Best Crypto To Buy After $836M $BTC Strategy Bet And Fed Cut Hints

What to Know:

- Strategy’s $836M Bitcoin buy during a drawdown reinforces institutional conviction in $BTC even as volatility spikes and macro signals stay noisy.

- Renewed expectations for further Fed rate cuts in 2025 support the broader risk-asset case, potentially extending the current crypto cycle into next year.

- Wallet infrastructure, Bitcoin scaling, and stablecoin payment rails are positioned as structural winners if on-chain activity and ETF-driven adoption keep growing.

- Best Wallet Token, Bitcoin Hyper, and Tron each tap into those narratives with different risk profiles: high-yield presales on one side, a revenue-generating Layer-1 on the other.

The crypto market just wrapped up one of its wildest weeks in months. Bitcoin slid hard early on, dragging altcoins with it as risk assets reacted to shaky macro signals and fading confidence in another Fed cut this year.

Midweek, the tone flipped. Strategy revealed an $836M Bitcoin buy, adding 8,178 $BTC and taking its treasury to 649,870 $BTC – more than 3% of Bitcoin’s total supply.

That’s a serious ‘buy-the-dip’ statement from the biggest corporate $BTC holder and a clear signal that institutional conviction hasn’t gone anywhere, even with spot prices under pressure.

On the macro side, rate-cut odds, which had been fading, started to firm again as traders repriced the chances of another move lower from the Fed.

Combined with ongoing ETF flows and corporate accumulation, the narrative for December is shifting from ‘is the bull market dead?’ to ‘how much risk does one want to take on the next leg up?’

In that kind of environment, the best crypto to buy isn’t just more $BTC. Wallet infrastructure, Bitcoin scaling plays, and high-throughput stablecoin rails all stand to benefit if institutions keep stacking sats and retail comes back in size.That’s where Best Wallet Token ($BEST), Bitcoin Hyper ($HYPER), and Tron ($TRX) enter the conversation.

1. Best Wallet Token ($BEST) – Self-Custody Super App With Yield

Best Wallet Token ($BEST) sits at the intersection of two big trends: self-custody and ‘all-in-one’ Web3 super apps. The project’s wallet is built as a non-custodial hub where users can store assets, swap across dozens of networks, and plug into staking and DeFi without leaving a single interface.

Unique to the Best Wallet app is the upcoming tokens option. This is a carefully curated and vetted selection of the best crypto presales, which you can buy directly. That means no hunting across countless sites for new presale opportunities and – most importantly – no chance of falling victim to rugpulls or other scams.

The team’s ambition is aggressive: capture a 40% share of the fast-growing crypto wallet market by the end of 2026.

The $BEST presale numbers suggest that vision is resonating. It has raised more than $17.3M, with a current presale price of $0.025995 per $BEST, and staking rewards at 75% APY.

The $BEST presale numbers suggest that vision is resonating. It has raised more than $17.3M, with a current presale price of $0.025995 per $BEST, and staking rewards at 75% APY.

Consider this: according to our Best Wallet Token price prediction, $BEST has the potential to reach $0.07 by 2030. That would mean a 169.3% ROI.

You don’t need to hold $BEST to enjoy the Best Wallet app’s unique features. But if you like the sound of higher staking rewards, lower transaction fees, and governance rights on the project’s direction, then now’s the time to invest in $BEST.

That’s because, with just four days left until the $BEST presale ends, the window of opportunity to join one of the hottest presales of the year is closing fast.

Join the Best Wallet Token presale while you still can.

Join the Best Wallet Token presale while you still can.

2. Bitcoin Hyper ($HYPER) – Bitcoin Layer-2 With Solana-Like Performance

If Bitcoin is still the asset institutions want to own, then scaling solutions around it are the leverage play.

Bitcoin Hyper ($HYPER) is pitched exactly there: a Bitcoin Layer-2 that will use a canonical bridge and Solana Virtual Machine (SVM) integration to deliver fast, low-fee $BTC transactions and smart contracts while keeping Bitcoin as the settlement anchor.

The bridge will connect Bitcoin’s Layer-1 to Hyper’s Layer-2, locking your $BTC on the base chain and minting an equivalent as wrapped $BTC on the Layer-2.

The SVM, meanwhile, will provide a high-performance execution environment, bringing Solana-style parallel transaction processing, fast confirmation, and scalable smart contract capabilities.

That also means developers will be able to deploy high-speed dApps (unheard of on the Bitcoin blockchain) on the Layer-2 while inheriting the efficiency and tooling of Solana’s ecosystem.

Fundraising momentum has been strong, with more than $28.37M raised in the presale and staking yields around 41% on offer to early buyers. That puts Bitcoin Hyper firmly in the ‘big-ticket’ presale category for 2025.

Fundraising momentum has been strong, with more than $28.37M raised in the presale and staking yields around 41% on offer to early buyers. That puts Bitcoin Hyper firmly in the ‘big-ticket’ presale category for 2025.

Our Bitcoin Hyper price prediction suggests a potential high of around $0.08625 by end-2026 if the Layer-2 launches on schedule and listings land on major exchanges. From a current presale price of $0.013325, that would mean a massive ROI of 547%.

In a week where a single corporate treasury just added $836M in Bitcoin on a drawdown, a $BTC-centric Layer-2 that promises faster settlement and smart-contract flexibility offers a way to lean into the same thesis with more upside and more risk.

Join the Bitcoin Hyper presale today.

Join the Bitcoin Hyper presale today.

3. Tron ($TRX) – Stablecoin Rail With Real Revenue And Deflation

While presales chase future narratives, Tron ($TRX) is already one of the most used blockchains in the world. The network consistently processes thousands of transactions per second with negligible fees and has become the primary rail for $USDT transfers.

Tron carries over $80B of $USDT – more than half of global supply – and regularly settles tens of billions of dollars in stablecoin volume per day.

Tron carries over $80B of $USDT – more than half of global supply – and regularly settles tens of billions of dollars in stablecoin volume per day.

That usage shows up in the token’s fundamentals. Tron’s Delegated Proof-of-Stake design routes all transaction fees into burns, giving $TRX a net-deflationary profile when on-chain activity is strong.

Recent analyses show multi-percent annual deflation as burned fees outpace new issuance, while Tron ranks among the most profitable chains by fee and revenue metrics.

In parallel, the community recently approved a large network-fee cut to keep $USDT transfers cheap and defend its lead as a payments rail.

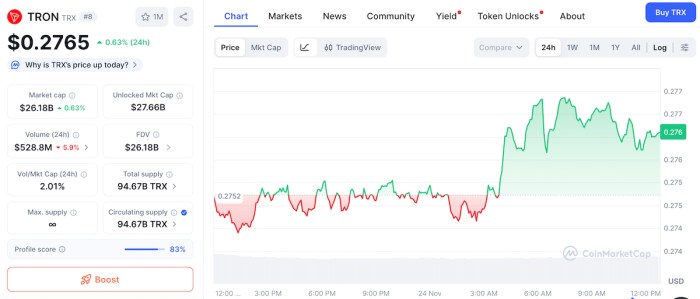

At around $0.28 per token and a market cap near $26.2B, $TRX is not a micro-cap moonshot, but it offers something many Layer-1s lack: clear product-market fit around stablecoin payments and a business model that throws off real protocol revenue.

In a world where rate-cut optimism and institutional $BTC buys pull liquidity back into crypto, the rails that move that liquidity for retail users – often in stablecoins – can benefit in a quieter, compounding way.

Trade $TRX on Binance and other leading exchanges.

Trade $TRX on Binance and other leading exchanges.

Disclaimer: This article is informational only and not financial advice; crypto assets and presales are highly volatile and you can lose capital.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/news/best-crypto-to-buy-after-836m-btc-strategy-bet-and-fed-cut-hints

You May Also Like

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

Kalshi debuts ecosystem hub with Solana and Base