First Month of XRP ETFs Analyzed: The Good, The Bad, and The Ugly

Following the political and regulatory changes in the United States that began after last year’s presidential elections, the entities behind numerous altcoins started to hope for the launch of spot ETFs tracking their respective assets’ performance.

Ripple’s XRP was among the most highly anticipated alts to have such funds on Wall Street, and the first, Canary Capital’s XRPC, hit the US markets exactly a month ago. Since then, four more joined the list, including 21Shares’ TOXR, which was the most recent one. Here’s what happened in the first 30 days.

What Happened During the First Month?

As reported the day after the successful launch of XRPC, Canary Capital’s financial vehicles broke the 2025 record for trading volume during its debut. The volume was just under $60 million, which outpaced Bitwise’s SOL ETF launch, while the overall inflows stood at around $243 million.

As mentioned above, TOXR was the latest to see the light of day. Grayscale’s GXRP was converted into an ETF, while Bitwise’s XRP and Franklin Templeton’s XRPZ were released in the meantime.

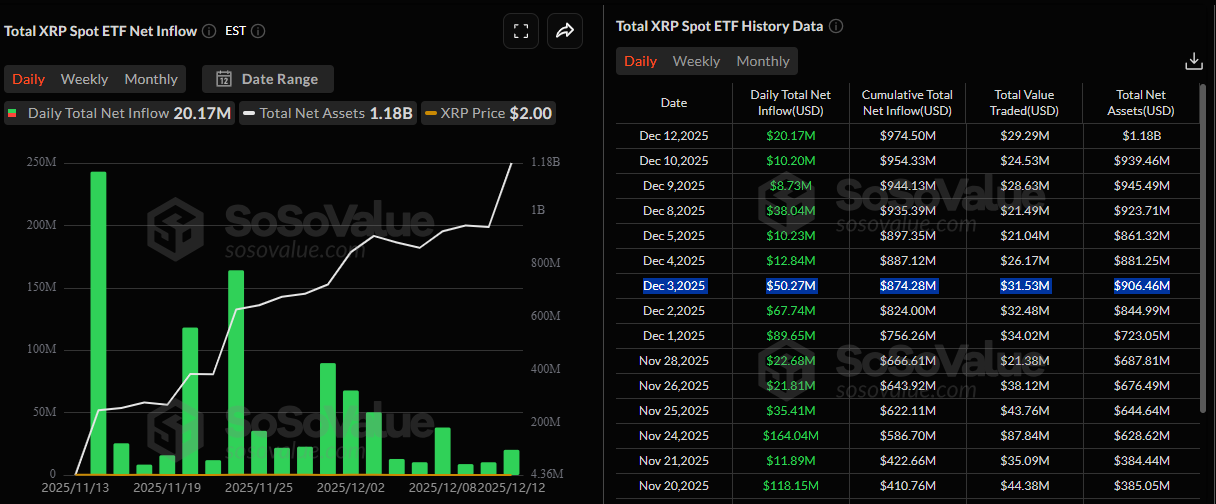

The inflow streak has been quite impressive, as all trading days since the debut of XRPC have been in the green. While the initial day record of $243 million in net inflows cannot be reached yet, the total inflows since then continue to climb to $974.50 million as of Friday’s close.

The total net assets have shot up above the $1 billion mark and stand at $1.18 billion, according to data from SoSoValue.

XRP ETF Inflows as of December 13. Source: SoSoValue

XRP ETF Inflows as of December 13. Source: SoSoValue

XRP Price Impact

Given the fact that the spot XRP ETFs outperformed the BTC and ETH counterparts for the most part since their launch, it would be logical to assume that the impact on the underlying asset’s price should be quite positive. Moreover, the company behind the token has been making big moves with partnerships and regulatory approvals.

However, the reality is different. In the hours ahead of XRPC’s launch, XRP traded above $2.50 and even close to $2.60. Since then, it dipped below $2.00 on several occasions and even bottomed at $1.85 during the late November crash. Although it has reclaimed the $2.00 support, it still sits just inches above it, which means it has dropped by 20% in a month despite the funds attracting $974 million.

XRPUSD December 13. Source: TradingView

XRPUSD December 13. Source: TradingView

The post First Month of XRP ETFs Analyzed: The Good, The Bad, and The Ugly appeared first on CryptoPotato.

You May Also Like

BitGo expands its presence in Europe

Now You Don’t’ New On Streaming This Week, Report Says