Monad Price Down 15% in First Hours of Mainnet Launch, Listings

Monad mainnet launched on November 24, together with MON’s token generation event (TGE), unlocking and distributing approximately 10% of a 100 billion supply. As forecasted by many analysts, the Monad price is down in the first few hours of the public listings at a $2.5 billion fully diluted value (FDV).

According to data from CoinMarketCap, MON started trading at $0.0329 in the pre-market, and other sources like Bitget report a pre-market range between $0.032 and $0.034. This puts Monad at an effective 15% loss while trading at $0.024 by the time of this writing.

Monad (MON) price and market data as of November 24, 2025 | Source: CoinMarketCap

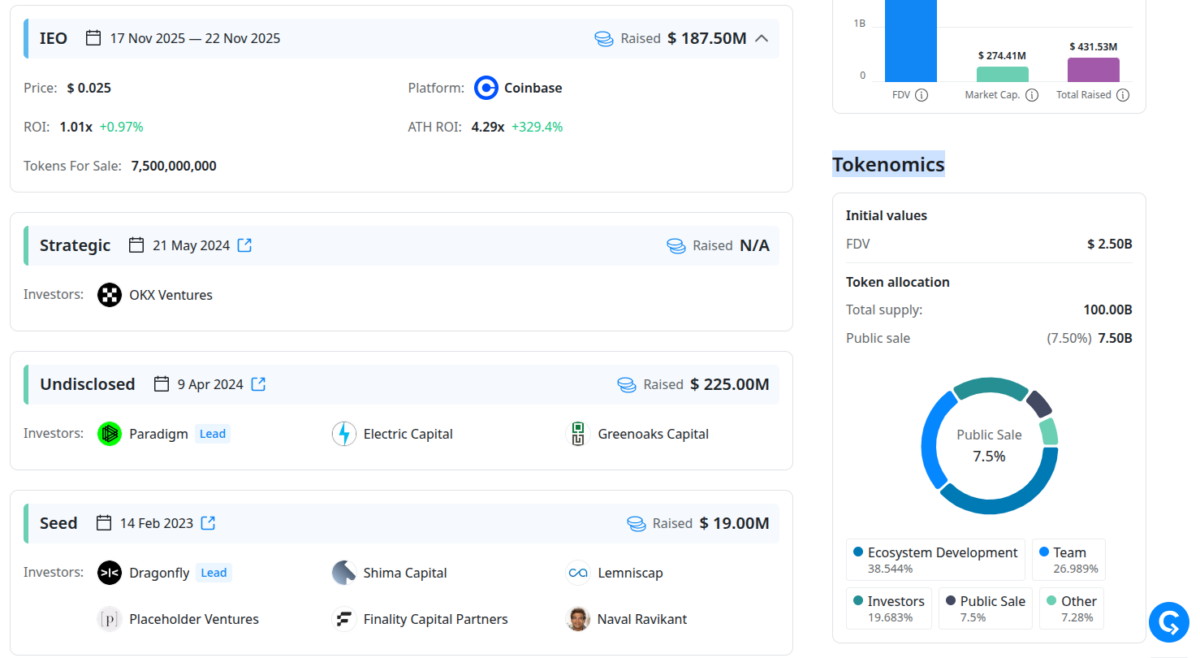

Before today’s listing and pre-market trades, investors had the chance to get exposure to Monad in Coinbase’s first launchpad ICO at a price of $0.025 per token, the same used by MEXC. Coinbase’s fundraising was the second most meaningful round for the project, raising $187.50 million from November 17 to November 22—selling 7.5 billion MON to participants who have gone through a due identification process (KYC).

The most meaningful fundraising happened in an undisclosed private round led by Paradigm on April 9, 2024, per CryptoRank data, raising $225 million with an unknown token allocation amount and, therefore, an unknown unitary price for MON. Yet, at a $264 million current market cap, Paradigm, Electric Capital, and Greenoaks Capital have theoretical unrealized gains of 17.33% in 19 months, based on the capitalization alone.

Monad fundraising data | Source: CryptoRank

What Analysts Are Saying About Monad Launch and Price

Related commentary on X varies a lot, and Monad has gathered both strong support and skepticism during its mainnet launch day and token listing events. In particular, a pseudonymous analyst known as Red Hair Shanks commented on the ICO dynamics.

According to him, the results signaled weakness, as “EVERYONE who wanted to buy monad” could have done it at a $2.5 billion FDV, and “there is no one left who wants to buy” after only raising $260 million between these events. MON currently has a fully diluted value of $2.43 billion, below the ICO valuation.

Hantengri chimed in, pointing to the irony that market participants can now buy the token at a lower price, without complex identification processes, having an advantage over the 85,820 properly identified participants of the Coinbase event.

Other commentators highlighted the airdrop dynamics, suggesting a stronger incentive to sell the tokens received for free, creating a supply pressure that could explain the early performance. Jeremy, Glyde co-founder, posted a screenshot swapping 4,156 MON for $124 worth of USDC, while Sweep, another Glyde co-founder, reported a single MON short position opened six hours before the launch that was profiting $300,000 by the posting time.

GE, founder of Stress Capitals, disclosed his plans to claim and sell his airdrops while opening shorts against Monad earlier this morning.

Nevertheless, Monad’s story is just beginning with the mainnet launch. There are ongoing integrations with Solana SOL $137.0 24h volatility: 3.1% Market cap: $76.58 B Vol. 24h: $5.88 B and NEAR Intents, opening the already 224-project ecosystem to the broader crypto industry. Monad is an EVM-compatible layer-one (L1) blockchain designed for high performance with claims of up to 10,000 transactions per second (TPS), currently maintaining around 100 TPS, based on data from the Monad Vision explorer.

nextThe post Monad Price Down 15% in First Hours of Mainnet Launch, Listings appeared first on Coinspeaker.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

Moonshot MAGAX vs Shiba Inu: The AI-Powered Meme-to-Earn Revolution Challenging a Meme Coin Giant