Bitcoin faces ‘late-cycle fragility’ as whale accumulation slows, retail interest surges: analysts

Bitcoin’s sharp drop below $86,000 early Monday has coincided with a shift in wallet behavior that signals large holders have slowed accumulation just as smaller retail wallets have increased their buying — a pattern that, analysts warn, often marks a late-cycle phase of increased fragility.

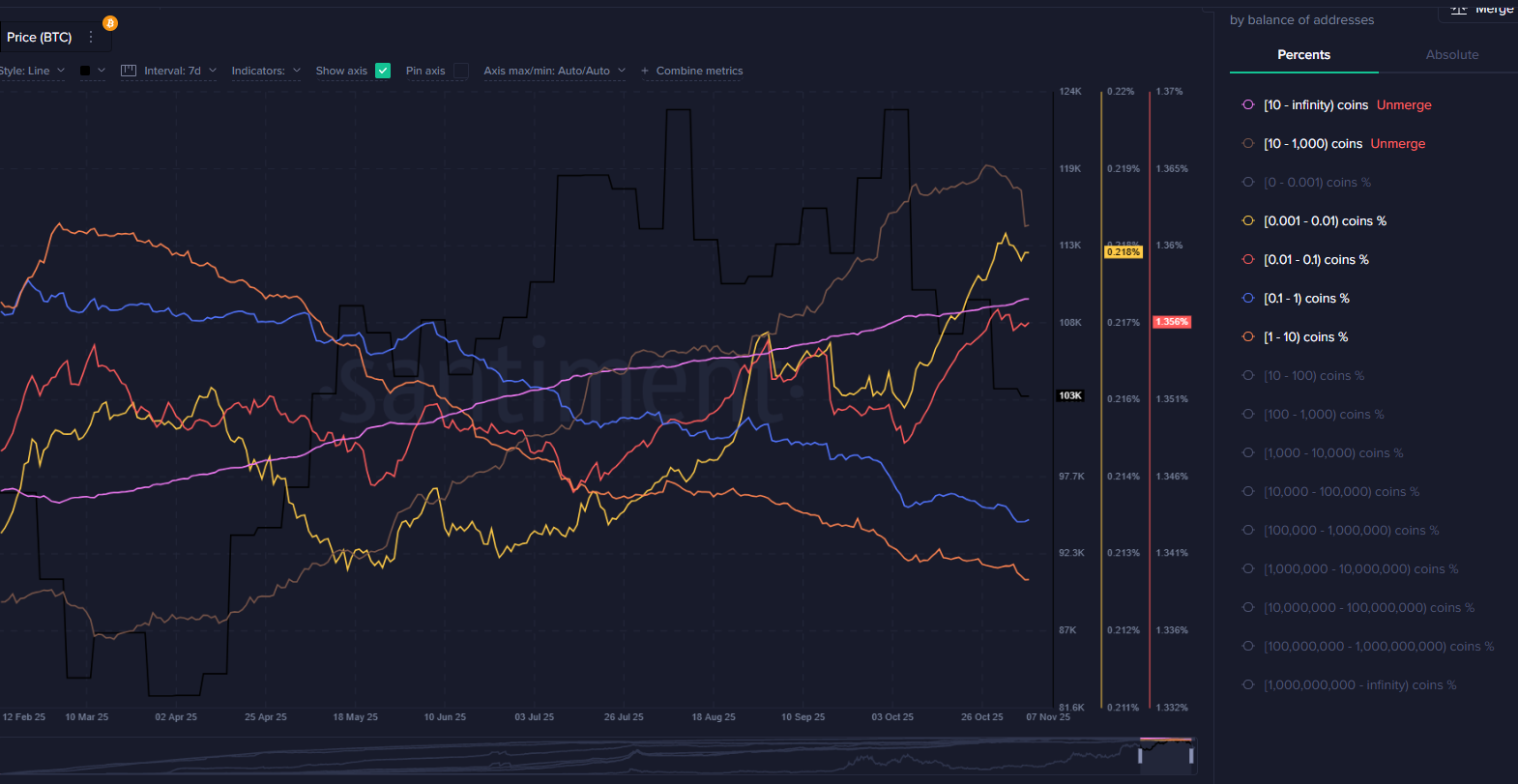

Onchain data shows that the long-term and large-wallet cohorts have meaningfully slowed their accumulation pace in recent weeks. In contrast, smaller wallets — those holding under 1 BTC — accelerated buying into recent dips.

Timothy Misir, head of research at BRN, said the divergence has emerged at an awkward time for market structure. “Whales have slowed buying while retail wallets are accumulating — a classic late-cycle pattern that increases short-term fragility,” he shared with The Block. “This morning’s washout is a liquidity and positioning event. The market hasn’t signaled a regime change; it has signaled stress.”

BTC whale accumulation slows | Image: Santiment

The update arrived shortly after a violent liquidity event in early Asian trading, where Bitcoin plunged to roughly $85,600 and erased about $144 billion in total crypto market value. More than $600 million in crypto liquidations occurred over the past 24 hours, including an estimated $567 million in long positions, according to Coinglass data.

Misir added that short-term holders realized losses spiked into the selloff, suggesting an “emotional reset.” He added that exchange balances and stablecoin inflows indicate both buying capacity and potential sell-side liquidity.

Price pressure links directly back to Asia

The overnight drop followed a cluster of bearish developments across Asia. In a note, QCP Capital said Bitcoin’s slide from $91,000 to the mid-$86,000s was fueled by hawkish remarks from Bank of Japan Governor Kazuo Ueda, which pushed Japan’s two-year yield to 1% and raised the odds of a December rate hike.

Fresh weakness in China’s non-manufacturing PMI, which contracted for the first time in nearly three years, intensified concerns about regional demand and global liquidity. QCP added that sentiment deteriorated further after Strategy CEO Phong Le said the firm could sell BTC reserves if equity funding conditions tightened — comments that “sparked panic and forced liquidations of leveraged longs” ahead of a critical December index-review window for the company.

Flows vs. fundamentals

Today’s unwind comes in the face of what some analysts describe as a supportive macro backdrop.

U.S. quantitative tightening ended, rate-cut odds into year-end have climbed, and global crypto investment products saw $1 billion in weekly inflows after a difficult November that saw $3.5 billion in outflows — the largest monthly total since February.

Still, price has not responded to those tailwinds. “After a 15% rebound off the $81K lows, a pullback was due,” QCP wrote. “But the question now is whether BTC can defend prior lows as sentiment turns more cautious.”

BTC is currently trading near $86,500, down almost 4% in the last 24 hours, according to The Block’s price page. Meanwhile, Ethereum hovers around $2,900, Solana trades near $130, and BNB sits close to $825.

Traders now turn to a heavy U.S. data slate — ISM PMIs, ADP, JOLTS, and PCE — that Misir said could determine whether Monday’s drop was “a capitulation or the beginning of a deeper phase.” Conversely, gold continues to attract safety flows, touching $4,261 and increasingly competing with crypto for risk capital.

“Expect violent two-way action,” Misir said. “To regain stability, Bitcoin needs to reclaim the low-$90Ks and see ETF and onchain flows flip decisively positive. Until then, rallies should be treated with skepticism.”

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates