The old public chain Kadena launched a $50 million incentive plan, betting on whether RWA is the solution or a repeat of the same mistakes

Author: Frank, PANews

Recently, Kadena, a well-established public chain founded in 2016, announced the launch of a $50 million incentive plan. This move seems to be intended to return to the spotlight of the cryptocurrency market through the current popular RWA track. After a period of silence, this series of new developments of Kadena has attracted widespread attention in the industry. This article aims to deeply analyze Kadena’s recent strategic initiatives, past development history and unique technical architecture, and explore whether this large-scale incentive plan can bring it new development opportunities, as well as its potential in the RWA field.

Morgan Elite Creates "Programmable POW" Dark Horse

The development of Kadena has a deep relationship with the traditional financial giant JPMorgan Chase and the SEC. Kadena was co-founded in 2016 by Stuart Popejoy and Will Martino, both of whom worked for JPMorgan Chase. Before founding Kadena, Stuart Popejoy led JPMorgan Chase's Blockchain Center of Excellence, responsible for the development of the bank's core distributed ledger infrastructure, and created its open source blockchain project Juno. Will Martino served as the chief engineer of the Juno project and served as the technical director of the SEC's Cryptocurrency Steering Committee. They were responsible for developing the first version of JPMorgan Chase's JPM Coin (a digital stablecoin circulated between banks) to build the infrastructure.

This blockchain practical experience, which originates from traditional financial giants, has given Kadena an "enterprise-level" or "institutional-level" design philosophy from the very beginning.

Kadena's core technological innovation lies in its unique Chainweb architecture, a scalable, multi-chain parallel proof-of-work (PoW) consensus mechanism. Chainweb is not a single blockchain, but a network of multiple independent, simultaneously running peer chains that are interconnected in a "braided" manner. Each chain mines independently and can process transactions in parallel. This design is also quite different from other types of POW chains on the market, so Kadena positions itself as the only programmable L1.

Under this design architecture, theoretically, it has a very high throughput. In 2020, when expanding to 20 chains, Kadena claimed that the theoretical TPS reached 480,000. This data value far exceeds other public chains of the same period, including Solana, which is famous for its speed.

With the background halo and technological advantages of JPMorgan Chase, Kadena has once become a star in the public chain since its establishment. In 2021, the highest price of its token rose to US$27, which was more than 100 times higher than the US$0.2 in early 2020, and its market value was close to US$4 billion. In addition, the Kadena network also quickly expanded to 20 chains at the beginning of its launch, becoming the fastest POW public chain at the time.

A big bet on RWA: Can the 50 million incentive break the deadlock?

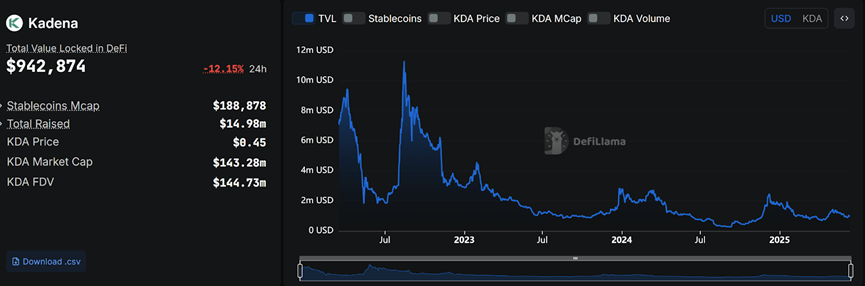

However, Kadena's glory vanished with the end of the bull market in 2021. Since 2021, its price has plummeted and its market value has fallen to only about $150 million. Its official medium blog has not been updated since 2023, and there is little news about Kadena on social media.

On May 20, 2025, Kadena announced the launch of a $50 million incentive program to promote the development of Chainweb EVM, RWA tokenization, and AI-driven blockchain solutions. This news has once again drawn the market's attention to this old public chain. Will it also begin to reshape its brand like EOS did before?

According to official information, $25 million of the total $50 million fund pool will be used specifically to support compliant RWA tokenization projects. The remaining $25 million will be used to support projects built on the Kadena multi-chain EVM compatible network (Chainweb EVM) and AI integration projects. This funding is non-equity funding, which means that the funded projects do not need to transfer equity.

The first RWA grantee of Kadena's new incentive program is CurveBlock in the UK, which received $400,000 in funding in June 2025. Founded in 2018, CurveBlock is a UK real estate technology startup focused on sustainable real estate investment. From a background point of view, CurveBlock is the first real estate company to be accepted into the UK Digital Securities Sandbox (DSS). This also means that the reason why CurveBlock can become Kadena's first grantee is inseparable from compliance.

In addition, Kadena proposed that in addition to providing financial support, it would also provide technical assistance, project development advice, marketing and promotion, etc.

However, Kadena officials have not stated how much each funded company will receive, nor have they announced specific funding criteria. So far, the only publicly funded company is CurveBlock.

RWA has been a hot track in the market in recent years. Many established public chains are actively seeking transformation with the help of this narrative. For example, Injective has also been expanding in this direction recently. In addition to launching an incentive plan, Kadena has also recently developed an RWA token standard based on its native smart contract language Pact, which refers to Ethereum's EIP-3643. This standard is designed to enforce on-chain permissions and regulatory controls and support compliant asset issuance, trading, and redemption.

The previous $100 million incentive plan failed, and the implementation of the funding plan has become a problem

However, the $50 million incentive plan officially launched by Kadena is not the first. In 2022, facing the overall market decline and reduced attention, Kadena has also launched an incentive plan with a total amount of up to $100 million. In that incentive, Kadena funded the development and adoption of projects such as games, metaverse, NFT, Web3, DeFi and DAO in the Kadena ecosystem.

According to Kadena's official annual review at the end of 2022, the $100 million incentive program received "overwhelming attention and hundreds of applications", and its "first batch of grantees included nine projects", some of which have "achieved extraordinary achievements". Looking through the subsequent quarterly summaries, we can see that the program has announced some projects one after another, but in the end, we did not find an overall description of the incentive program, and no specific funding amount was mentioned when each funded project was announced.

Judging from the performance of the data, this $100 million incentive plan has not increased Kadena's market attention and community activity. On the one hand, its price is still falling, and on the other hand, the only TVL-related data available on the Internet fell to hundreds of thousands of dollars in 2023. As of June 13, its TVL was only $940,000, and the market value of stablecoins was about $180,000.

Back to the current $50 million incentive plan, the market cycle launched is also very similar to that in 2022. Both are after the first peak of the bull market. However, we are currently unable to predict whether the subsequent market cycle trend will replicate the overall bear market in 2021-2022 or open a new round of larger market cycle. However, to some extent, if Kadena's incentives encounter a market trend similar to that in 2022, it may usher in another "bamboo basket to draw water".

In addition, unlike other public chains that directly incentivize users, Kadena's incentives are more oriented to project parties. In the absence of user volume, project parties may face greater investment risks if they choose Kadena just for uncertain incentives. Looking closely at some of Kadena's user-oriented promotion plans, the incentive content is to promote for at least 4 weeks, and then draw a lottery, in which 50 lucky winners can get 40 KDA. According to the current price of KDA of $0.48, users may not get a $20 reward in the end after one month of promotion. The cost-effectiveness of this incentive seems a bit tasteless.

Therefore, although the RWA narrative is popular and the $50 million incentive is huge, it seems that Kadena needs to think about gaining market and community recognition in a more sincere way. Otherwise, this $50 million incentive may end up with a lot of noise but little results.

You May Also Like

Shibarium May No Longer Turbocharge Shiba Inu Price Rally, Here’s Reason

👨🏿🚀TechCabal Daily – When banks go cashless