The Turkish lira has been depreciating for many years. When the fiat currency is lost in the crisis, can crypto assets become a safe haven?

Author: Weilin, PANews

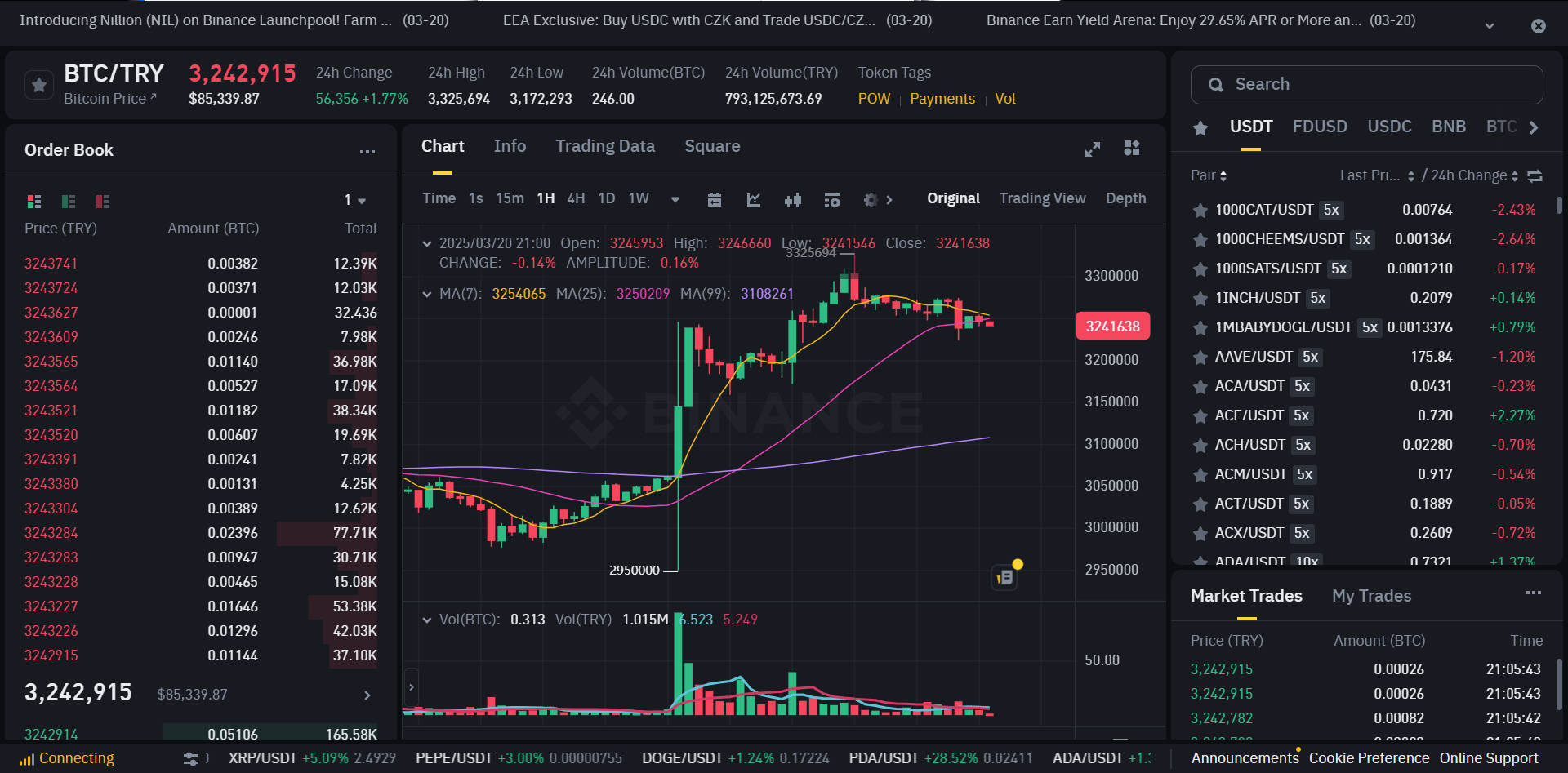

On March 19, Ekrem Imamoglu, the mayor of Istanbul and a rival of President Erdogan, was arrested, causing panic among local investors. The Turkish lira plummeted at around 4 p.m., reaching a new historical low of 41:1 (TRY:USD). About an hour later, a risk-averse trend emerged in the crypto market, and the BTC/TRY trading volume on Binance soared.

Looking back over the past five years, every time Turkey experienced a major currency devaluation crisis, Bitcoin trading volume mostly saw a significant increase. As global economic volatility intensifies, will cryptocurrency become a financial hedging tool for people in more countries with unstable currencies?

Bitcoin trading volume surges as Turkey's lira plunges to all-time low amid turmoil

On March 19, affected by the domestic turmoil, the exchange rate of Turkish lira (TRY) against the US dollar (USD) fell to a historical low of 41 lira to 1 US dollar, a single-day depreciation of nearly 10%. The direct consequence of the exchange rate plunge was a wave of capital aversion in the crypto market, and the trading volume of Bitcoin-Lira (BTC/TRY) on the Binance platform soared. From 15:00 to 16:00 on March 19, the trading volume of the trading pair reached 93 BTC, the highest level in at least a year. At the same time, partly due to the influence of US macroeconomic policies, the price of Bitcoin also saw a significant increase during this period. As of 8 am on March 20, BTC broke through $87,000, with a daily increase of 2.78%. Some market analysts also believe that Turkey's trading demand stimulated the rise of BTC/USD.

After that, Strategy founder Michael Saylor even posted a chart of the lira’s depreciation on the social media platform X, calling for “trying Bitcoin”, further promoting the market’s attention to BTC as a value storage tool.

Against the backdrop of the sharp depreciation of the Turkish lira, investors are rapidly turning to Bitcoin and stablecoins to seek a more stable way to store value. This is not an isolated case. Looking back over the past five years, whenever Turkey experienced a currency crisis, the trading volume of Bitcoin and stablecoins in the country mostly showed a surge, which highlights the hedging role of cryptocurrencies as a "safe haven" in countries with unstable currencies.

How has BTC/TRY volume and Bitcoin performed as the Turkish Lira fell over the past 5 years?

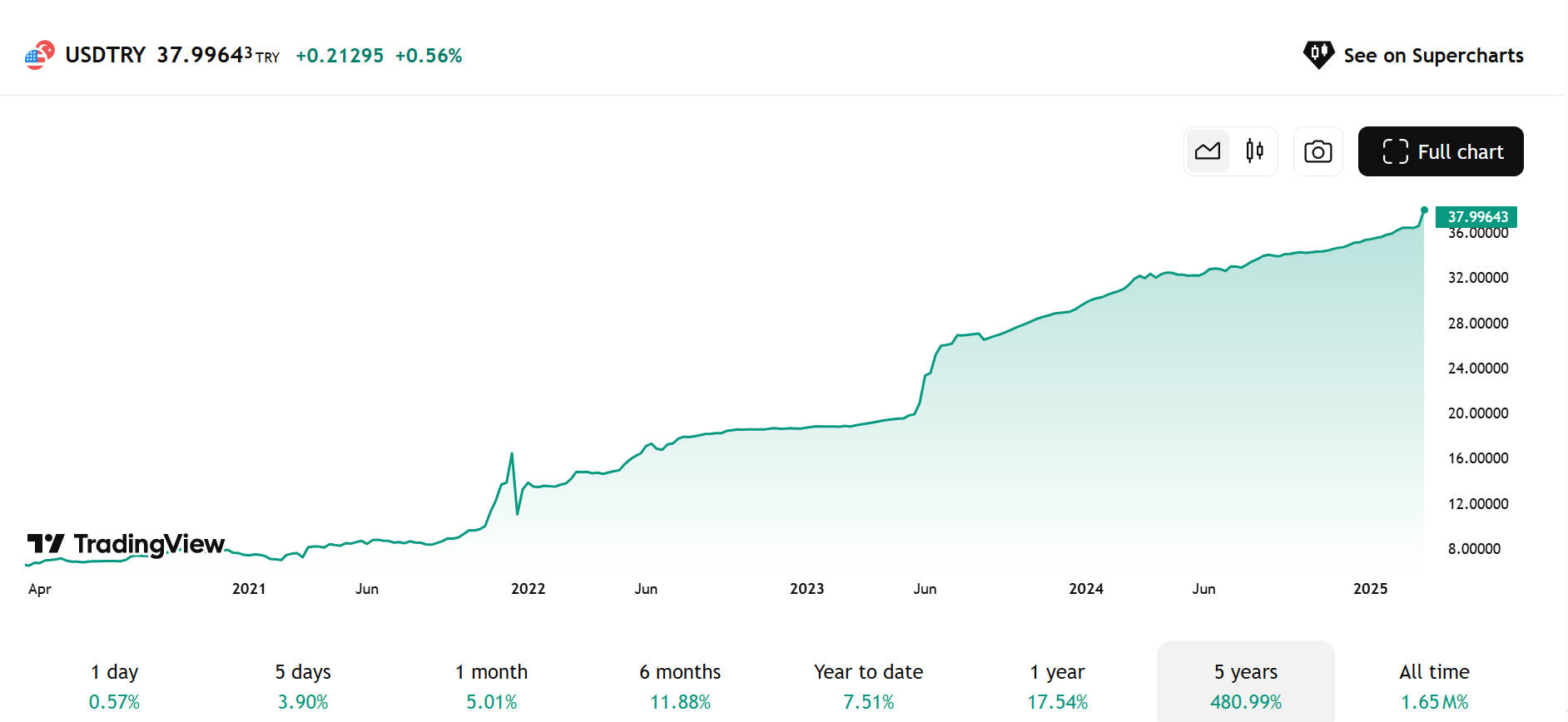

The trend of the US dollar against the lira from 2020 to 2025 shows that the lira is continuing to depreciate .

The Turkish lira has experienced several significant declines against the U.S. dollar in recent years.

2020: Global epidemic impact and policy mistakes, the lira fell below 7 to 1 dollar

In 2020, the outbreak of the global COVID-19 pandemic had a severe impact on emerging market economies. Turkey's foreign exchange reserves fell rapidly, and the Erdogan government insisted on a low interest rate policy, exacerbating capital outflows. At the end of July, the lira fell below the 7:1 mark against the US dollar. Binance data shows that the daily trading volume of BTC/TRY has increased from 43.79 BTC on July 21 to 60.33 BTC on August 21. By November 7, the lira fell further to 8.43:1 against the US dollar. This year, the cumulative depreciation of the lira throughout the year was close to 26%.

Bitcoin performed well in 2020, climbing from $7,194 at the beginning of the year to $28,990 at the end of the year, with an annual increase of 303%. Although the "3.12 crash" on March 12 caused BTC to fall to a low of $4,106, the subsequent strong rebound once again proved the potential of Bitcoin as an anti-inflation asset.

2021: Central bank turmoil intensifies, lira plunges 17% in a single day

In 2021, Turkey's financial market fell into a crisis of confidence. On March 20, the central bank governor Naci Agbal was suddenly dismissed, causing panic in the market. On March 22, the lira plummeted nearly 17% against the US dollar in a single day, falling to 8.4:1. From then until April 13, Binance BTC/TRY daily trading volume was on an upward trend. During the same period, Google search data showed that Bitcoin searches in Turkey soared by 566%, showing a surge in market demand for BTC as a safe haven. In terms of Bitcoin, the global price of Bitcoin did not rise significantly in March.

On November 23, 2021, Erdogan defended the interest rate cut policy and rejected the orthodox interest rate hike to deal with inflation. Turkey's inflation rate is close to 20%. On November 23, the lira fell by more than 15% in a single day, and fell below 12 to 1 US dollar at the end of November. On November 24, the daily trading volume of BTC/TRY soared to 873.52 BTC.

However, after the lira plummeted this time, Bitcoin did not rise significantly in the global market (BTC/USD) in the short term, and even fell from late November to early December.

In 2021, the lira fell by about 82% throughout the year, from about 7.43 at the beginning of the year to about 13.50 at the end of the year.

2022: Cryptocurrency trading is active amid hyperinflation

In 2022, Turkey's inflation rate soared to a 20-year high of over 85%. Although the government launched the "Lira Deposit Protection" plan to stabilize the market, investor confidence has not yet recovered. In mid-December, the lira fell below 18:1 against the US dollar, with a cumulative depreciation of 39% throughout the year. In January of the following year, a new peak in BTC trading appeared on Binance.

Bitcoin fell into a bear market in 2022. Affected by the Fed's interest rate hikes and the collapse of FTX, BTC fell 64% throughout the year. Despite this, Turkish investors are still active in the crypto market, and DOGE has become one of the most popular trading assets. Between October and November 2022, its trading volume even exceeded the sum of BTC and ETH, reaching $380 million. Although the Erdogan government once warned the public to stay away from cryptocurrencies, local residents still use them as an anti-inflation tool.

2023: Post-election policy adjustments are unlikely to reverse the decline, and BTC/TRY trading volume rises

In May 2023, Erdogan was successfully re-elected, and the government's economic team began to adjust monetary policy. The central bank raised interest rates sharply to stabilize the market. However, due to the previous economic damage, inflation remained high. By June, the lira fell to 23:1 against the US dollar, and further fell to 29.5:1 at the end of the year, a year-on-year depreciation of 58%. On June 27, BTC/TRY reached a daily trading volume of 502.9 BTC.

During the year, the global Bitcoin market experienced a strong rebound from June to December 2023, with the price rising from $26,800 to $42,300, a 58% increase. The rise in the global price of Bitcoin was driven more by factors such as institutional capital inflows and expectations for ETF approval, but in Turkey, due to the depreciation of the lira, the price of BTC rose more significantly, from 700,000 liras to 1.25 million liras, a 78% increase.

2024: Türkiye frequently runs account deficits, BTC breaks through $100,000

In October 2024, the global dollar strengthened, the Russian-Ukrainian conflict pushed up energy prices, and aggravated Türkiye's current account deficit. In mid-October, the lira fell below 35:1 against the dollar, depreciating by 19% throughout the year.

During the same period, the price of Bitcoin once fell to $58,000 due to the strong dollar, but in December, due to the clear policy after the US election and the positive crypto market (such as the surge in ETF trading volume), it broke through $100,000 several times. This trend also led to an increase in the trading volume of the BTC/TRY trading pair. For example, Binance data showed that after the US election, people's enthusiasm for cryptocurrencies increased. On December 17, BTC/TRY reached a daily trading volume of 123.23 BTC.

BTC and Stablecoins: A Safe Haven for People in Countries with Unstable Currencies

In economies experiencing hyperinflation and currency depreciation, BTC and stablecoins are becoming important safe-haven tools for residents.

According to a report by Coingecko, in Venezuela, the country's inflation rate is still as high as 60% in 2024, although it is lower than the peak in 2018, but the economic difficulties remain severe. The Petro cryptocurrency launched by the government went bankrupt in 2024, but the trading volume of Bitcoin and stablecoins surged. In 2024, the use of cryptocurrencies as remittances surged, and 9% of Venezuela's annual remittances of US$5.4 billion were transferred in cryptocurrencies.

In Argentina, where inflation is expected to reach 276% in 2024, Bitcoin has become an important tool to hedge against the depreciation of the peso. The country's cryptocurrency trading volume is expected to reach $91.1 billion between 2023 and 2024, surpassing Brazil to become one of the most active crypto markets in Latin America.

Bitcoin is considered "digital gold" due to its decentralization, fixed supply (21 million coins) and anti-censorship characteristics, and is suitable for long-term value storage. Stablecoins (such as USDT and USDC) are more suitable for short-term transactions and risk aversion because they are pegged to the US dollar and provide price stability.

In countries with unstable currencies, BTC and stablecoins form a complementary system: Bitcoin is used to fight inflation in the long term, while stablecoins provide short-term liquidity needs. Although cryptocurrencies cannot solve the fundamental problems of the economy, they undoubtedly provide individuals with a realistic solution for value preservation and transactions during hyperinflation and exchange rate crises.

In general, the example of the lira's collapse this time also shows that in an economy experiencing hyperinflation, cryptocurrencies highlight the importance of individuals coping with financial crises. Cryptocurrencies like Bitcoin and stablecoins provide timely and practical solutions for protecting wealth and facilitating transactions, especially when traditional currencies fail. In the future, cryptocurrencies may become an important part of the global financial ecosystem.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates