Bitcoin Whales Go Quiet On Binance As Inflows Collapse: Supply Shock Setup?

Bitcoin whale deposits to Binance fell sharply in December, a shift CryptoQuant framed as a constructive near-term signal because it implies less immediate sell-side supply moving onto the market’s biggest exchange venue.

Bitcoin Selling Pressure Is Fading For Now

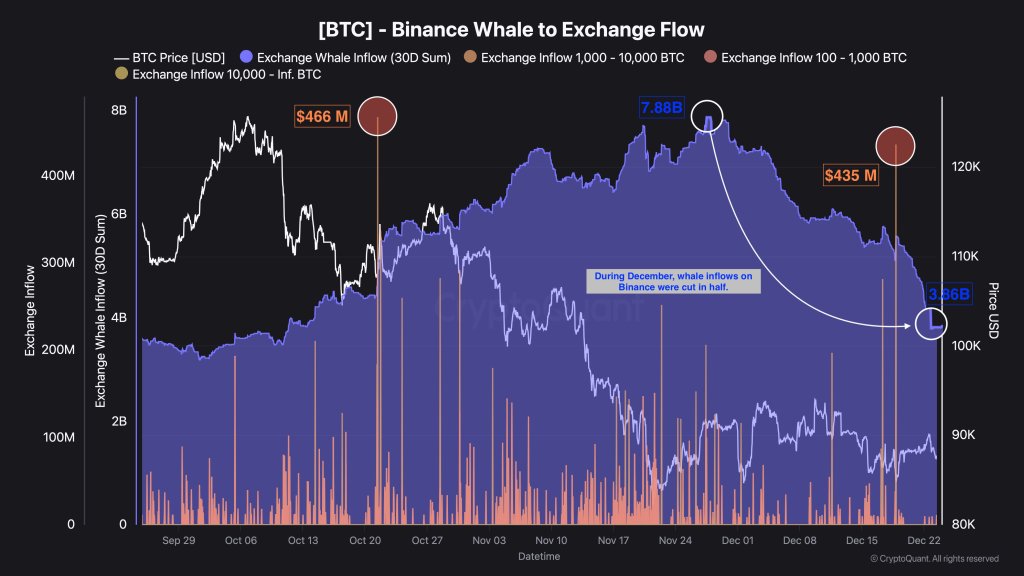

CryptoQuant analyst Darkfost wrote on Dec. 24 that “the latest data shows a clear decline in Bitcoin inflows to Binance coming from whales over the month of December.” He said monthly whale inflows dropped from roughly $7.88 billion to $3.86 billion, “effectively being halved within just a few weeks,” calling it “a significant slowdown in BTC deposits to Binance by the largest holders.”

The bullish read is mostly mechanical. Exchange inflows are not the same thing as selling, but they are a prerequisite for selling at scale, and Binance remains the dominant exchange in exchange-related flows in CryptoQuant’s framing.

Darkfost put it plainly: “In the current environment, the observed trend remains constructive. Binance continues to capture the largest share of exchange-related flows. When inflows from influential participants such as whales decline on this platform, it generally suggests a reduction in their selling pressure.”

He also cautioned that a downtrend in aggregate deposits does not eliminate the risk of sudden, market-moving transfers. “That said, this broader trend does not rule out the occurrence of occasional significant movements,” Darkfost wrote. “Some inflows can still impact the market, even if they remain relatively isolated.”

As an example, he pointed to a recent $466 million spike across the 100 BTC to 10,000 BTC cohorts, alongside more than $435 million in inflows coming specifically from the 1,000 to 10,000 BTC range.

Related Reading: The Macro Conditions For Bitcoin In 2026: Analyst Breaks Them Down

Those bursts matter because they can reintroduce volatility even if the baseline is calmer. “These sudden movements are a reminder that whales retain the ability to influence volatility at any time, even within a broader slowdown,” Darkfost said, adding that when large holders “move thousands of BTC in single transactions,” they can trigger sharp moves “whether through sudden volatility spikes or deeper corrections, depending on the volumes deposited and potentially sold.”

BTC Whale Capitulation On Pause

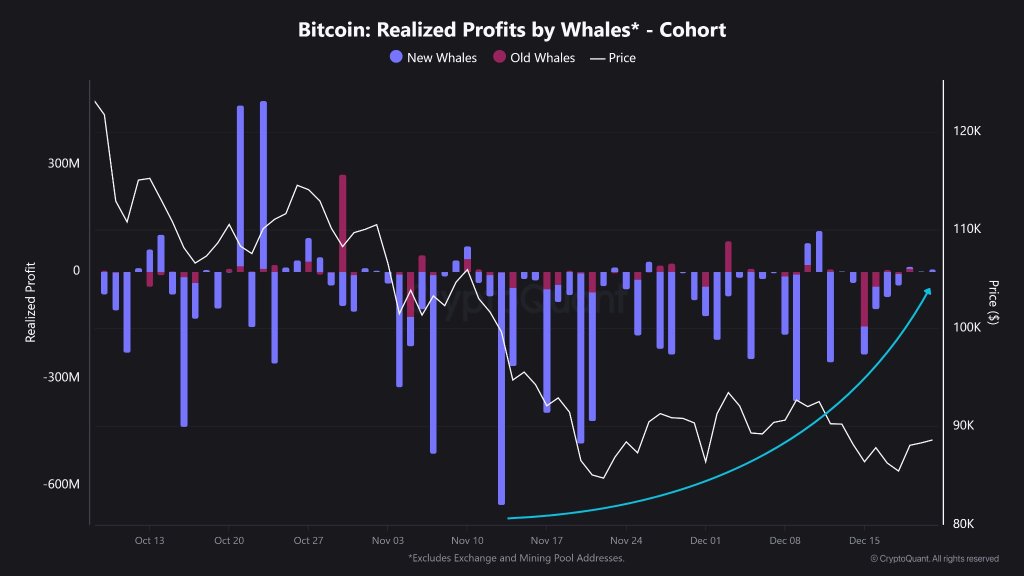

A separate CryptoQuant update on Dec. 23 echoed the idea that the most acute stress may have eased. “Whale Capitulation on Pause,” the firm wrote, saying realized losses from “new whales” “significantly impacted the price drop from $124K to $84K.” Since the recent low, CryptoQuant said, those realized losses “have declined and are now flat.”

Put together, the message is that one key source of near-term supply pressure,large deposits onto Binance,has cooled, while the realized-loss impulse tied to “new whales” is no longer intensifying. The caveat is the same one Darkfost emphasized: the market can look quiet in aggregate and still get rattled by a handful of large deposits if whales decide to move size again.

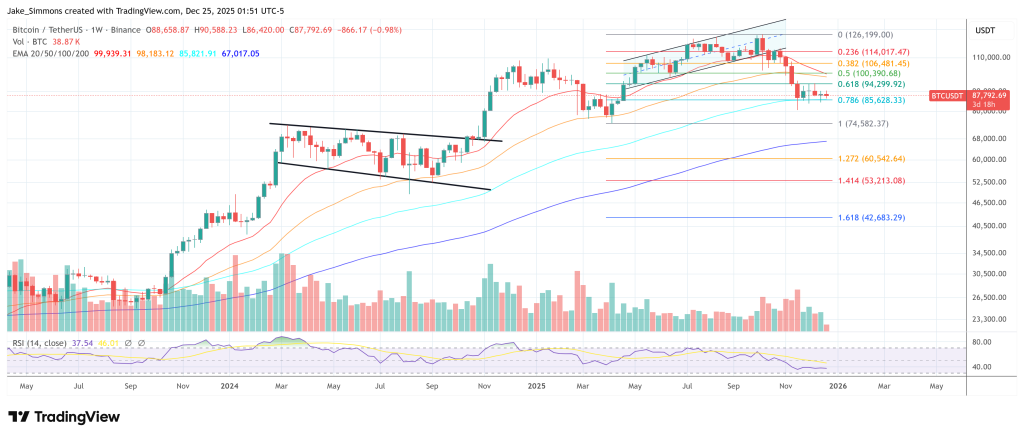

At press time, BTC traded at $87,792.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!