Behind the “underestimated” Solana DeFi: How to break the “ecological internal friction” between high-yield staking and lending protocols?

Author: Frank, PANews

Traditional financial giant Franklin Templeton recently released a survey report on Solana's DeFi ecosystem, pointing out that although Solana's DeFi business far exceeds Ethereum in terms of transaction volume growth and protocol revenue, the market value of its related tokens is seriously underestimated. Data shows that in 2024, the average growth rate of Solana's top DeFi projects will be as high as 2446% (Ethereum is only 150%), and the market value to revenue ratio is only 4.6 times (Ethereum is 18.1 times), which is a value trough in comparison.

However, when the market focuses on Solana DEX's brilliant record of accounting for 53% of the total network's trading volume, the "other side" of its ecology is surging. After the MEME craze subsided, the on-chain transaction volume plummeted by more than 90%; the 7%-8% staking yield of the validator node sucked away liquidity like a black hole, and the lending protocol struggled under the yield suppression. Behind this value revaluation game caused by the data paradox, Solana's DeFi ecology is standing at a critical crossroads - should it continue to play the role of "crypto Nasdaq" or risk transforming into an all-round financial protocol arena? The SIMD-0228 inflation reduction proposal to be voted on may determine the final direction of this ecological revolution.

Solana DEX transaction volume accounts for half of the entire network

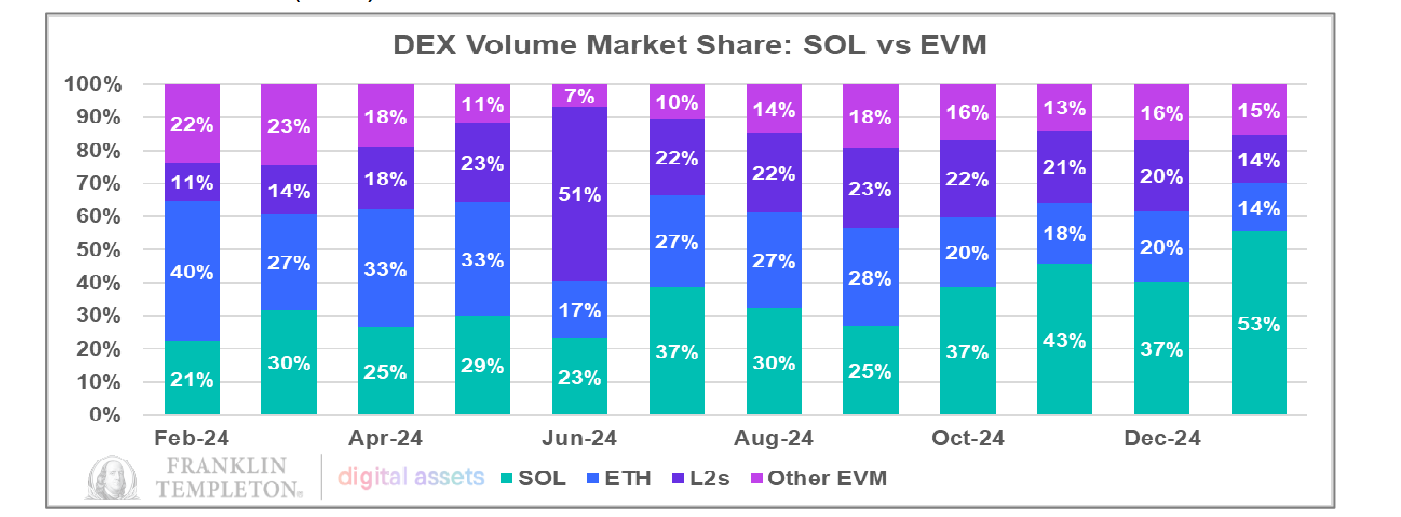

In Franklin Templeton's report, the main argument is based on Solana's DEX market share. In fact, Solana's DEX trading volume has indeed achieved remarkable results in the past year or so.

In January, Solana’s DEX trading volume exceeded Ethereum’s DEX trading volume and the total trading volume of all DEXs based on the Ethereum Virtual Machine (EVM), accounting for 53% of the entire network.

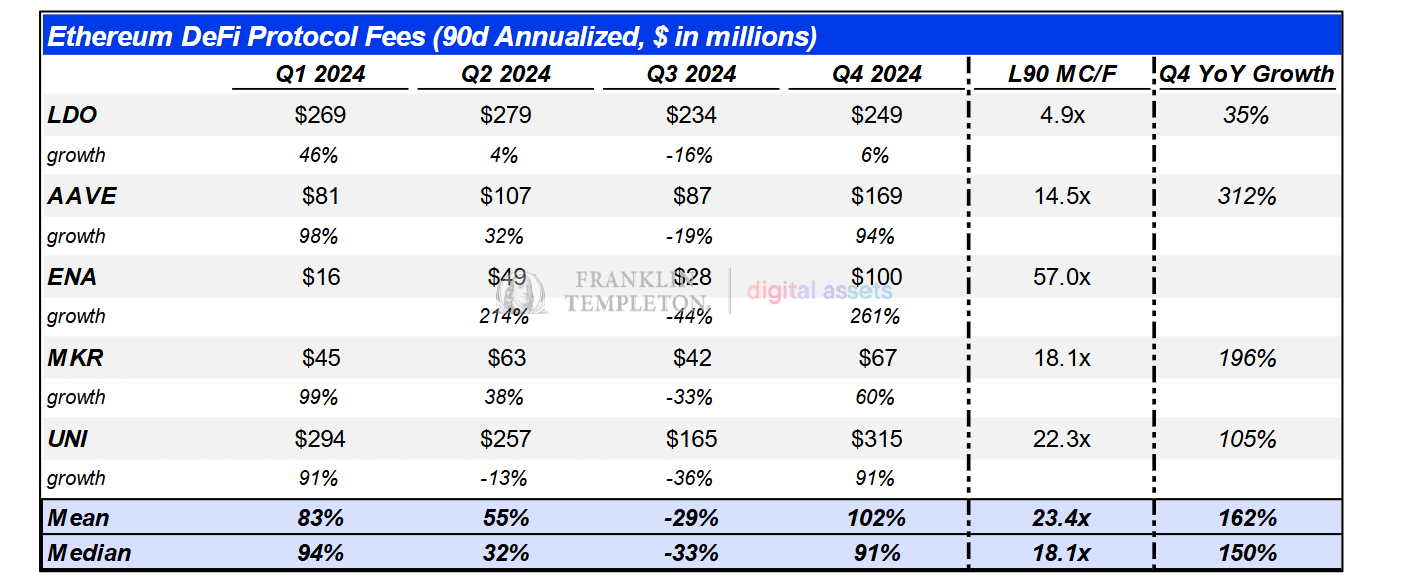

By comparing Solana and Ethereum's top DeFi projects, we can find that the average growth rate of Solana's top five DeFi projects in 2024 reached 2446%, while Ethereum's average growth was only 150%. In terms of market value to revenue ratio, Ethereum's average ratio reached 18.1 times, while Solana's ratio was 4.6 times. From this perspective, Solana's DeFi project does have better advantages in terms of revenue and transaction volume. However, whether this means that Solana's DeFi is undervalued, and whether the subsequent DeFi development can become the main theme, still needs to further understand the ecological characteristics of the two.

The choice of ecological positioning: trading center or universal bank?

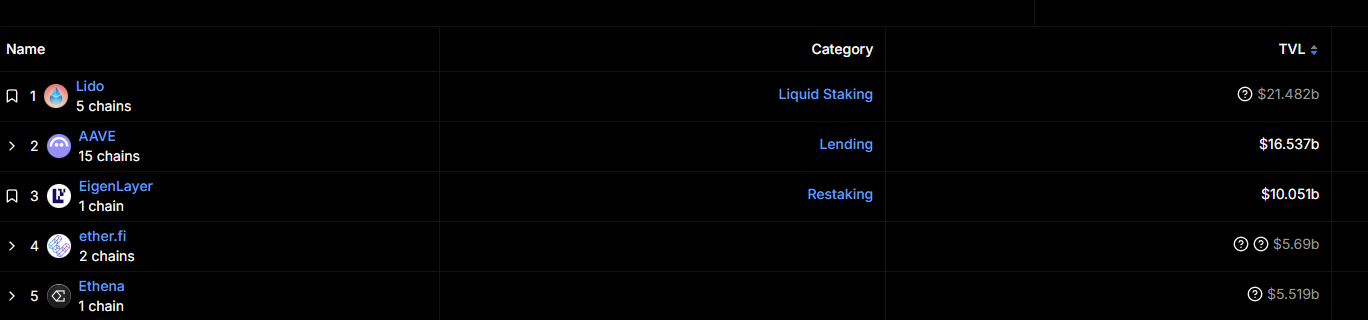

By comparing the DeFi protocols of Ethereum and Solana, we can see that the top five DeFi projects on Ethereum are almost all projects that focus on staking and lending.

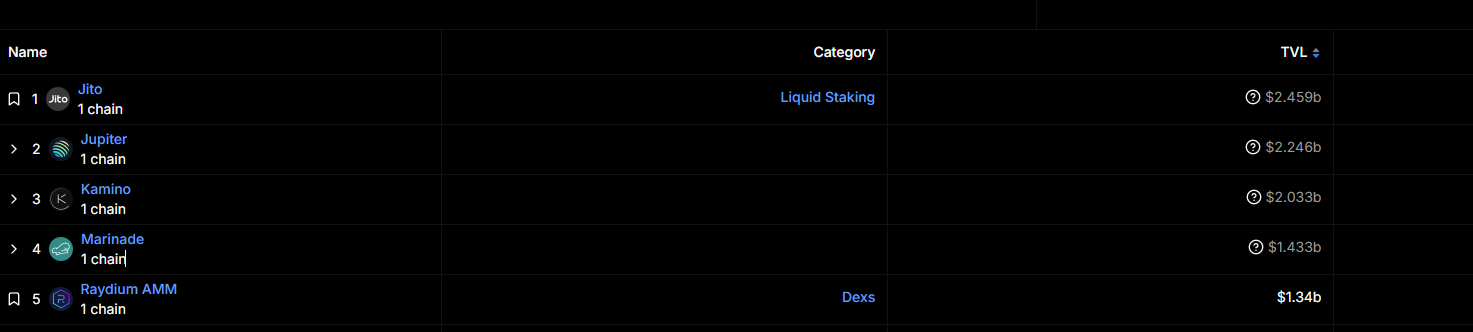

On the Solana chain, the top five TVL projects are mostly aggregators or DEXs. Obviously, trading is the main theme on Solana.

From this perspective, if we compare both to financial institutions, Ethereum is more like a bank, while Solana is more like a securities trading center. One is mainly engaged in credit business, and the other is mainly engaged in trading business, so their positioning is very different.

But at present, both seem to have encountered considerable problems. Ethereum, which focuses on credit, has problems maintaining the most critical value. Solana, which focuses on trading business, is clearly facing a trend of shrinking market liquidity.

Faced with the imbalance of ecological positioning, it may be a good choice for Solana to enhance credit-related businesses. However, this transformation is a long and arduous journey. The TVL on the Solana chain has fallen by 40% since January, but this decline is mainly due to the decline in the price of SOL. Judging from the number of SOLs, the TVL on the chain has not changed much.

Since Trump issued his personal token, the DEX transaction volume on the Solana chain has been declining. On January 18, the DEX transaction volume hit an all-time high of $35 billion, but as of March 7, it had fallen to $2 billion.

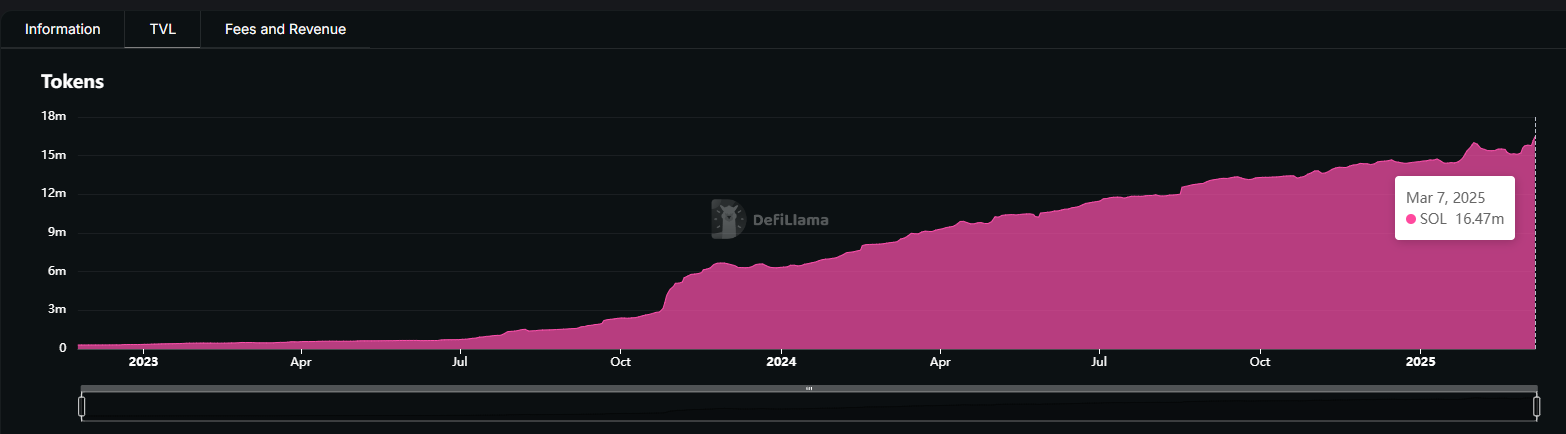

After the MEME carnival subsided, capital competed for staking income

On the contrary, with the price of SOL falling and the cooling of MEME coins, the number of tokens staked on the chain has actually been rising recently. Taking Jito, which ranks first in TVL, as an example, the number of SOLs participating in the stake has been climbing. The total staked amount has reached 16.47 million. Judging from the inflow situation, it has been in a state of token inflow recently. Since January 1, 2025, the net inflow of SOL stake has increased by 12% year-on-year. Obviously, this TVL growth mainly comes from token staking rather than active trading.

However, this asset growth does not seem to flow to the lending protocol, but still turns to the staking income of the validator. Even though the staking income of the validator is in a declining state, it still attracts most of the SOL token TVL.

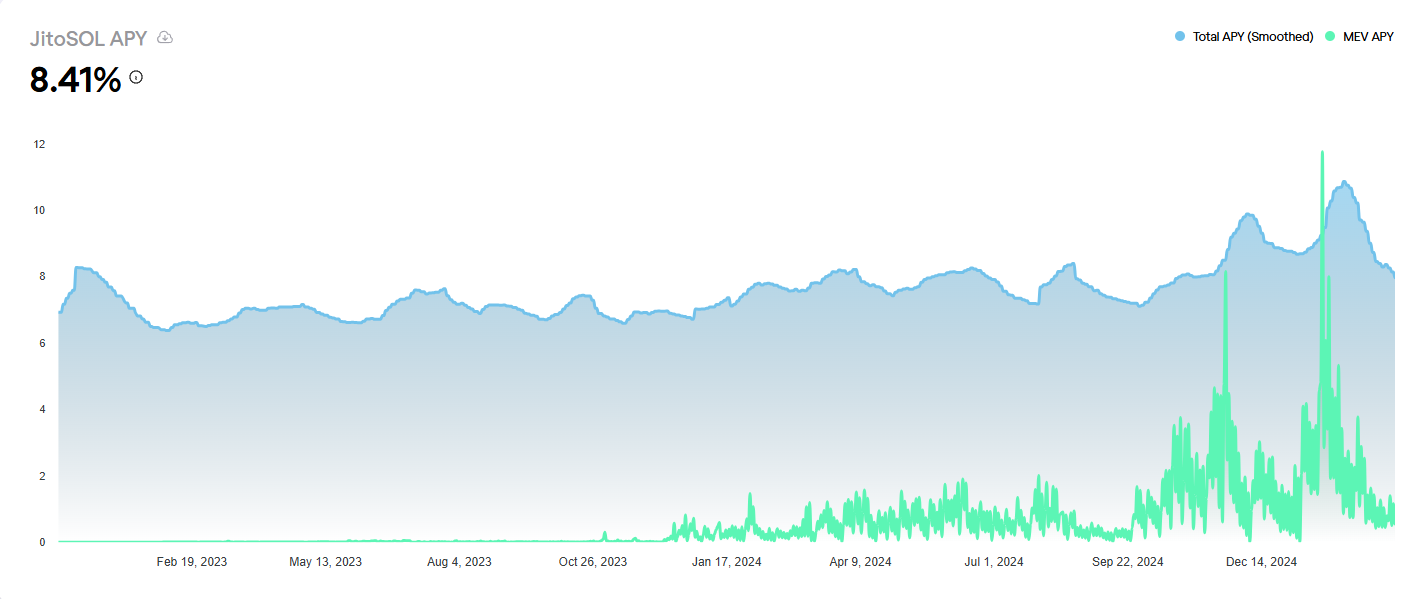

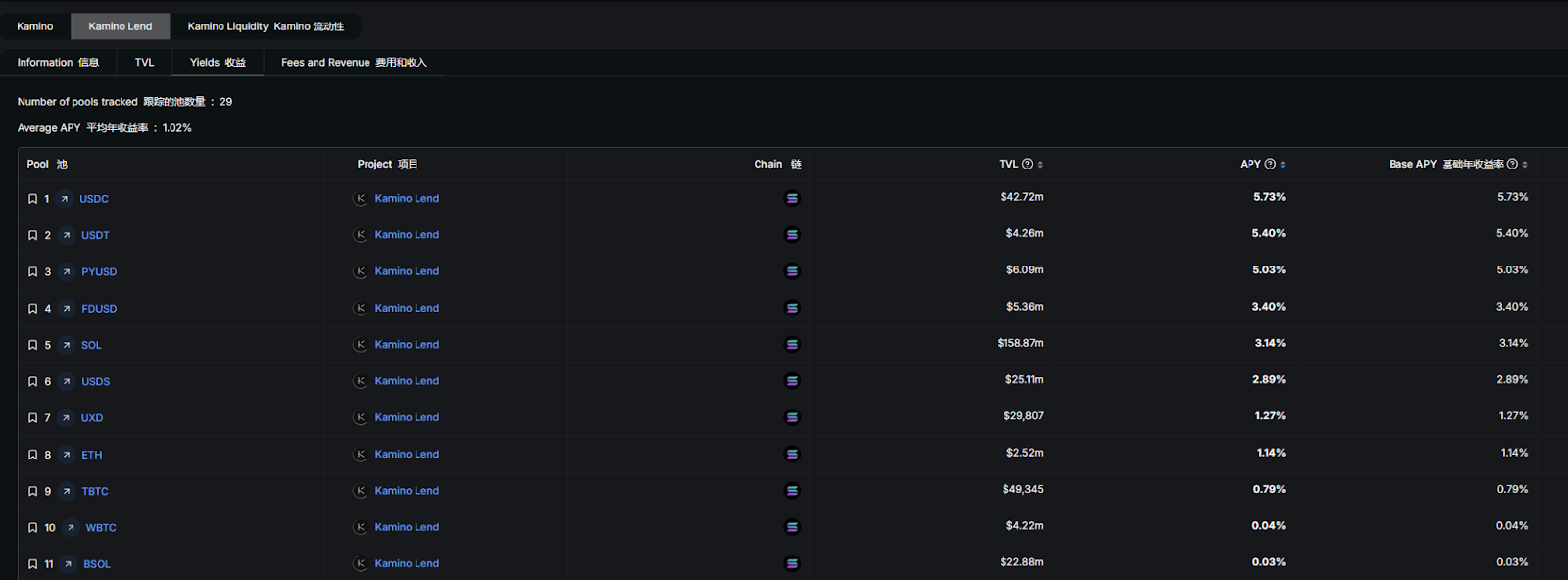

According to Jito data, JitoSOL's APY has been falling since February, along with the number of bundled transactions and priority fee income across the network. As of March 7, JitoSOL's APY fell to 8.41%. However, compared with other categories of staking income on Kamino, it is still at least 3 percentage points higher.

8% validator income suppresses DeFi liquidity, SIMD-0228 proposal aims to solve the problem

In fact, the yield of node staking on the Solana chain is basically maintained at around 7%~8%. It is generally higher than the returns of participating in other types of DeFi protocols. This is why a large amount of funds on the Solana chain choose to pledge funds to various validator nodes instead of investing in lending protocols such as Kamino.

Recently, Solana launched the SIMD-0228 proposal, attempting to reduce the annual issuance of SOL by 80% by dynamically adjusting the inflation rate. At the same time, the adjustment was also made by reducing the staking yield to encourage funds to flow to other DeFi. (Related reading: Solana Inflation Revolution: SIMD-0228 Proposal Triggers Community Controversy, and the 80% Reduction in Inflation Hides the Risk of a "Death Spiral" )

According to the simulation results of the new proposal, if the same amount of staking is maintained, the yield of on-chain staking will drop to 1.41%, a drop of 80%. Therefore, most of the funds may be withdrawn from validator staking and choose other DeFi income products.

But there is actually a logical problem here, that is, the best way to promote the flow of funds to DeFi should be to increase the returns of other DeFi products, rather than reducing the original staking income products. It should be noted that after the funds are withdrawn from the validator node, they do not have to stay in the Solana ecosystem. In line with the profit-seeking nature of capital, it is more likely to look for products with higher returns.

By comparing several products with the largest TVL on the ETH chain, such as AAVE and Lido, we can see that the annualized rate of return of general mainstream assets is between 1.5% and 3.7%. In comparison, Kamino on the Solana chain still has certain profit advantages.

However, for large amounts of funds, another important consideration is the depth of fund liquidity. Currently, Ethereum is still the largest fund reservoir among all public chains. As of March 7, Ethereum's TVL still accounted for 52%, accounting for half of the market. Solana's TVL accounted for about 7.53%. The project with the highest TVL on the Solana chain is Jito, with a TVL of approximately US$2.32 billion, which ranks only 13th in the Ethereum ecosystem.

At present, Solana's DeFi still needs to rely on high returns. SVM and re-staking platform Solayer recently announced the launch of native SOL staking, with a direct yield of about 12%. However, according to PANews' observation, this high return is still obtained through the combination of validator staking.

If the SIMD-0228 proposal is implemented, DeFi protocols that rely on validator staking income may face the "stampede risk" of capital withdrawal. After all, these major high-yield products are mainly achieved through validator staking.

In the evolution of Solana's DeFi ecosystem, although the glory of DEX trading volume briefly reaching the top has confirmed the explosive power of its technical architecture, the negative coupling relationship between staking income and DeFi development is like a sword of Damocles hanging over the ecosystem. The SIMD-0228 proposal attempts to cut this knot, but the mandatory reset of income may trigger a more complex on-chain butterfly effect than expected. Lily Liu, chairman of the Solana Foundation, also expressed concerns about this proposal in an article on the X platform. She believes that "the 0228 proposal is too half-finished" and may cause more uncertainty.

From the perspective of ecological strategy, what Solana needs to build is not only the re-anchoring of the yield curve, but also a revolution in the underlying value capture mechanism. When the validator pledge is transformed from a revenue fortress to a liquidity hub, or the lending protocol can create a compound income model beyond simple pledge, Solana may be able to truly open the value closed loop of DeFi. After all, the real ecological prosperity does not lie in the digital stacking of funds in the pledge pool, but in the formation of a perpetual cycle of capital between lending, derivatives, and combination strategies - this may be the "Goldbach Conjecture" that the "Ethereum Killers" need to jointly crack.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates