Finally Revealed? Why Banks Have Been Unable to Hold XRP, and Why It Is About to Change: Pundit

- Banks avoided holding XRP due to Basel III rules, which classify it as a high-risk crypto and impose a punitive 1,250% capital requirement.

- The barrier was regulatory, not technological or demand-related, forcing institutions to avoid or keep XRP exposure off-balance sheet.

- A potential reclassification could change everything, allowing banks to hold, custody, and use XRP directly.

Crypto pundit Stern Drew has outlined why banks have historically avoided holding XRP on their balance sheets, despite its relevance to cross-border payments. According to Drew, the issue has not been demand or technology, but regulatory capital treatment under Basel III.

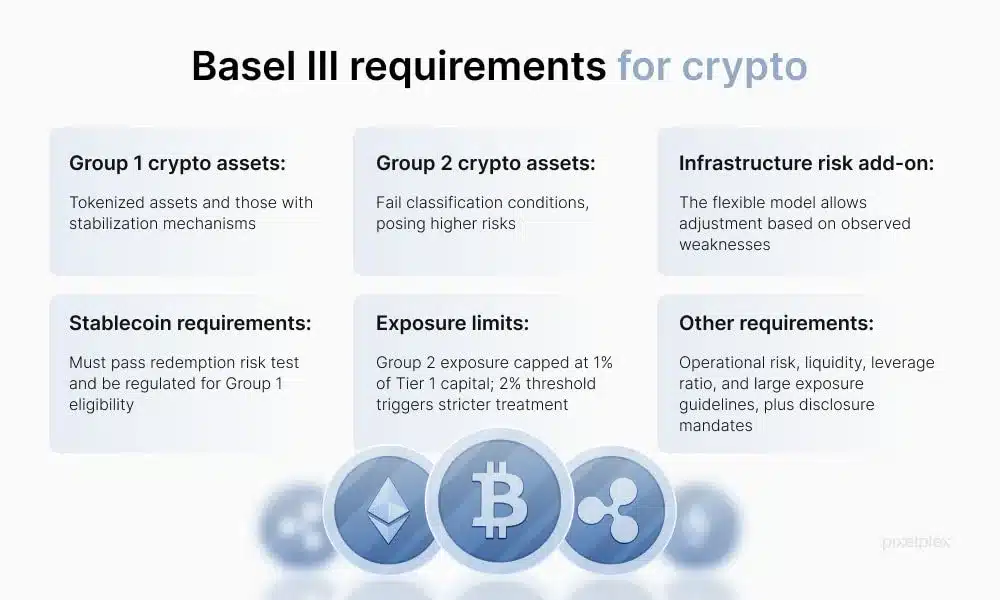

Under current Basel III rules, XRP is categorized as a Type 2 crypto exposure, which carries a punitive 1,250% risk weight. In practical terms, this makes holding XRP capital-inefficient for regulated banks.

“For every $1 of XRP exposure, a bank must effectively reserve $12.50 in capital,” Drew explained. This requirement, he argued, makes direct XRP holdings irrational for banks, regardless of the token’s utility or market demand.

Capital Inefficiency Drove Institutional Hesitation

The high risk weighting has forced banks to avoid holding XRP outright, instead relying on off-balance-sheet structures or avoiding exposure altogether. Stern Drew emphasized that this regulatory burden, rather than skepticism about XRP itself, explains years of limited institutional participation.

Under such constraints, even banks interested in XRP-powered settlement solutions faced steep capital penalties, discouraging adoption at the balance-sheet level.

A Potential Regulatory Inflection Point Emerges

According to Drew, the situation may be nearing a turning point. As legal and regulatory clarity around XRP improves, he believes the asset has a credible pathway toward reclassification into a lower-risk category, such as Type 2B or another qualifying exposure under Basel standards.

Such a shift would materially reduce, or potentially eliminate, the current 1,250% risk weight. “If that happens, the math changes overnight,” Drew stated.

Also Read: Will XRP Be a Better Buy Than BTC in 2026? Fool Analyst Gives Insight

What Reclassification Could Unlock for XRP

A lower risk classification would have immediate implications for institutional use. Drew outlined several potential outcomes:

- XRP would become balance-sheet holdable for banks

- Institutions could custody, deploy, and settle using XRP without punitive capital requirements

- Liquidity provisioning could shift from indirect or off-balance-sheet usage to direct institutional ownership

This transition, he argued, would mark a structural change in how banks interact with digital assets.

Source: Stern Drew/X

Why This Is Not About Price Speculation

Stern Drew stressed that the discussion is not centered on short-term price movements. Instead, it focuses on Basel capital mechanics, the regulatory framework that determines whether large-scale institutional capital can flow into an asset.

“These are the same mechanics that decide whether trillions move or stay sidelined,” he noted, underscoring the systemic importance of regulatory classification.

Markets May Be Underestimating the Setup

According to Drew, markets tend to front-run regulatory changes rather than narratives. He suggested that investors may be overlooking the significance of a potential reclassification and its impact on institutional demand. “When capital rules flip, demand doesn’t trickle in; it switches on,” he said.

In Drew’s view, XRP is on a clear path toward becoming a Tier-1 digital asset for global institutions. If regulatory treatment evolves as expected, banks could move from cautious experimentation to full-scale adoption.

For now, the market continues to watch developments around regulatory clarity and capital rules. If those conditions align, the long-standing barriers that made XRP “unholdable” for banks could soon be removed, reshaping institutional demand across the digital asset landscape.

Also Read: Shiba Inu Burn Spike Wipes Out 46M SHIB as Price Tests Key Level

The post Finally Revealed? Why Banks Have Been Unable to Hold XRP, and Why It Is About to Change: Pundit appeared first on 36Crypto.

You May Also Like

From random auctions to forward contracts, how does ETHGas transform block space into a priced resource?

Headwind Helps Best Wallet Token