Follow the Money: $1B Invested in Kalshi, Focus on Venture Deals and Lull Among DATs

- From November 15 to 22, 21 projects announced investments.

- Five did not disclose details.

- The rest raised $1.4 billion, of which $1 billion is accounted for by Kalshi.

Between November 15 and November 22, 2025, Incrypted’s editorial team recorded a total of 21 investment rounds, of which 15 had details disclosed. The total funding received for the latter amounted to $1.41 billion. This week, the focus has shifted to venture deals, among which a $1 billion infusion into the Kalshi platform stands out.

Incrypted infographic.

Incrypted infographic.

During this period, 15 projects reported this type of infusion, including:

- $1 billion — Kalshi. The crypto asset event betting platform raised the said amount at a valuation of $11 billion, TechCrunch reported. Counterparties including Sequoia, CapitalG, Andreessen Horowitz, Paradigm, Anthos Capital and Neo are believed to have participated. The structure and terms of the infusion were not disclosed. Also note that at the time of writing, the Kalshi team has not commented on this information.

- $200 million — Kraken. The cryptocurrency exchange announced that Citadel Securities has additionally invested the said amount in the company after the completion of a $600 million round in September 2025. The capital will be used to expand Kraken’s global presence.

- $70 million — Doppel. The project announced the completion of a Series C round led by Bessemer Venture Partners and with participation from NTT DOCOMO Ventures, Aurum Partners, a16z, South Park Commons, and business angels. The company’s valuation at the end of the infusion reached more than $600 million. The project specializes in developing measures to defend against AI and social engineering attacks such as dipfakes.

- $37 million — Obex. The new crypto project incubator received the said amount from Framework Ventures, LayerZero and the Sky ecosystem. The organization aims to support the formation of the next wave of revenue-generating stablecoins, using Sky’s infrastructure to prevent potential collapses. The incubator will implement a 12-week program for early-stage teams, offering capital, technical resources and professional advice.

- $34.72 million — Deblock. The French fintech firm raised €30 million in a Series A round led jointly by Speedinvest, CommerzVentures and Latitude. The project is founded by Ledger and Revolut exits. The company is positioned as Europe’s first onchain banking platform. The platform enables users to manage both traditional and cryptocurrency assets in a secure and compliant manner.

- $30 million — Numerai. The hedge fund company received an infusion from both new and existing investors in a Series C round. The organization applies crowdsourced machine learning models and blockchain mechanics to predict the stock market.

- $10 million — Wizzwoods. A Web3 game in the farm simulation genre completed a Series A round with participation from Animoca Brands, IVC, and business angels. The project has a low entry threshold and is integrated with a number of other platforms, including Telegram.

- $7 million — RateX. Revenue protocol on the Solana network reported a round with participation from Animoca Ventures, ECHO, GSR, Crypto.com Capital, Gate, Rzong Capital, BGX Capital and Summer Capital. The project specializes in leveraged trading and working with returns through synthetic assets.

- $4.6 million — HelloTrade. The mobile trading platform closed a seed round for this amount led by Dragonfly Capital. Mirana Ventures and business angels also participated. The project is founded by BlackRock natives Wyatt Reich and Kevin Tang, who participated in the launch of the company’s spot bitcoin-ETF. The project’s global goal is to remove barriers to entry into global markets by providing investors with convenient tools for trading cryptoassets, equities and derivatives.

- $3.5 million — 0xbow. The company behind Privacy Pools has closed a seed round led by Starbloom Capital. Coinbase Ventures, BOOST VC, Status Research & Development GmbH, Plutos Capital, and business angels also participated. Note that the Privacy Pools protocol has been integrated into the Kohaku framework promoted by the Ethereum Foundation.

- $1.5 million — Mu Digital. The real-world asset tokenization (RWA) platform announced the completion of a pre-seed round with participation from UOB Venture Management, CMS Holdings, Signum Capital, Cointelegraph Accelerator, Echo and business angels. The solution will launch on the Monad network on November 24, 2025.

- $1.5 million — ZENi. The InfoFi project and data layer provider for AI agents closed a seed round led by Waterdrip Capital and Mindfulness Capital. Rootz Labs, Attention Ventures, DePIN-X and Metalabs Ventures also participated. At the heart of the solution is InfoFi’s Data Layer engine, which processes over 1 million signals from social media and other portals every day. This data is then transformed and used to train the AI.

Several projects have announced that they have received investment but have not disclosed details. These include:

Crypto asset storage, tokenization and management platform Parfin has received funding from Tether, the issuer of the USDT stablecoin. The deal aims to expand institutional use of the stablecoin in Latin America. Parfin itself is a provider of transparent and regulated infrastructure for the circulation of crypto assets. The terms of the deal are not disclosed.

Another project that received an infusion from Tether is Ledn. It is a provider of consumer loans secured by bitcoins. The investment is part of Tether’s efforts to support real financial services based on digital assets. The company has issued $2.8 billion in loans.

USD.AI’s protocol for lending to AI companies secured by hardware reported a strategic infusion from Coinbase Ventures, the venture capital arm of the exchange of the same name. Its details were not disclosed.

Cryptocurrency wallet Zengo Wallet announced a strategic partnership with MoonPay. As part of the deal, the latter became the exclusive provider of payment services for wallet users.

IXS Finance Protocol announced a strategic infusion from Flowdesk. The project is an institutional exchange settlement layer for RWA. As part of the agreement, Flowdesk’s infrastructure will be integrated into the IXS ecosystem.

On November 20, 2025, the MiRA project successfully completed a token sale on the Kommunitas platform, raising $300,000. It is positioned as a platform that integrates Eastern metaphysics, artificial intelligence, augmented and virtual reality (AR/VR) and RWA tokenization.

In addition, Solomon Labs, the issuer of the USDv revenue-generating stablecoin, held a token sale on MetaDAO, raising $8 million. The SOLO token, in turn, allows holders to participate in management decisions and entitles them to certain preferences. The asset is traded on Jupiter.

The BOB project, in turn, raised $4.2 million in a public token sale, which increased the total amount of raised funding to $25 million. The solution is positioned as a kind of gateway to the DeFi space in the bitcoin network.

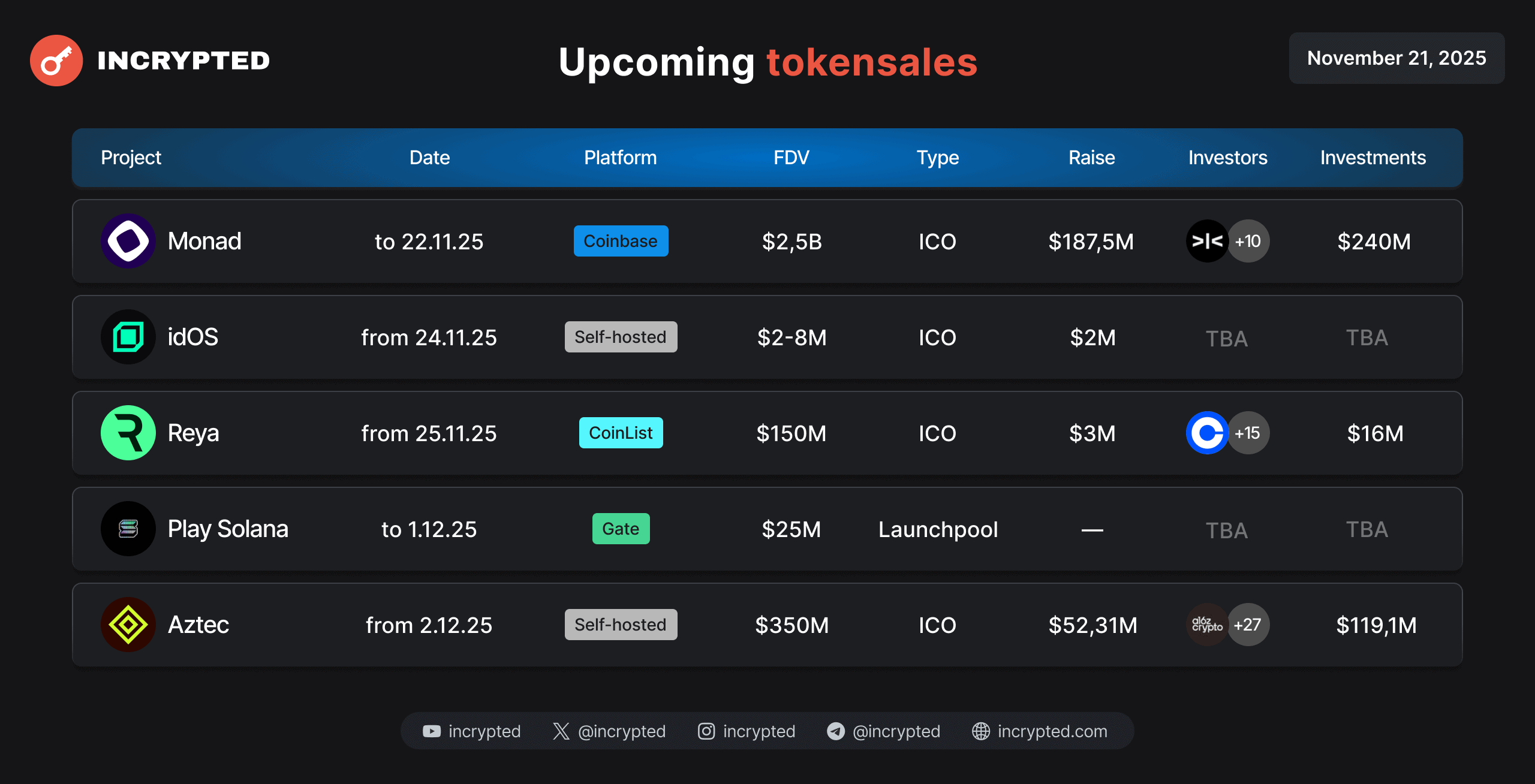

We remind you that you can find more information about token sales, both past and future, on a separate page of our website. In addition, the team maintains a special Telegram channel, where the main news and updates on the topic are published promptly.

Incrypted infographics.

Incrypted infographics.

No such rounds were recorded this week. Treasury companies (DATs) are having difficulty raising capital amid volatility in the cryptocurrency market and the resulting fall in the premium of their shares.

on November 18, 2025, the pvp.trade project announced the purchase of Hyperdash, an analytics service in the Hyperliquid network. The amount of the deal was not disclosed. The pvp.trade team said it has been redesigning the tool for several months and the V2 version is almost ready to launch. Large traders on Hyperliquid, a derivatives exchange, will get bonuses and exclusive access.

No such rounds were reported this week.

From November 15 to November 22, the most active investors were counterparties such as Tether, a16z, echo, Coinbase Ventures (2 each) and Animoca Brands, according to CryptoRank.

Incrypted infographic.

Incrypted infographic.

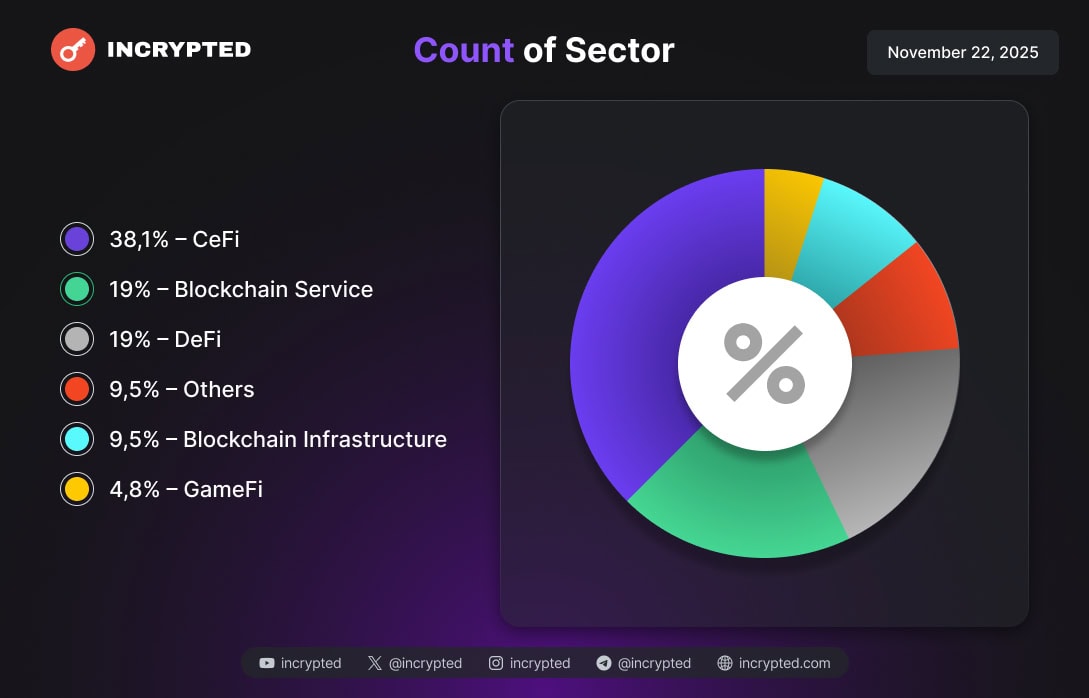

The CeFi sector was the focus of venture capitalists and business angels this week. Blockchain services, blockchain infrastructure providers, DeFi and others are also worth noting.

Incrypted infographic.

Incrypted infographic.

Recall that last week, 13 projects received more than $200 million in investments. More details — in a material.

You May Also Like

The Manchester City Donnarumma Doubters Have Missed Something Huge

Marathon Digital BTC Transfers Highlight Miner Stress