Crypto stumbles as Dow rockets to record high, triggering a big-ticket rotation out of tech

The crypto market slid on Thursday even as the Dow Jones Industrial Average soared to a fresh record, underscoring a sharp investor rotation out of tech and into economically sensitive stocks following the Federal Reserve’s latest interest-rate cut.

- Crypto slumped even as the Dow hit a record high, with Bitcoin and Ethereum falling alongside a broad selloff.

- Investors rotated out of big tech and AI plays after weak Oracle earnings.

- Despite price declines, Bitcoin and Ethereum ETFs saw strong inflows, signaling sustained institutional interest.

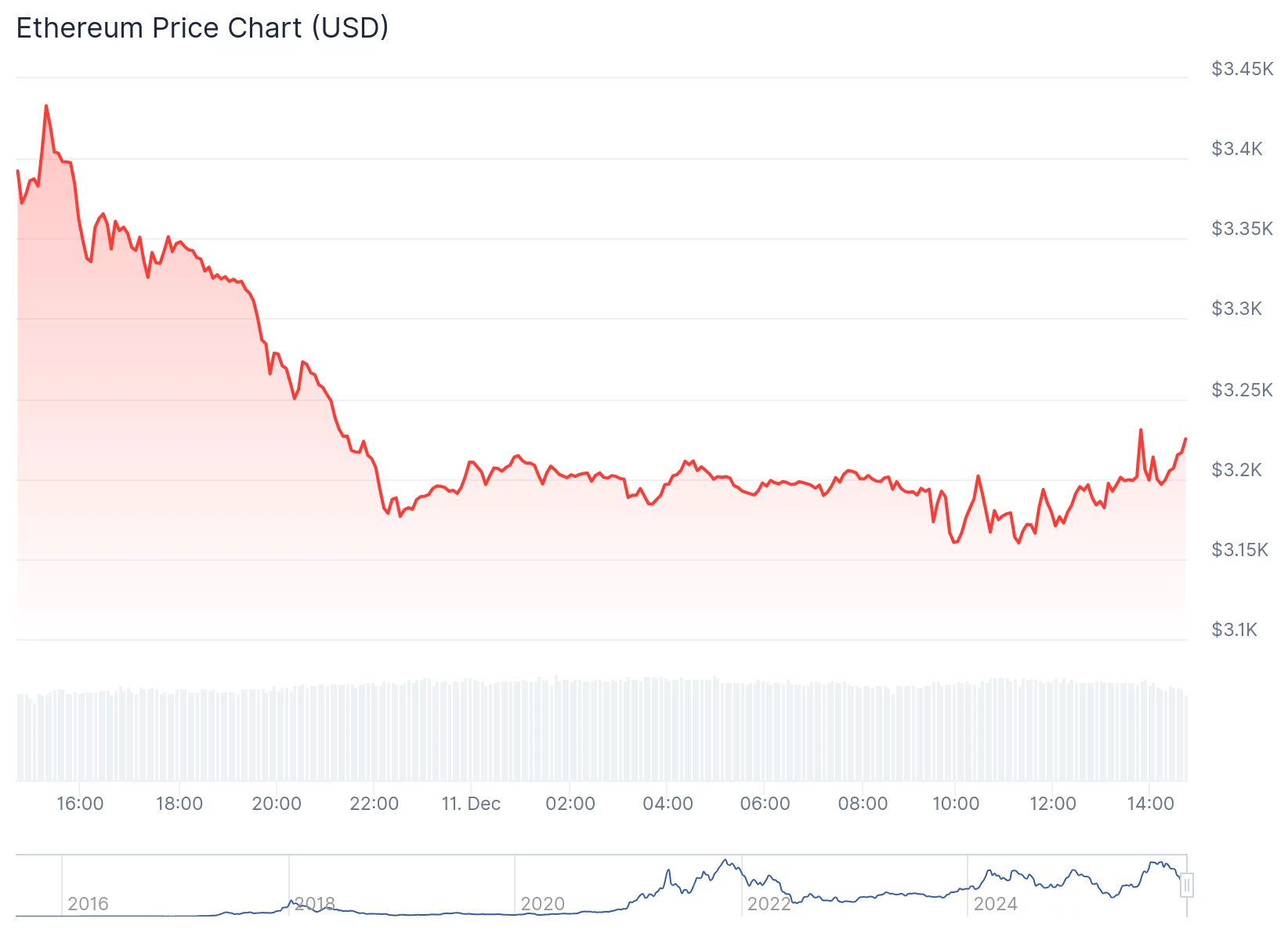

Bitcoin hovered just above $91,000, down about 1.5%, while Ethereum slipped roughly 5% to trade near $3,200.

The declines mirrored a broader selloff across digital assets: total crypto market capitalization fell 2.3% to about $3.2 trillion. One report tallied that 97 of the top 100 tokens were trading lower.

Despite the slump, Bitcoin and Ethereum ETFs still attracted fresh inflows, signaling persistent institutional appetite. According to data gathered on Thursday, Dec. 10:

- Spot Bitcoin ETFs pulled in $224 million-worth of net inflows

- Ethereum ETFs saw a net inflow of $57.6 million

- Spot XRP ETFs attracted $954 million in investment ever since Canary Capital’s November launch.

Traditional markets tell a different story

The 30-stock Dow jumped 600 points, or 1.3%. Per CNBC, that’s a record high.

Investors fled high-growth tech names after Oracle’s earnings disappointed, raising alarms about how quickly companies can monetize their massive artificial intelligence (AI) investments.

Oracle carries more than $100 billion in debt tied to data-center expansion, a point that weighed heavily on sentiment and dragged down other AI-linked stocks: Nvidia, Broadcom, AMD, and CoreWeave—to name a few.

The rotation dampened momentum from the prior session, when the S&P 500 closed just shy of its own record after the Fed cut interest rates for the third time this year, bringing the benchmark range to 3.5%–3.75% and signaling no hikes ahead.

Lower borrowing costs boosted small-caps, sending the Russell 2000 (up 1.3% at last check) to a new intraday high Thursday, after hitting a record close the day before.

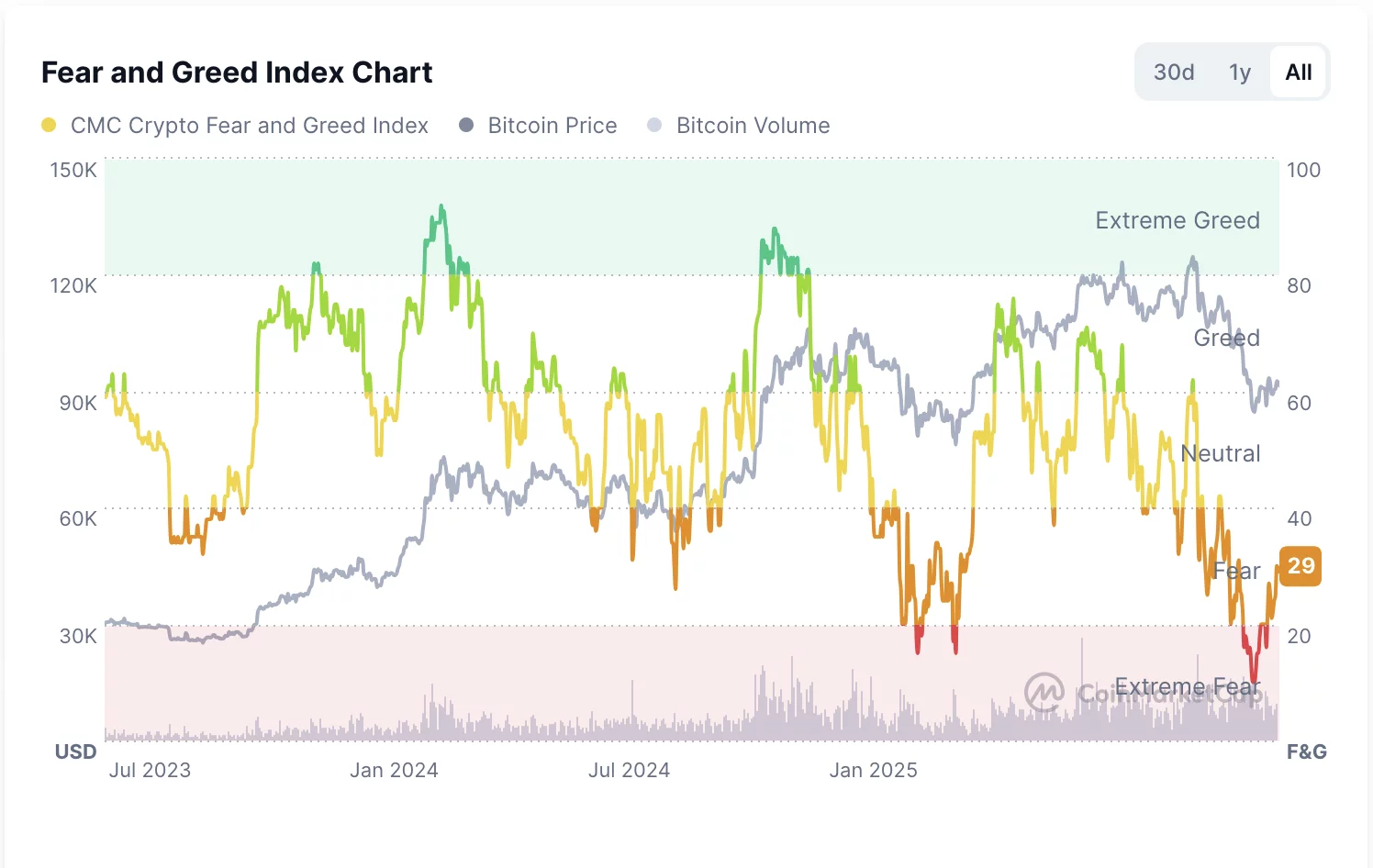

In crypto, sentiment remains fragile: the crypto fear and greed index ticked down from 30 to 29, staying firmly in “fear” territory ahead of further macroeconomic signals and government actions following recent administrative disruptions.

What’s next

Even with uncertainty rising, ETF inflows suggested that big investors aren’t leaving crypto—just bracing for a choppier ride.

Whether a so-called Santa Claus rally can push the S&P 500 above 7,000 into year-end, remains to be seen. As for 2026, observers expect various headwinds, including a Fed leadership change and the midterm elections.

You May Also Like

Pi Network Tech Upgrade Unlocks Mainnet Migration for 2.5 Million Users and Introduces Palm Print Security

PayPal P2P, Google AI Payments, Miner Pivot — Crypto Biz