Best Cryptocurrencies to Invest in Today, December 22 – HYPE, LINK, ETH

Highlights:

- Hyperliquid has rebounded from key support as short-term recovery momentum takes shape.

- Chainlink is stabilizing near support as selling pressure fades and the chart hints at a possible breakout.

- Ethereum is showing steady strength as long-term support holds and momentum builds toward a larger recovery move.

The crypto market is modestly trading in the green zone on the daily chart. Institutional investors are stacking up BTC ahead of the upcoming Fed rate cut. In addition, the market has cleared most of the short liquidations, adding to the bullish momentum. At press time, the total market cap is up 0.94% to $3.01 trillion. In addition, the trading volume is up 41.38% to $78.66 billion in the past day.

The crypto market has experienced a total of $196.18 million in liquidations in the last 24 hours, with $110.63 million in short positions liquidated. Meanwhile, the fear and greed index is improving but still stuck in the fear zone at an index of 29. With the market crypto sentiment turning bullish, here are the best cryptocurrencies to invest in today.

Best Cryptocurrencies to Invest in Today

1. Hyperliquid (HYPE)

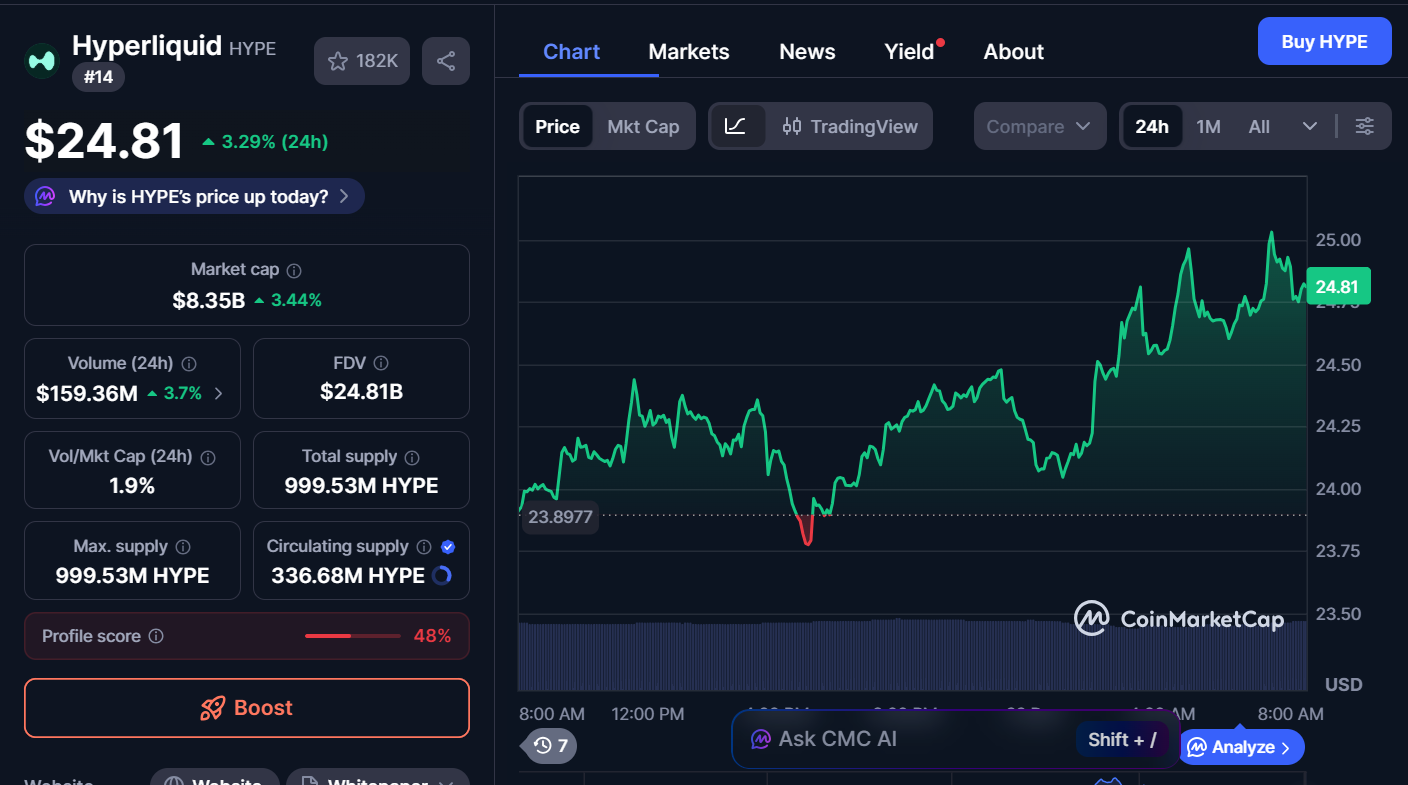

HYPE is currently trading at around $24.81, with a 3.29% increase in the past day. Its trading volume has increased by 3.7% to $159.36 million, while the market cap stands at $8.35 billion.

Source: CoinMarketCap

Source: CoinMarketCap

Hyperliquid is turning upward after defending key support near the lower channel boundary. The price is showing an improving structure following a sharp selloff and steady base formation. Moreover, recent candles reflect stronger demand near current levels. As a result, short-term direction is favoring a recovery phase.

Source: CoinMarketCap

Source: CoinMarketCap

The current support is holding between $24.5 and $25 after several successful defenses. Below that area, deeper support sits near $22 from the prior liquidity sweep. Meanwhile, resistance appears near $30 and later near $36 from previous breakdown zones. Therefore, a sustained move above $28 could drive a meaningful short-term advance for the cryptocurrency.

2. Chainlink (LINK)

LINK is currently trading at $12.57, with a 0.37% increase in the last 24 hours. The trading volume of the coin has increased by 42.5% to $382.8 million, while the market cap stands at $8.9 billion. Despite the increase today, the cryptocurrency is down 25.51% on the monthly chart.

Source: CoinMarketCap

Source: CoinMarketCap

Chainlink is pressing into a key resistance zone after weeks of controlled downside movement. The price is trading just below the $14 area, which has repeatedly capped recovery attempts. However, recent pullbacks show less intensity, which suggests fading sell pressure. At the same time, higher lows continue to form, reflecting improving structure.

The support remains firm between $12.2 and $12.6, where demand consistently steps in. This zone now defines the downside boundary. Meanwhile, consolidation has tightened and is signaling a growing balance in the market. If Chainlink clears resistance near $14 with conviction, the price could extend toward the $15.5 region in the short term.

3. Ethereum (ETH)

The second-largest cryptocurrency is trading at $3,028, representing a 1.86% increase on the daily chart. The market cap stands at $365.49 billion, and the trading volume has increased by 94.59% to $14.59 billion. ETH has gained 10.69% on the monthly chart.

Source: CoinMarketCap

Source: CoinMarketCap

According to a recent analysis by Bitcoinsensus, Ethereum continues to trend higher inside a long-term ascending channel. The price is holding firm above the rising support near $3,200, which has repeatedly absorbed pullbacks. Moreover, buyers defended this zone during recent dips, which confirms strong demand.

However, resistance remains clear near $4,000, where the price faced multiple rejections before each pullback. The upper channel resistance aligns near $7,000, which marks the major upside barrier. If support near $3,200 holds, Ethereum could gradually push toward $4,000 first and later extend toward the $7,000 resistance zone.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Intel’s stock surges as Nvidia invests $5 billion in the chipmaker

JPMorgan's Jamie Dimon doesn’t see more Fed rate cuts unless inflation drops