Bitcoin Live News Today: Latest Insights for Bitcoin Maxis (December 4)

Stay Ahead with Our Immediate Analysis of Today’s Bitcoin Insights

Check out our Live Bitcoin Updates for December 4, 2025!

In 2010, Bitcoin was worth a few cents. One year later, it hit $20. In six years, it was $17,000, and only a month ago, it hit an ATH of $126K, a 641% in six years and 629,900% in 14 years.

Historically, if you’d invested in Bitcoin at launch, you’d have an ROI of 188,643,000%. The likes of Mastercard, JP Morgan, and scores of S&P 500 companies are buying Bitcoin in droves.

Arthur Hayes just predicted $BTC to hit $200K by the end of 2025, and Saylor is doubling down on Bitcoin despite the crypto’s slump to under $85K.

There’s never been anything like Bitcoin before, and investors are waking up to that reality. If you’re looking for the newest insights on Bitcoin, you’re in the right place.

We update this page regularly throughout the day with the latest insider insights for Bitcoin maxis. Keep refreshing to stay ahead of the pack!

Disclaimer: No crypto investment comes without risk. Our content is for informational purposes, not financial advice. We may earn affiliate commissions at no extra cost to you. Bitcoin ETF Euphoria Steers Bitcoin Liquidity Toward Bitcoin Hyper’s Layer-2 BetDecember 4, 2025 • 10:00 UTC

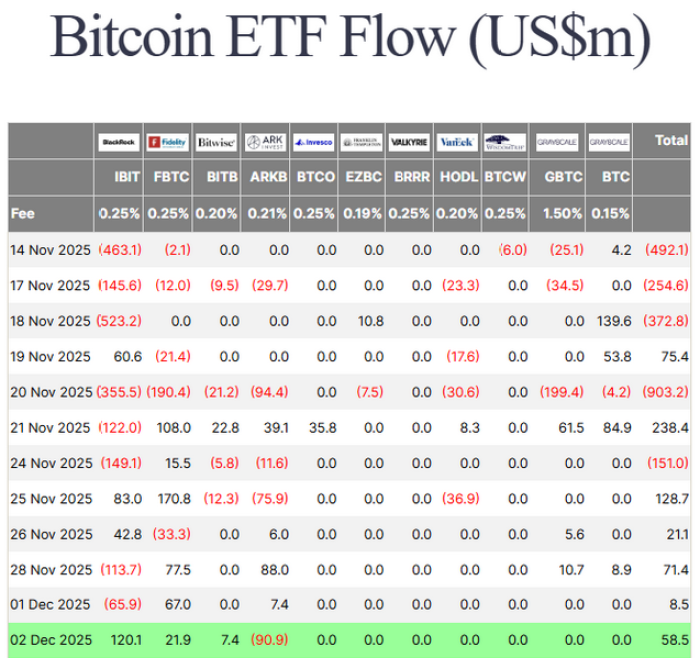

Bitcoin has bounced from $84K to around $93K in a 7% move while analysts map a path toward $120K, as long as the five-day streak of $58.5M in daily spot Bitcoin ETF inflows holds.

BlackRock’s IBIT alone added $120.1M in one day, which shows that the marginal buyer is now an ETF, not a degen on leverage.

That kind of regulated demand keeps $BTC structurally bid and pushes more value onto the base chain over time.

As more volume and capital move through Bitcoin, blockspace and fees trend higher, and the trade shifts from hoarding coins to owning the rails that keep the network usable.

Bitcoin Hyper ($HYPER) is that rails play. It is a Bitcoin Layer-2 built on the Solana Virtual Machine, using a canonical bridge so you can move $BTC into an environment with fast execution and Solana-style dApp support while still anchored to Bitcoin’s brand and security.

Explore Bitcoin Hyper’s presale in our guide.

BlackRock’s Bitcoin-Aware ‘Mega Forces’ Narrative Aligns With SUBBD Token’s Creator Economy PushDecember 4, 2025 • 10:00 UTC

BlackRock’s latest outlook stays risk-on and leans into ‘mega forces’ like AI, tokenization, and stablecoins, arguing these trends will reshape markets over the next decade rather than just fuel a short-term pump.

With $BTC trading near $93K and stablecoins at a multi-hundred-billion-dollar market cap, capital clearly prefers programmable rails over legacy intermediaries. That backdrop rewards projects where real economic activity, not just speculation, settles on-chain.

SUBBD Token ($SUBBD) fits that lane by turning the $85B creator economy into an on-chain, AI-powered subscription stack.

The platform uses an ERC-20 token to handle subscriptions, tipping, and staking, while AI tools automate fan engagement and content flows, so value accrues to creators and holders instead of Web2 middlemen.

With $1.38M already raised at a presale price of $0.0571, you step into an early-stage play that sits exactly where BlackRock expects structural growth: AI, payments, and Bitcoin-adjacent on-chain liquidity.

Here’s how to buy $SUBBD now.

Authored by Bogdan Patru, Bitcoinist — https://bitcoinist.com/bitcoin-live-news-today-december-4-2025

You May Also Like

Huawei goes public with chip ambitions, boosting China’s tech autonomy post-Nvidia

Tron Makes Bold Moves in TRX Tokens Acquisition