Grayscale Says Tokenized Assets Could Grow 1,000x by 2030, Driving Activity on ETH, BNB, SOL, AVAX and LINK

- Grayscale said this growth in the tokenization industry will drive higher on-chain activity across major smart-contract platforms such as Ethereum, Solana, BNB Chain, and Avalanche.

- It noted that middleware providers like Chainlink will play a crucial role in offering data delivery, compliance, interoperability, and privacy for institutional tokenization.

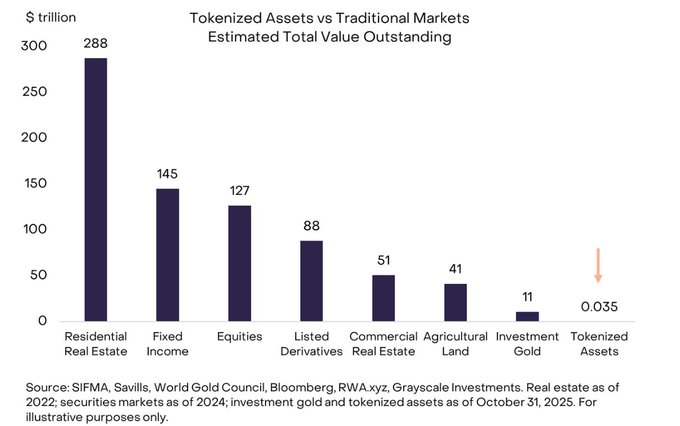

Even as the broader crypto market has remained volatile throughout 2025, one theme that’s capturing everyone’s attention is the tokenization of real-world assets (RWA). Earlier this month, digital asset manager Grayscale shared that this industry could see 1000x growth by 2030. It cited an industry-wide shift taking place and how traditional financial firms are moving towards tokenized assets amid major benefits.

Grayscale Bets on Tokenization Among Top 10 Investing Themes

In its latest report, dubbed the 2026 Digital Asset Outlook, crypto asset manager Grayscale said tokenized assets currently account for only around 0.01% of global equity and bond markets. However, the asset manager believes that this could expand by as much as 1,000 times by 2030 with improvements in regulatory clarity and blockchain infrastructure.

The asset manager said that this growth will lead to a major increase in on-chain activity across blockchain networks. It includes some of the top blockchains like Ethereum, Solana, BNB Chain, and Avalanche. Furthermore, the asset manager also highlighted the importance of middleware providers.

It noted that oracle services provider Chainlink will play a key role by allowing secure data flows and connectivity needed to support large-scale tokenization of traditional financial assets. As per the latest report from Blockworks Research, Chainlink will be a major player of institutional tokenization. The network will support critical functions across data delivery, compliance, interoperability, and privacy.

Source: Grayscale on X

Source: Grayscale on X

Grayscale also added that core blockchain infrastructure and smart contract platforms, including Ethereum, Solana, Avalanche, and BNB Chain, are well-positioned to benefit as tokenization adoption expands.

Rising Adoption By Top Blockchain Platforms

Some of the top blockchain platforms, as well as traditional market players, are shifting towards tokenized assets, while seeing their greater market benefits. Last week, Russia’s largest banking institution, Sberbank, stated that it has started testing different decentralized finance (DeFi) products amid the rising crypto demand from clients. As reported by CNF, the banking institution has chosen the Ethereum blockchain network, to offer tokenized assets to clients.

At the same time, Pakistan has signed a memorandum of understanding (MoU) with crypto exchange Binance in order to explore the tokenization of the $2 billion worth of government bonds and reserves. As per the non-binding agreement, Binance will advise the government on different blockchain-based ways to approve the digital versions of treasury bills and sovereign bonds.

SBI Ripple Asia also announced a partnership with decentralized finance startup Doppler Finance to develop new blockchain-based financial offerings built on the XRP Ledger. Under the collaboration, the two firms plan to introduce XRP-focused products alongside initiatives centered on real-world asset (RWA) tokenization, aiming to expand institutional and enterprise use cases on the XRPL.

]]>You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

TrendX Taps Trusta AI to Develop Safer and Smarter Web3 Network