Uniswap Burns 100M UNI Following Governance Approval

Highlights:

- Uniswap Labs has permanently eliminated 100 million UNI tokens from its total supply.

- The DeFi platform hinted at future burns, using subsequent fees collected by Uniswap.

- The burn proposal gained approval with over 90% vote from UNI token holders.

Decentralised cryptocurrency exchange protocol Uniswap has completed a major burn just a few days after its long-anticipated burn proposal was approved with strong community support. The protocol permanently removed 100 million UNI tokens, valued at over $550 million, from its token supply.

EmberCN reported that the burn occurred around 4:30 a.m. UTC on December 28, adding that future Uniswap fees will fund more token burns after deducting costs for Optimism and Ethereum networks. With this move, Uniswap has completed one of the biggest token burns ever seen in decentralized finance (DeFi).

Uniswap Labs confirmed the token burn in an X post, stating that UNIfication has officially been executed on-chain. The DeFi platform also noted that Uniswap Labs’ interface fees have been set to zero. Additionally, fees are now active for v2 and selected v3 pools on mainnet.

The DEX platform added:

Community members have reacted to the massive token burn, describing it as a step in the right direction that could boost the Uniswap ecosystem valuation. A verified X user praised the Uniswap team for its transparency throughout the process. The user stated: “This kind of on-chain governance follow-through is exactly what people want to see from major protocols at this stage.”

UNIfication Passes with Over 90% Community Approval

The burn followed a community vote in favour of the long-awaited protocol fee switch, known as UNIfication. The proposal passed with 99.9% approval, highlighting massive support from UNI holders. Notably, community members spent over 125 million UNI tokens voting in favour of UNIfication, as against 742 tokens against it.

Prominent figures in the crypto industry also supported the proposal, including Jesse Waldren, founder and managing partner at the crypto investment firm Variant, Kain Warwick, founder of Infinex and Synthetix, and Ian Lapham, a former Uniswap Labs engineer.

Developers Set to Benefit from 20 Million UNI Tokens Allocation

Uniswap Foundation clarified that the burn proposal will not halt the company’s support for developers. The DeFi platform emphasized that it will continue its grant programs, as helping builders remains one of its top priorities. To support this plan, the foundation plans to set up a Growth Budget. The budget will distribute 20 million UNI tokens to support development and expansion across the Uniswap ecosystem.

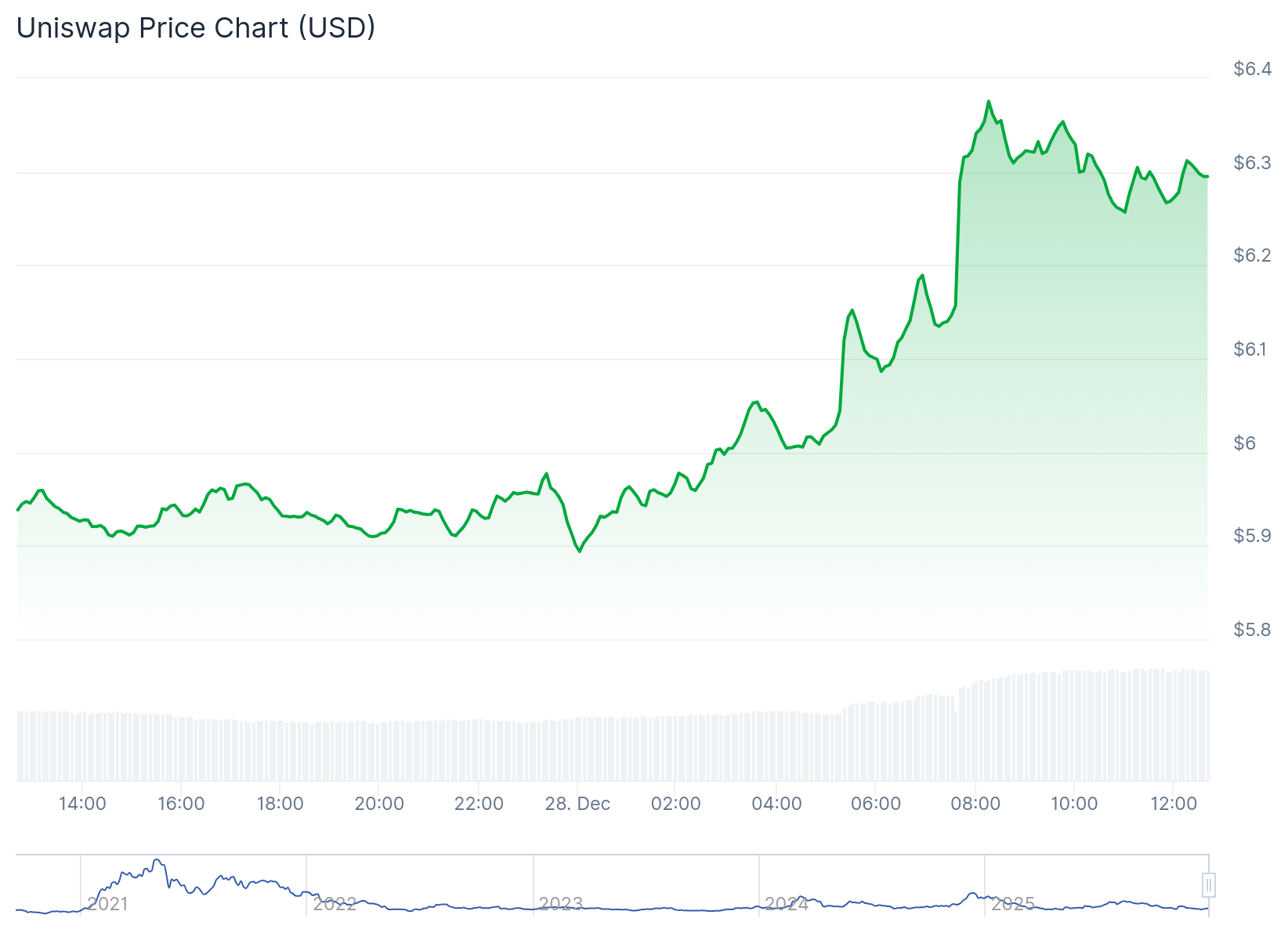

UNI Price Spikes as Uniswap Burns 100M Tokens

At the time of writing, UNI is changing hands at $6.29, following a 6.2% upswing in the past 24 hours. Despite burning 100 million tokens, CoinGecko data shows UNI has a circulating supply of 729.9 million tokens with a market cap of $4.6 billion and a 24-hour trading volume of $398.88 million. It currently ranks as the 34th most valuable cryptocurrency on CoinGecko.

UNI’s supply inflation and volatility remain high at 21.63% and 5.96%, respectively. Sentiment is bearish with the “Fear & Greed Index” at “Extreme Fear.” The token is down 53% year-to-date and trading below its 200-day Simple Moving Average (SMA) with only 14 profitable days in the past 30 days.

Source: CoinGecko

Source: CoinGecko

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Solana Co-Founder Predicts Stablecoin Supply Could Top $1T by 2026

Tokenization and AI: The emergence of orbital cloud infrastructure | Opinion