Strategy’s bitcoin premium heading toward ‘crypto winter’ lows, TD Cowen says

Michael Saylor’s Strategy (formerly MicroStrategy) has seen its bitcoin premium continue to slide, now "heading toward 'crypto winter' lows" of 2021–2022, Lance Vitanza, managing director at TD Cowen Research Group’s TDSecurities, said in a note to The Block on Monday.

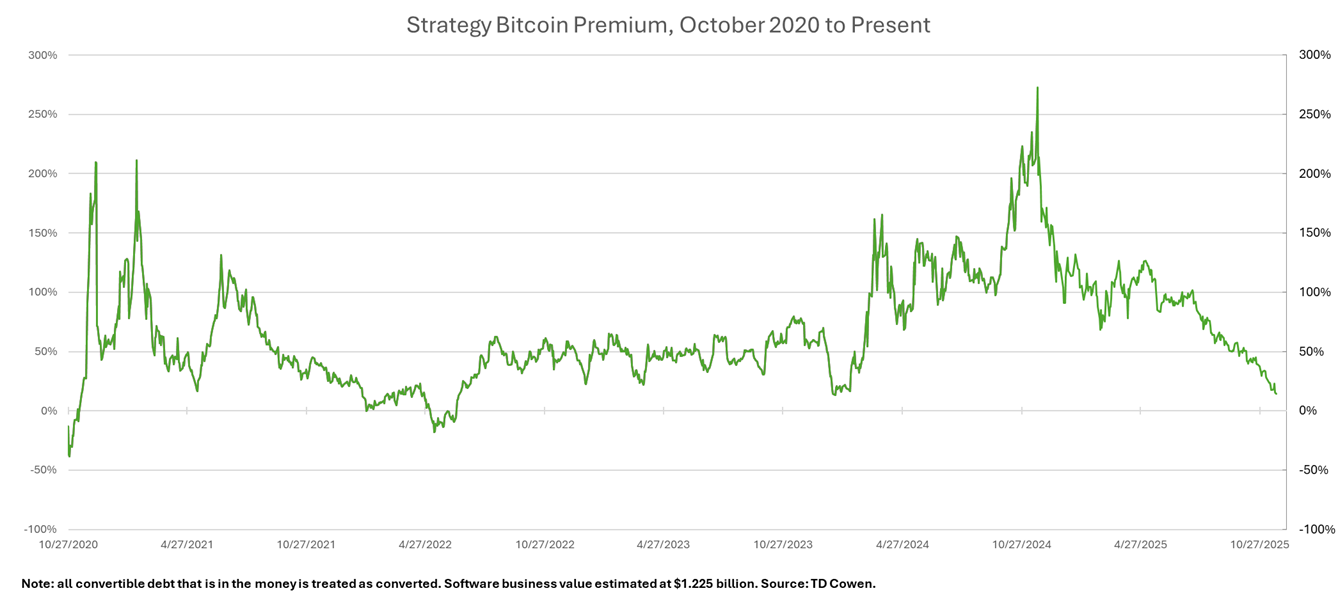

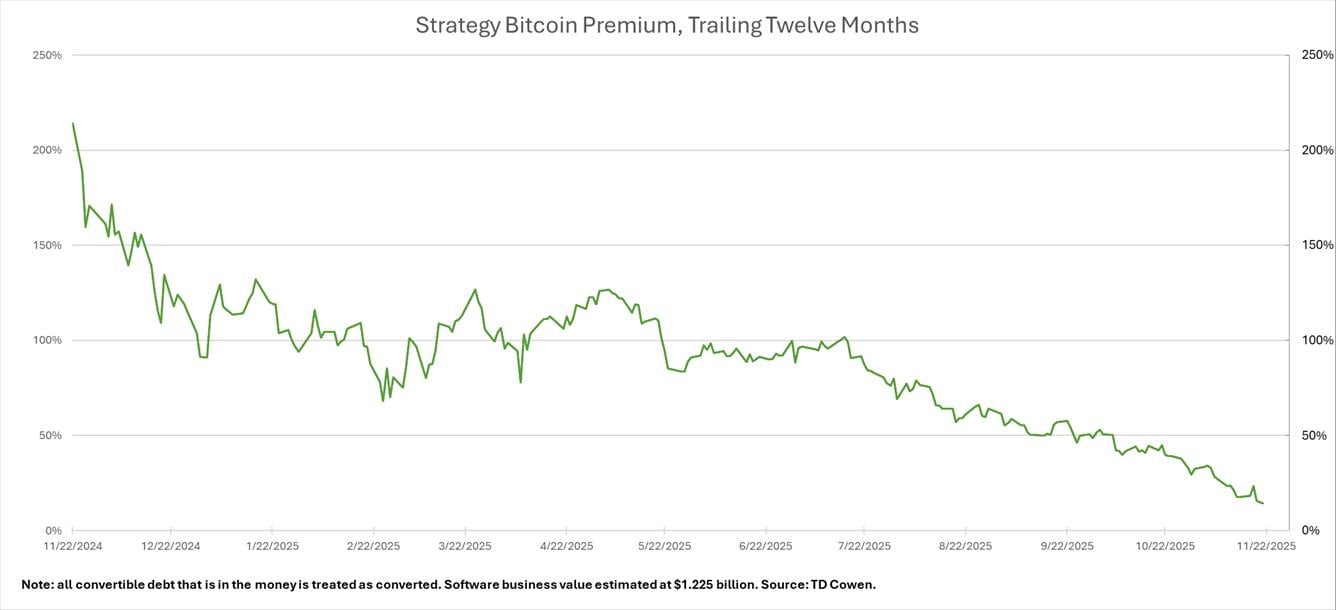

Sharing the company’s two updated bitcoin-premium charts, Vitanza said Strategy did not issue any shares under its at-the-market (ATM) programs today and did not purchase any new bitcoin — a detail that prompted renewed focus on where the premium stands now. Both charts, one extending back to 2020 and another covering the trailing twelve months, show the metric compressing steadily toward its late-2021 and early-2022 levels.

Source: TD Cowen

Source: TD Cowen

In Strategy’s case, the bitcoin premium refers to the price investors pay for Strategy's stock (ticker MSTR) relative to the net asset value of its bitcoin holdings. When the stock trades closer to the value of those holdings, the premium narrows; when investors treat the company as a leveraged way to gain exposure to bitcoin, it widens. The charts show that the premium is down sharply from peaks above late last year.

TD Cowen keeps $535 MSTR target, remains bullish

Despite the continued premium decline, Vitanza and his colleague Jonnathan Navarrete remain bullish on MSTR. They maintain their buy rating and $535 price target — around 200% above Strategy’s current share price of about $180 — calling it "a reasonable outcome in one year's time."

"We make no changes to our underlying bitcoin price deck and continue to expect Strategy will own 815k bitcoins by the end of FY27," Vitanza and Navarrete's detailed report, separately published Monday, noted. "We thus continue to model over $185 billion of bitcoin holdings at Dec-27, i.e., intrinsic bitcoin value at ~ $540 per share. Our price target at $535 thus continues to reflect a 0% premium to intrinsic value per share at Dec-27."

The report also highlighted concerns around Strategy’s potential removal from MSCI indices — a risk that has weighed on the stock. Vitanza and Navarrete said they do, in fact, expect Strategy to be removed from the indices and remain under pressure on sustained MSCI overhang.

"Though it feels capricious, we now expect PBTCs [public bitcoin treasury companies] like Strategy will be dumped from all MSCI indexes this coming February," the report reads. "MSCI has itself proposed as much, and we expect a formal decision will be announced mid-January."

"The decision may be as misguided as it is unfortunate," the report adds. "Strategy is neither a fund, a trust, nor a holding company. It is instead a public operating company with a $500 million software business and a unique treasury strategy using Bitcoin as productive capital. While the software business may only account for a small portion of total value, it accounts for 100% of the company's revenues."

Removing PBTCs from MSCI indices would require substantial passive-fund selling at a time Strategy's stock is already trading at depressed levels, the report noted. "How forcing passive investment funds to book real losses serves anyone is beyond us, but we believe ~$2.5 billion of value is attributable to MSTR holdings within MSCI indexes, with another ~$5.5 billion in other indexes that could in theory follow MSCI's lead," it said.

Last week, JPMorgan analysts made a similar point, saying Strategy could face about $2.8 billion in outflows if MSCI removes it from its indices, and another $8.8 billion if other index providers follow.

At the time, Saylor responded to the possibility of removal by saying: "Index classification doesn't define us. Our strategy is long-term, our conviction in Bitcoin is unwavering, and our mission remains unchanged: to build the world’s first digital monetary institution on a foundation of sound money and financial innovation."

TD Cowen’s Vitanza and Navarrete appear aligned with Saylor's stance. "A bias against Strategy is a bias against bitcoin, and we expect it will outperform to the extent bitcoin recovers," they wrote in the report.

"Regardless of index inclusion, Strategy continues stacking bitcoin faster than corresponding liabilities," they added. "Though perhaps counter-intuitive, it should necessarily trade at a premium to the value of its underlying holdings if bitcoin becomes increasingly integrated into global finance."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

You May Also Like

Tuesday, November 25 (Tip Top)

Thumzup Media Boosts Dogecoin Treasury with $2 Million Acquisition