart that showed LINK has reached a crucial ascending support trendline. Historically, this support acted as a foundation for major rallies.

In the current market cycle, Ali thinks this crucial support trendline could act as a launchpad towards $26 or higher to $47.

]]>You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator

Wormhole token soars following tokenomics overhaul, W reserve launch

Wormhole’s native token has had a tough time since launch, debuting at $1.66 before dropping significantly despite the general crypto market’s bull cycle. Wormhole, an interoperability protocol facilitating asset transfers between blockchains, announced updated tokenomics to its native Wormhole (W) token, including a token reserve and more yield for stakers. The changes could affect the protocol’s governance, as staked Wormhole tokens allocate voting power to delegates.According to a Wednesday announcement, three main changes are coming to the Wormhole token: a W reserve funded with protocol fees and revenue, a 4% base yield for staking with higher rewards for active ecosystem participants, and a change from bulk unlocks to biweekly unlocks.“The goal of Wormhole Contributors is to significantly expand the asset transfer and messaging volume that Wormhole facilitates over the next 1-2 years,” the protocol said. According to Wormhole, more tokens will be locked as adoption takes place and revenue filters back to the company.Read more