Trading time: Crypto market pulls back across the board, Ethereum nearly halved since the beginning of the year

1. Market observation

Keywords: Coinbase, ETH, BTC

BTC fell below $77,000 this morning. Greeks.live briefings show that traders are generally bearish at present, with most focusing on the $74,000-76,000 area as a potential downside target, and $87,000 as a resistance level. Arthur Hayes, co-founder of BitMEX, predicts that Bitcoin may bottom out around $70,000, which is equivalent to a 36% correction from the historical high of $110,000, which is a normal adjustment in the bull market. Although Strategy did not increase its holdings of Bitcoin last week, it has submitted a new prospectus to issue $21 billion in preferred shares, which may be used to purchase Bitcoin.

In the case of Ethereum, the situation is even more serious. Its price has fallen below $1,800 this morning. An address holding 65,000 ETH is facing liquidation risk, and another whale has sold 25,800 ETH for risk aversion, with a loss of $31.75 million. Yuga Labs executives warned that if the market enters a bear market, ETH may fall below $1,500, or even reach the $200-400 range, which is consistent with the 90% maximum retracement in historical bear markets.

In the traditional financial market, the US stock market experienced a "Black Monday", with the Nasdaq falling 4%, Tesla falling 15%, and blockchain concept stocks generally falling, including Coinbase falling 17.58% and MicroStrategy falling 16.68%. In this regard, Arthur Hayes believes that the next step is to pay attention to the plunge in US stocks and the risk of bankruptcy of traditional financial institutions, and then major central banks may adopt loose policies to stimulate the economy. Cathie Wood, founder of ARK Invest, believes that the market is digesting the last stage of the recession and expects a deflationary boom in the second half of the year. However, Federal Reserve Chairman Powell recently said that the Federal Reserve is not in a hurry to cut interest rates due to the continued strength of the labor market, the uneven inflation path, and the uncertainty of the impact of Trump's trade, fiscal, immigration and regulatory policies. Goldman Sachs has lowered its forecast for US economic growth to 1.7% and raised its inflation forecast. It is worth noting that futures traders are increasingly betting that the Federal Reserve will cut interest rates in June, July and October.

Facing the current market situation, Delphi Digital researcher Minty suggested that investors should not measure investment by historical highs, but rather a target of 50-70%. He said that most altcoins may never return to their historical highs, major opportunities only appear a few times a year and are fleeting, and over-trading and lack of patience are the main reasons for profit loss.

2. Key data (as of 13:00 HKT on March 11)

-

Fear index: 24 (extreme fear)

- 24-hour BTC long-short ratio: 0.9685

-

Average GAS: BTC 3 sat/vB, ETH 1.11 Gwei

-

Market share: BTC 61.1%, ETH 8.7%

-

Upbit 24-hour trading volume ranking: XRP, BTC, ETH

-

Sector ups and downs: DeFi sector fell 8.32%, Meme sector fell 9.19%

-

Bitcoin: $80,007.13 (-14.6% year-to-date), with a daily spot volume of $58.486 billion

-

Ethereum: $1,865.44 (-44.05% year-to-date), with a daily spot volume of $38.414 billion

-

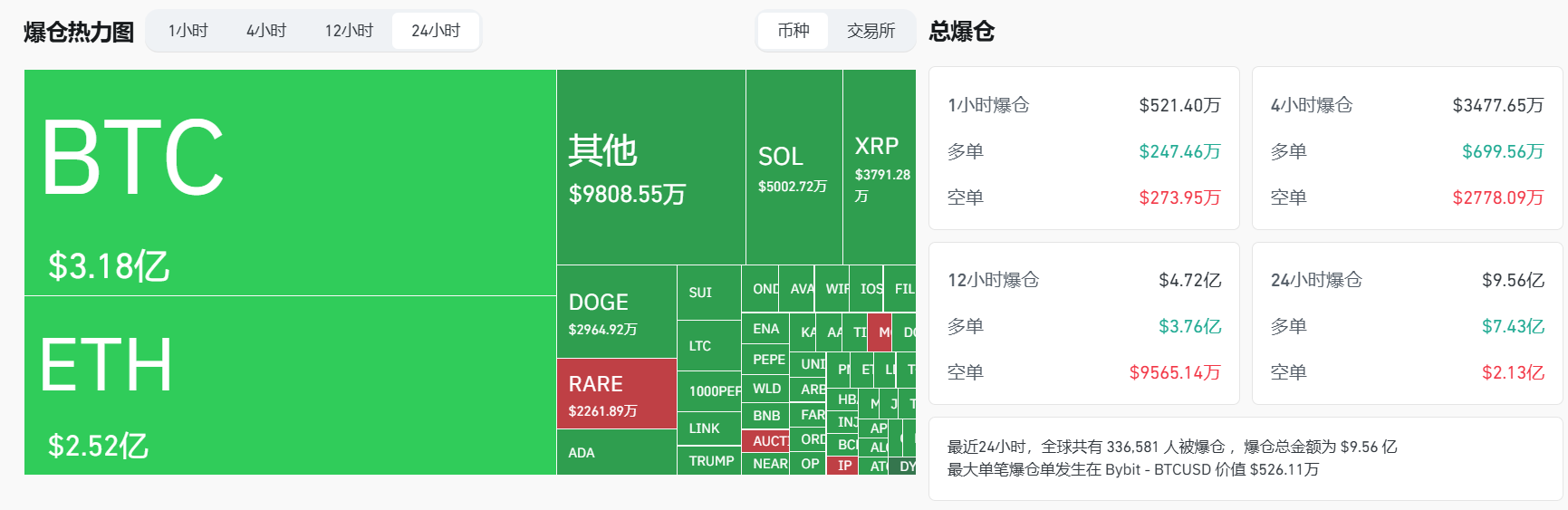

24-hour liquidation data: A total of 336,581 people were liquidated worldwide, with a total liquidation amount of US$956 million, including BTC liquidation of US$318 million and ETH liquidation of US$252 million.

3. ETF flows (as of March 10 EST)

-

Bitcoin ETF: -$189 million

-

Ethereum ETF: -$34 million

4. Important Dates (Hong Kong Time)

US President Trump met with US technology leaders, including the CEOs of HP, Intel, IBM, and Qualcomm. (March 11, 2:00)

US President Trump signed an executive order. US February unadjusted CPI annual rate (March 12, 20:30)

-

Actual: None / Previous: 3% / Expected: 2.9%

U.S. February seasonally adjusted CPI monthly rate (March 12, 20:30)

-

Actual: None / Previous: 0.50% / Expected: 0.30%

Number of initial jobless claims in the United States for the week ending March 8 (10,000 people) (March 13, 20:30)

-

Actual: None / Previous: 22.1 / Expected: None

5. Hot News

El Salvador and Paraguay Sign Cryptocurrency Regulatory Agreement

Bithumb launches Elixir (ELX) Korean Won trading market

Maker will update the oracle price to $1806 at 10:00, and the whale address position of 65,000 ETH may face forced liquidation

Longling Capital transferred 21,000 ETH to Binance, about 38.81 million US dollars

Mt. Gox transfers about 11,502 BTC to unknown wallet, possibly related to creditor repayment plan

The U.S. Senate updates the stablecoin bill GENIUS Act 2025: Expanding the reciprocity clause for overseas payment stablecoins

BTC falls below $77,000, down 3.80% on the day

Solana transaction fees fall to lowest level since September 2024, on-chain activity drops sharply

Black Monday in US stocks: Nasdaq plunges 4% and Tesla falls 15%

Coinbase will launch Cookie DAO (COOKIE)

Coinbase to launch 24/7 Bitcoin and Ethereum futures contracts in the U.S.

Movement public mainnet Beta is now live

DeFi TVL has completely given up the gains since Trump was elected as the US president, falling by more than $45 billion from its previous peak

UK Treasury: No plans to introduce US-style Bitcoin reserves

MyShell: Terminated cooperation with illegal market makers and introduced new partners, and plans to repurchase SHELL

Thai regulator adds stablecoins USDC, USDT to approved cryptocurrencies

Strategy files prospectus for offering up to $21 billion in preferred stock

Crypto executives suggest that Bitcoin can be exchanged for Trump's "gold card"

Singapore Exchange plans to launch Bitcoin perpetual futures contracts in the second half of 2025

Market News: Japan's cryptocurrency reform bill will be submitted to the Diet after cabinet approval

Standard Chartered Bank: The United States can build up Bitcoin reserves by selling gold and using treasury funds

Cayman Islands’ new cryptocurrency regulatory framework introduces new licensing requirements, effective April 1

CoinShares: Last week, digital asset investment products saw a net outflow of $876 million, marking the fourth consecutive week of outflows

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates