Top 3 reasons Amp crypto price will rebound after crashing 40%

Amp crypto price has crashed by over 40% from its highest point in May and by nearly 80% from its 2024 high.

Amp (AMP) token dropped to a low of $0.00293 this week, its lowest level since April. This retreat has brought its market cap to $286 million, down from its all-time high of $3.5 billion. Here are the top three reasons why the coin may rebound soon.

Amp crypto has formed a double-bottom pattern

The first reason Amp may bounce back is that it has formed a double-bottom pattern on the daily chart. This pattern consists of two distinct lows and a neckline. In this case, the bottom section is at $0.0029, while the neckline is at $0.00578.

The profit target in a double-bottom is established by subtracting the lower side from the neckline. In this case, the calculation gives the pattern’s height as $0.00288. Adding this figure to the neckline gives a target of $0.0086, up 155% from the current level.

Whales are buying Amp

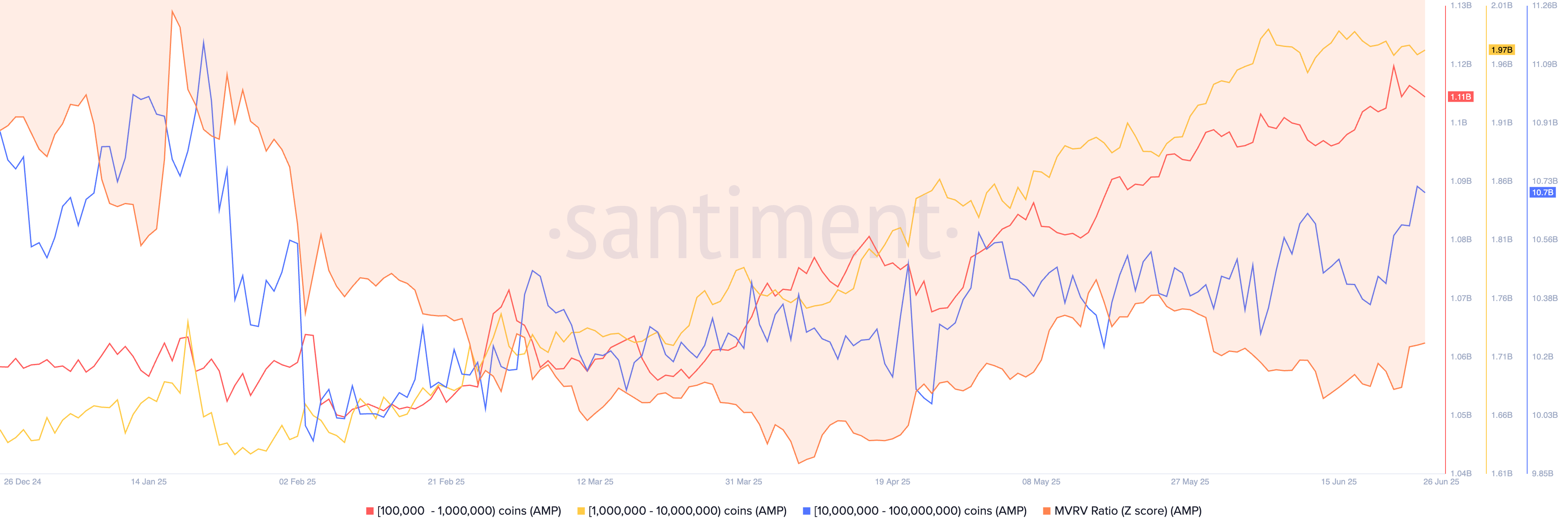

Another reason the Amp token may rebound is that whales are actively accumulating AMP. These large holders are increasing their token holdings, signaling expectations of a price recovery.

One reason for this accumulation is the belief that Amp is highly undervalued, as the MVRV ratio has plunged to -1.78. An MVRV ratio below 1 typically indicates that a token is trading at a discount.

The chart below shows that wallets holding between 100,000 and 1 million AMP have increased their holdings to 1.1 billion from the year-to-date low of 1.05 billion. Similarly, whales holding between 1 million and 10 million tokens now hold over 1.97 billion coins, while those with 10 million to 100 million now hold 10.7 billion.

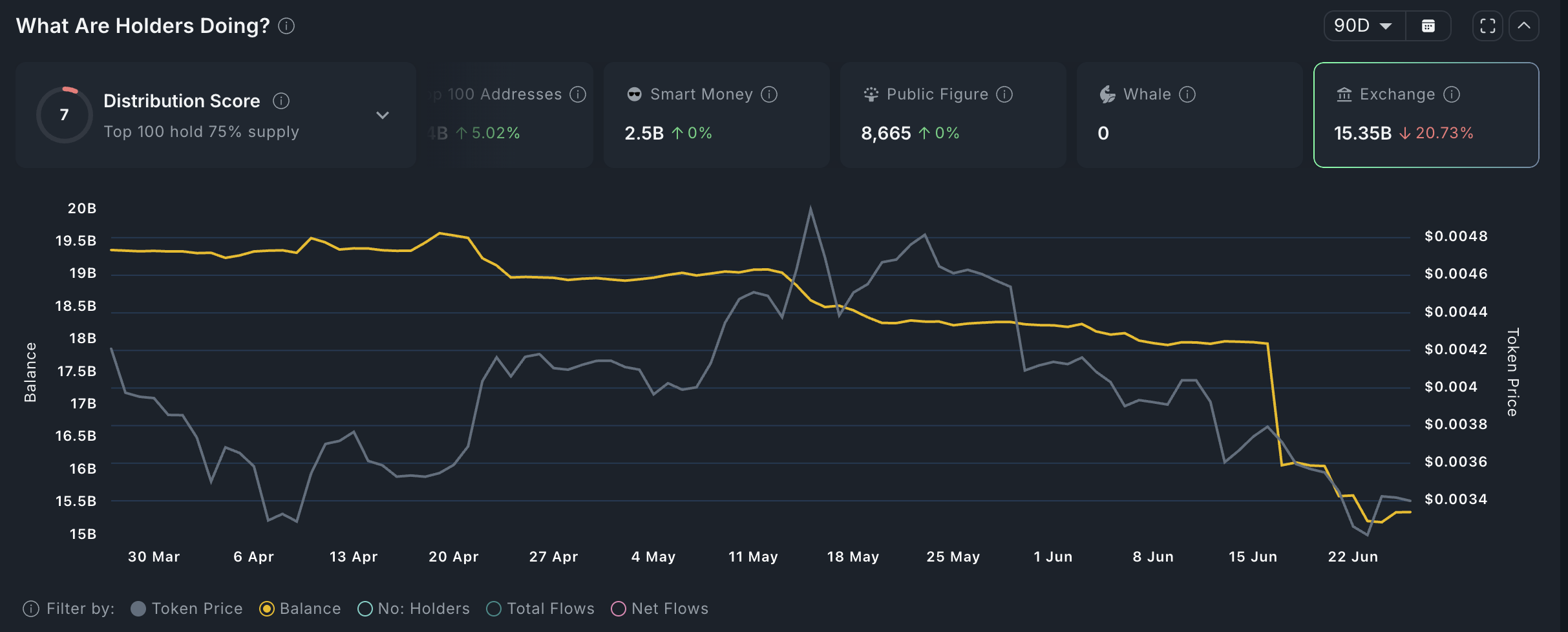

Supply on exchanges is falling

Meanwhile, there are signs that investors are not dumping AMP even as its price declines. Nansen data shows that exchange balances have dropped to 15.35 billion tokens, down 15% in the last 30 days and 20% in the last 90. There were nearly 20 billion AMP on exchanges in April.

Therefore, the strong technicals, combined with the falling supply on exchanges and increased whale accumulation, suggest that AMP may bounce back.

You May Also Like

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus