Pepe Could 30x Again, But Ozak AI Prediction Dominates Analyst Reports for 2025

Pepe continues to attract aggressive bullish forecasts as traders speculate on another potential 30x breakout during the next major crypto expansion. Its strong community base, rising liquidity, and consistent meme-sector dominance all contribute to the renewed optimism surrounding its chart.

Yet even with all this momentum behind Pepe, analysts across the market are focusing far more heavily on Ozak AI (OZ)—the AI-native intelligence engine now being projected as one of the strongest 2025 outperformers. With live millisecond predictive technology, autonomous multi-chain agents, and real-time data processing capabilities already functioning before launch, Ozak AI presents a fundamentally different growth model from meme-driven assets, and this difference is driving far more aggressive long-term expectations.

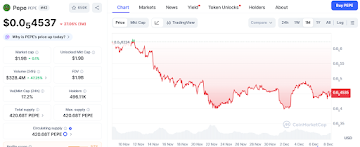

Pepe coin (PEPE)

Pepe trades around $0.000004537 and continues forming a clean accumulation zone supported by steady buyer activity. Support at $0.000004320 holds the short-term uptrend, while deeper layers at $0.000004100 and $0.000003820 reinforce long-term strength. Pepe begins building breakout pressure once it challenges resistance at $0.000004800, with higher levels at $0.000005050 and $0.000005330 often triggering acceleration phases in previous cycles. This setup is what fuels the 30x projections—Pepe has a proven history of going parabolic when liquidity surges across the meme sector.

Yet even as Pepe’s technical outlook strengthens, analysts consistently shift their highest-confidence forecasts toward Ozak AI because its upside does not depend on hype cycles. Ozak AI grows through real-time computation, multi-chain intelligence, and autonomous system execution—giving it an exponential, utility-driven curve that meme tokens cannot replicate.

Youtube embed:

OZ Explained: The AI + Blockchain Project Changing Data Analytics 🌐

Ozak AI (OZ)

Ozak AI’s ecosystem is built around a functioning intelligence engine capable of analyzing market conditions in real time. Millisecond-speed predictive models process market shifts instantly, while ultra-fast 30 ms HIVE signals supply execution-grade insight that feeds directly into Ozak AI’s analytics layer.

SINT’s autonomous AI agents then act on-chain without human intervention, scanning liquidity imbalances, trend changes, and cross-chain opportunities at machine speed. Combined with Perceptron Network’s 700K+ node infrastructure, Ozak AI continuously learns and adapts—becoming smarter with every block of data.

This compounding intelligence gives Ozak AI a fundamentally different value path. Instead of relying on community momentum, it gains value from usage, data, and prediction accuracy. Analysts point out that this creates the rare potential for exponential expansion, making Ozak AI one of the most promising 100x candidates for 2025.

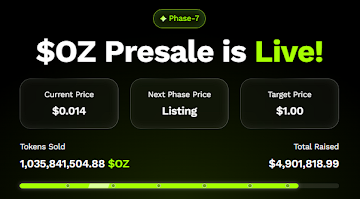

Ozak AI Presale Momentum

The Ozak AI Presale surpassing $4.9 million demonstrates strong conviction from both retail buyers and strategic investors. Unlike typical presales that promise future development, Ozak AI launches with working AI infrastructure—a major factor behind its early accumulation.

Traders viewing Ozak AI through the lens of past-cycle winners note that tokens with functional utility before launch tend to outperform dramatically once the next bull run begins. This is why Ozak AI consistently appears in analyst reports under high-ROI categories, often above AI-narrative tokens, meme coins, and even established altcoins.

Ozak AI Becomes the Strongest Narrative for 2025

Pepe’s 30x potential remains compelling, and its chart structure supports a powerful breakout during the next liquidity wave. But Ozak AI delivers something fundamentally different: a continuously evolving intelligence layer capable of serving traders, analytics platforms, AI-powered dApps, and agent-driven systems across chains. As more market participants adopt predictive tools and automated systems, demand for Ozak AI’s architecture is expected to expand rapidly.

Pepe may produce another explosive run, but analysts overwhelmingly agree that Ozak AI offers the stronger, more sustainable, and far more exponential upside. This is why Ozak AI now dominates 2025 analyst reports—and why many traders view it as the top early-stage project of the coming bull cycle.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Pepe Could 30x Again, But Ozak AI Prediction Dominates Analyst Reports for 2025 appeared first on Live Bitcoin News.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SHIB Price Analysis for February 8