PennyMac Mortgage Investment Trust Prices Further Reopening of $75 Million of 8.500% Exchangeable Senior Notes Due 2029

WESTLAKE VILLAGE, Calif.–(BUSINESS WIRE)–PennyMac Mortgage Investment Trust (NYSE: PMT) (“PMT” or the “Company”) today announced that its indirect wholly-owned subsidiary, PennyMac Corp. (“PMC”), has priced an offering of $75 million aggregate principal amount of its 8.500% Exchangeable Senior Notes due 2029 (the “Notes”) to an investor in a direct placement registered under the Securities Act of 1933, as amended. The Notes will be issued as a further reopening of, and will be part of the same series as, the $291.5 million aggregate principal amount of 8.500% Exchangeable Senior Notes due 2029 that PMC previously issued in May 2024 and in a reopening earlier in December 2025, all of which are outstanding. The issuance and sale of the Notes are expected to close on December 22, 2025, subject to the satisfaction of certain closing conditions. Interest on the Notes is payable semiannually in arrears on June 1 and December 1 of each year. The Notes will be fully and unconditionally guaranteed by the Company.

Upon exchange, PMC will pay cash up to the aggregate principal amount of the Notes to be exchanged and pay or deliver, as the case may be, cash, PMT’s common shares of beneficial interest (“Common Shares”) or a combination thereof, at PMC’s election, in respect of the remainder, if any, of its exchange obligation in excess of the aggregate principal amount of the Notes being exchanged. The exchange rate will initially equal 63.3332 Common Shares per $1,000 principal amount of Notes, which is equivalent to an initial exchange price of approximately $15.79 per Common Share. The initial exchange price is approximately 20% above the $13.19 per share closing price of PMT’s Common Shares on the New York Stock Exchange on December 18, 2025, and is subject to adjustment in accordance with the terms of the Notes. The Notes will be PMC’s senior unsecured obligations and will rank equally with all of its present and future senior unsecured debt and senior to any future subordinated debt. The Notes will mature on June 1, 2029 unless repurchased or exchanged in accordance with their terms prior to such date.

Net proceeds from the offering are expected to be approximately $75.6 million, after deducting estimated offering expenses payable by PMC. The net proceeds are intended to be used for the repayment of a portion of the borrowings outstanding under the Company’s secured mortgage servicing rights and servicing advance facilities; the repurchase or repayment of a portion of PMC’s 5.500% Exchangeable Senior Notes due 2026; and for other general corporate purposes.

The offering is being made pursuant to an effective shelf registration statement and prospectus, including a supplement thereto, and a related prospectus supplement, a copy of which, when available, may be obtained free of charge on the SEC’s website at www.sec.gov or by contacting the Company, attention: Investor Relations, at 3043 Townsgate Road, Westlake Village, California 91361, telephone: 818.224.7028.

This press release is neither an offer to sell nor a solicitation of an offer to buy the Notes or any other securities and shall not constitute an offer to sell or a solicitation of an offer to buy, or a sale of, the Notes or any other securities in any jurisdiction in which such offer, solicitation or sale is unlawful.

About PennyMac Mortgage Investment Trust

PennyMac Mortgage Investment Trust is a mortgage real estate investment trust (REIT) that invests primarily in residential mortgage loans and mortgage-related assets. PMT is externally managed by PNMAC Capital Management, LLC, a wholly-owned subsidiary of PennyMac Financial Services, Inc. (NYSE: PFSI).

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things, the Company’s financial results, future operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” “continue,” “plan” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain financial and operating projections or state other forward-looking information. Examples of forward-looking statements include: (i) projections of the Company’s revenues, income, earnings per share, capital structure or other financial items; (ii) descriptions of the Company’s plans or objectives for future operations, products or services; (iii) forecasts of the Company’s future economic performance, interest rates, profit margins and the Company’s share of future markets; and (iv) descriptions of assumptions underlying or relating to any of the foregoing expectations regarding the timing of generating any revenues. The Company’s ability to predict results or the actual effect of future events, actions, plans or strategies is inherently uncertain. Although the Company believes that the expectations reflected in such forward-looking statements are based on reasonable assumptions, the Company’s actual results and performance could differ materially from those set forth in the forward-looking statements. There are a number of factors, many of which are beyond the Company’s control, that could cause actual results to differ significantly from its expectations. Some of these factors are discussed below. Factors that could cause actual results to differ materially from historical results or those anticipated include, but are not limited to: changes in interest rates; the Company’s ability to comply with various federal, state and local laws and regulations that govern the Company’s business; volatility in the Company’s industry, the debt or equity markets, the general economy or the real estate finance and real estate markets; events or circumstances which undermine confidence in the financial and housing markets or otherwise have a broad impact on financial and housing markets; changes in real estate values, housing prices and housing sales; changes in macroeconomic, consumer and real estate market conditions; a prolonged federal government shutdown could increase loan delinquencies, delay the processing of government loan applications and make it more difficult for customers in flood-prone areas to procure government-backed insurance; the degree and nature of the Company’s competition; the availability of, and level of competition for, attractive risk-adjusted investment opportunities in mortgage loans and mortgage-related assets that satisfy the Company’s investment objectives; the inherent difficulty in winning bids to acquire mortgage loans, and the Company’s success in doing so; the concentration of credit risks to which the Company is exposed; the Company’s dependence on PNMAC Capital Management, LLC (the “Manager”) and PennyMac Loan Services, LLC (“Servicer”), potential conflicts of interest with such entities and their affiliates, and the performance of such entities; changes in personnel and lack of availability of qualified personnel at the Manager, Servicer or their affiliates; the Company’s ability to mitigate cybersecurity risks, cybersecurity incidents and technology disruptions; the availability, terms and deployment of short-term and long-term capital; the adequacy of the Company’s cash reserves and working capital; the Company’s ability to maintain the desired relationship between its financing and the interest rates and maturities of its assets; the timing and amount of cash flows, if any, from the Company’s investments; the Company’s substantial amount of indebtedness; the performance, financial condition and liquidity of borrowers; the Company’s exposure to risks of loss and disruptions in operations resulting from severe weather events, man-made or other natural conditions, including climate change and pandemics; the ability of the Servicer to approve and monitor correspondent sellers and underwrite loans to investor standards; incomplete or inaccurate information or documentation provided by customers or counterparties, or adverse changes in the financial condition of the Company’s customers and counterparties; the Company’s indemnification and repurchase obligations in connection with mortgage loans it may purchase, sell or securitize; the quality and enforceability of the collateral documentation evidencing the Company’s ownership rights in its investments; increased rates of delinquency, defaults and forbearances and/or decreased recovery rates on the Company’s investments; the performance of mortgage loans underlying mortgage-backed securities (“MBS”) in which the Company retains credit risk; the Company’s ability to foreclose on its investments in a timely manner or at all; increased prepayments of the mortgages and other loans underlying the Company’s MBS or relating to the Company’s mortgage servicing rights and other investments; the degree to which the Company’s hedging strategies may or may not protect it from interest rate volatility; the effect of the accuracy of or changes in the estimates the Company makes about uncertainties, contingencies and asset and liability valuations; the Company’s ability to maintain appropriate internal control over financial reporting; the Company’s ability to detect misconduct and fraud; developments in the secondary markets for the Company’s mortgage loan products; legislative and regulatory changes that impact the mortgage loan industry or housing market; regulatory or other changes that impact government agencies or government-sponsored entities, or such changes that increase the cost of doing business with such agencies or entities; the Consumer Financial Protection Bureau and its issued and future rules and the enforcement thereof; changes in government support of home ownership and home affordability programs; changes in the Company’s investment objectives or investment or operational strategies, including any new lines of business or new products and services that may subject the Company to additional risks; limitations imposed on the Company’s business and its ability to satisfy complex rules for it to qualify as a REIT for U.S. federal income tax purposes and qualify for an exclusion from the Investment Company Act of 1940 and the ability of certain of the Company’s subsidiaries to qualify as REITs or as taxable REIT subsidiaries for U.S. federal income tax purposes; changes in governmental regulations, accounting treatment, tax rates and similar matters; the Company’s ability to make distributions to its shareholders in the future; the Company’s failure to deal appropriately with issues that may give rise to reputational risk; and the Company’s organizational structure and certain requirements in its charter documents. You should not place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, and the statements made in this press release are current as of the date of this release only.

Contacts

Media

Kristyn Clark

mediarelations@pennymac.com

805.225.8224

Investors

Kevin Chamberlain

Isaac Garden

investorrelations@pennymac.com

818.224.7028

You May Also Like

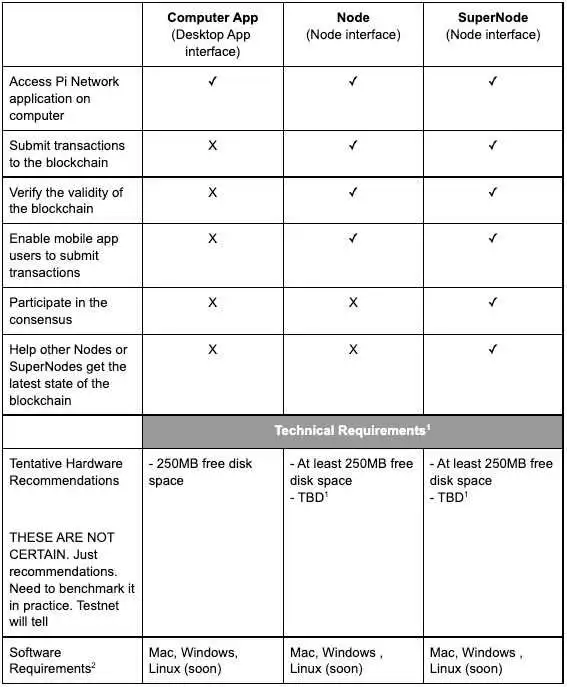

Pi Network Sets Feb 15 Deadline for Mainnet Node Upgrade

Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade