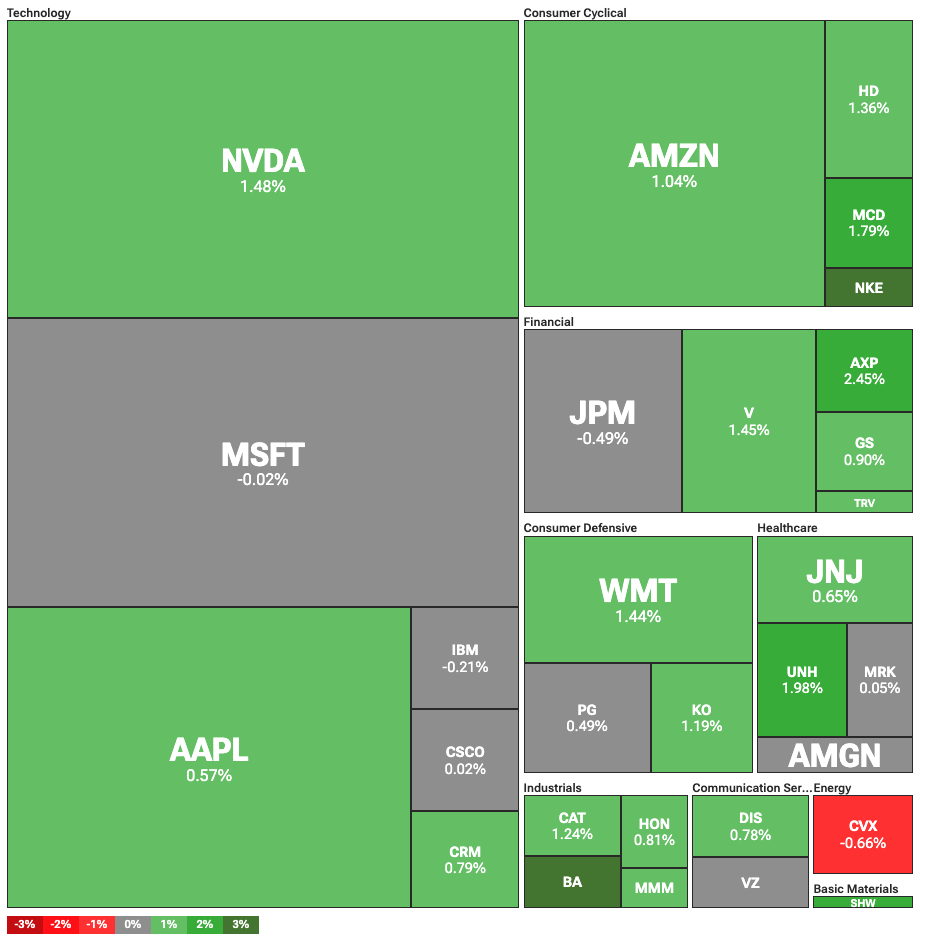

Dow Jones up 500 points as trade and Fed optimism sweeps the market

U.S. stocks were up, and the S&P 500 broke records earlier as good news on trade and interest rates boosted the markets.

Major U.S. stock indices saw strong growth amid several key positive macroeconomic developments. The Dow Jones gained 490 points, or 1.13%, while the tech-heavy Nasdaq was up 0.55%. The S&P 500 climbed 0.65%, breaking its previous all-time high and trading at 6,183.25.

Trade and monetary policy were front and center for investors. The U.S. and China moved closer to finalizing a full trade deal, signing a preliminary agreement that outlines a broad understanding between the two sides.

According to the document, the U.S. would gain access to magnets and rare earth minerals from China, while lifting a series of trade restrictions. Though full details remain unclear, China has previously emphasized the importance of high-powered semiconductors to its economy.

Fed rate cut odds improve on weaker inflation

In addition to trade optimism, consumer sentiment improved sharply in June, with inflation expectations falling. The Michigan Consumer Sentiment Index rose to 60.7, up 8.5 points from the previous month.

The figures are significant as they have a direct impact on the direction of monetary policy. Low inflation figures, as well as the relative weakness of the labor market, may push the Federal Reserve into a position where it has to cut interest rates sooner. This is what both stocks and crypto markets have been waiting for.

Still, risks remain. The U.S. economy faces structural challenges, particularly around its rising government debt. Donald Trump’s budget, dubbed the “big, beautiful bill”, continues to swell, according to reports.

As lawmakers scramble to include last-minute allocations for their constituencies, the total price tag may have ballooned well past $3 trillion.

You May Also Like

Federal Reserve’s Rate Cuts May Affect Cryptocurrency Market

‘High Risk’ Projects Dominate Crypto Press Releases, Report Finds