After the Bybit hack, how can DeFi effectively cope with market turmoil?

Original article: Omer Goldberg , Founder of Chaos Labs

Compiled by: Yuliya, PANews

After Bybit suffered a $1.4 billion hack, the cryptocurrency market faced a serious impact. How DeFi (decentralized finance) platforms responded to this largest hack in history, as well as potential contagion risks and USDe price fluctuations, has become the focus of attention in the crypto field. This article will explore the impact of this attack on Aave, Ethena, and USDe, analyze how the DeFi system responded to this incident, and explore whether Proof of Reserves can prevent liquidations of more than $20 million.

After the attack, the Chaos Labs team, together with bgdlabs, AaveChan and LlamaRisk, formed an emergency response team to assess the risks and systemic risks that Aave may face.

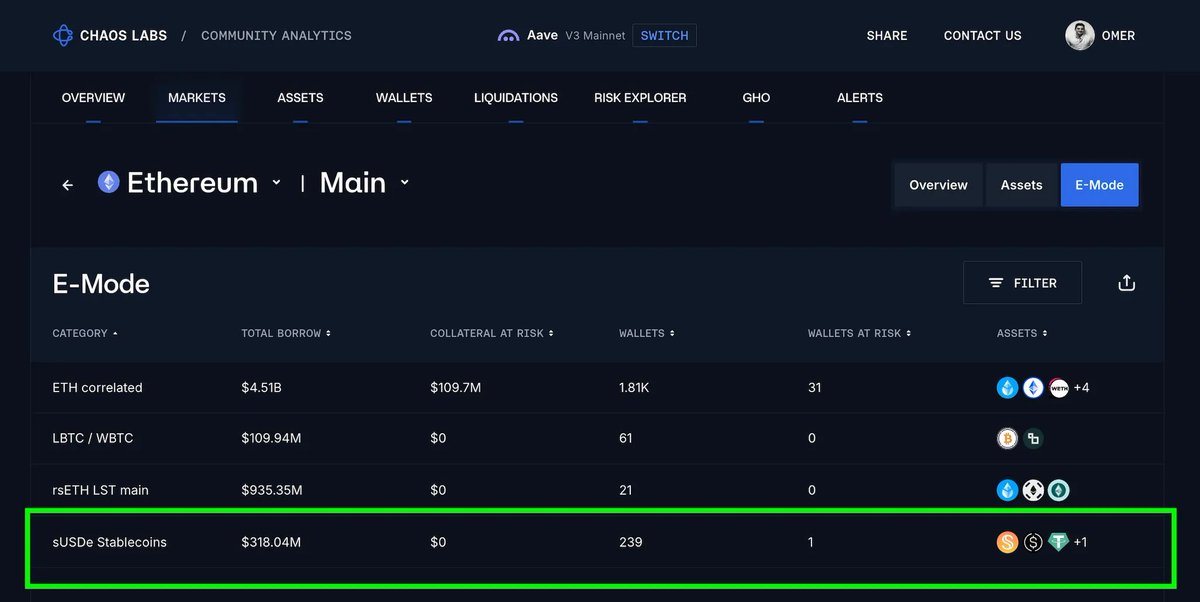

The emergency response team focused on several core issues: Bybit’s solvency status, whether there is a possibility of a larger attack, and the impact any bankruptcy or write-down might have on Aave given its exposure to sUSDe.

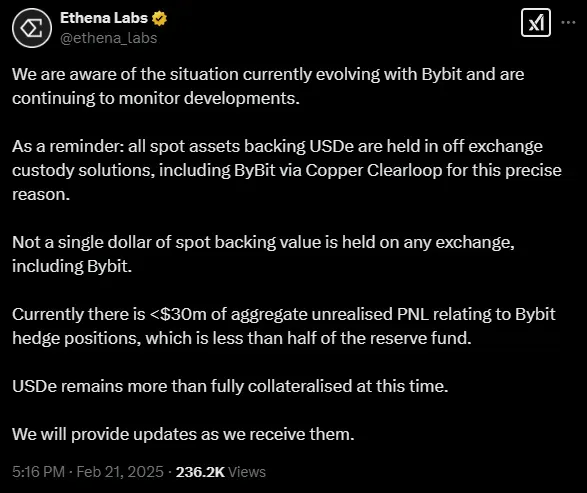

Ethena Labs confirmed that its funds are held in custody through Copper.co , but the market is still concerned about the chain reaction that may be caused by Bybit’s inability to realize profits and losses, and whether USDe will face a deeper risk of decoupling.

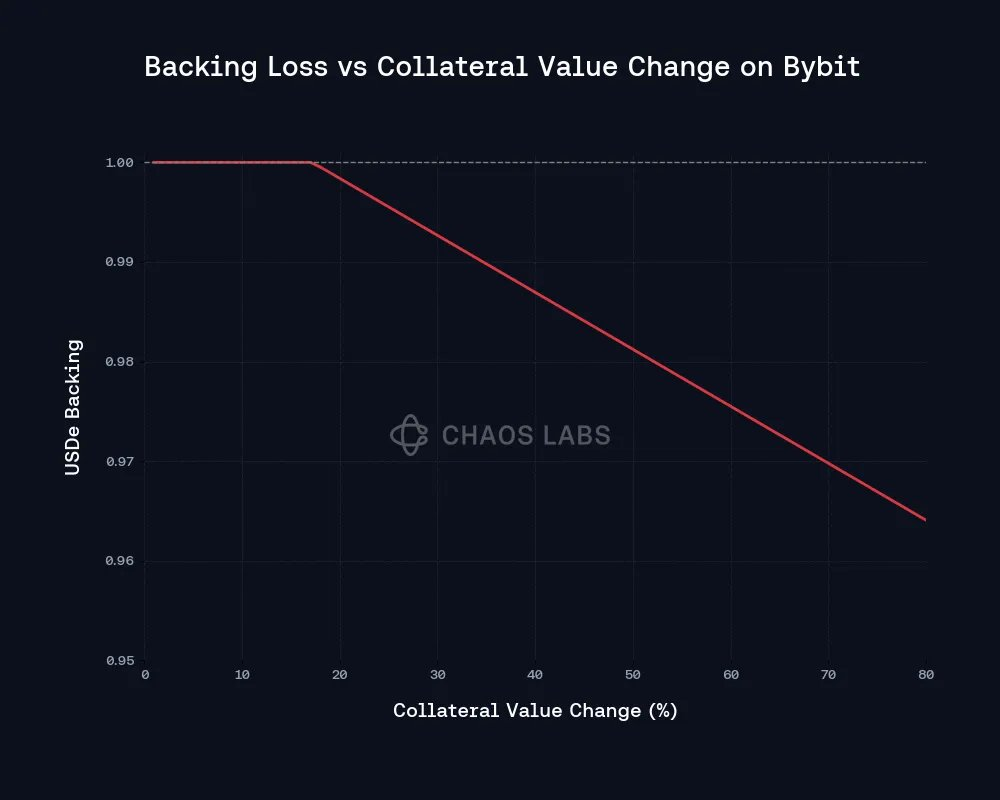

An analysis of Bybit’s bankruptcy risk shows that there are three main hidden dangers: exposure risk caused by USDe hedging failure, chain liquidation risk caused by ETH price decline, and potential DeFi contagion risk.

This prompted the relevant parties to accurately quantify the losses in order to decide whether to take measures such as freezing the sUSDe market. The transparency dashboard shows Ethena's ETH configuration on Bybit, while Ethena Labs' collateral is safely stored over-the-counter at Copper.co . This custody solution and over-the-counter settlement mechanism effectively avoids the bankruptcy risk of exchanges like FTX.

Assuming that the $400 million "book" notional ETH position cannot be liquidated and the ETH price drops 25% before Copper.co releases the funds, Ethena could face an unhedged loss of $100 million. However, considering the $60 million insurance fund, USDe's total backing loss is expected to be only 0.5%.

Based on the judgment that the risks are relatively controllable, Aave has prepared a risk response plan and continues to monitor developments.

In terms of price, USDe showed obvious price deviations in different trading venues. On the Bybit platform, USDe/USDT once fell to $0.96 due to panic selling and lack of immediate arbitrage.

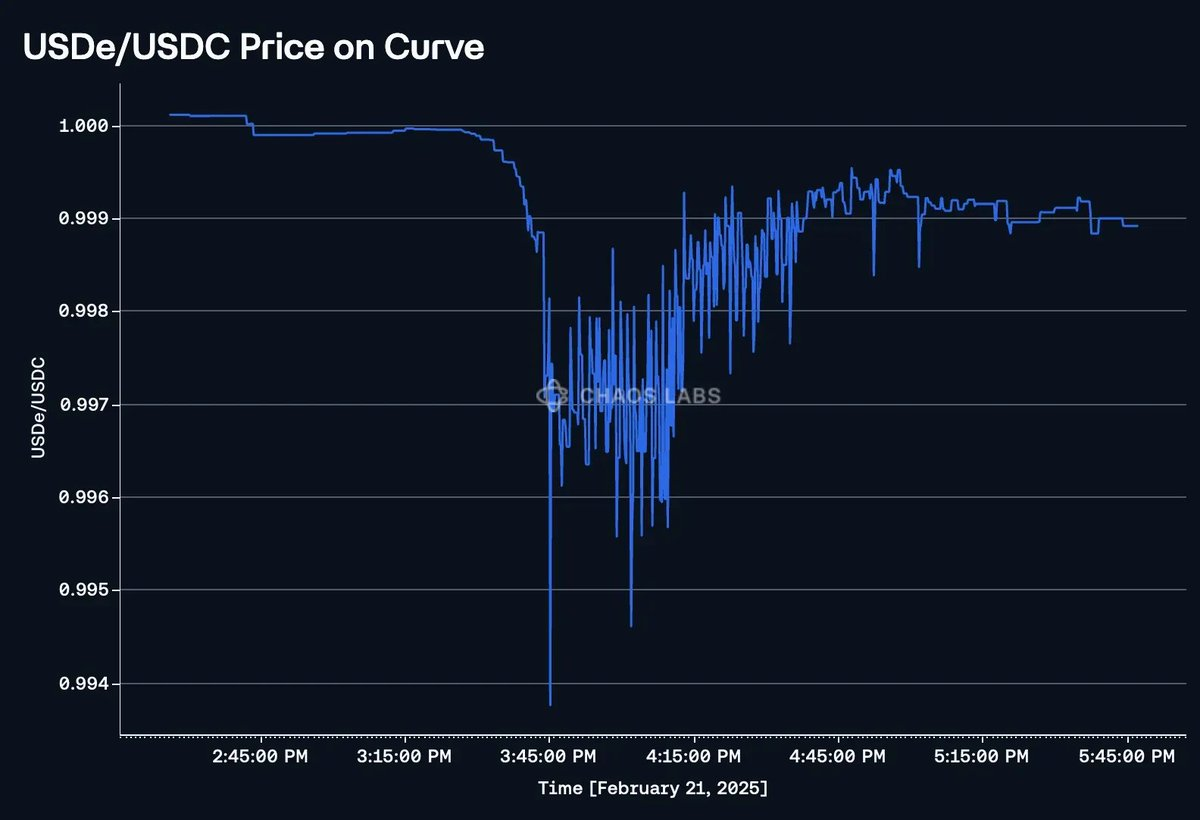

In contrast, on-chain pricing has been more stable, with only a brief decoupling to $0.994, which was quickly recovered through arbitrage. This difference is mainly due to the redemption mechanism and the role of the oracle.

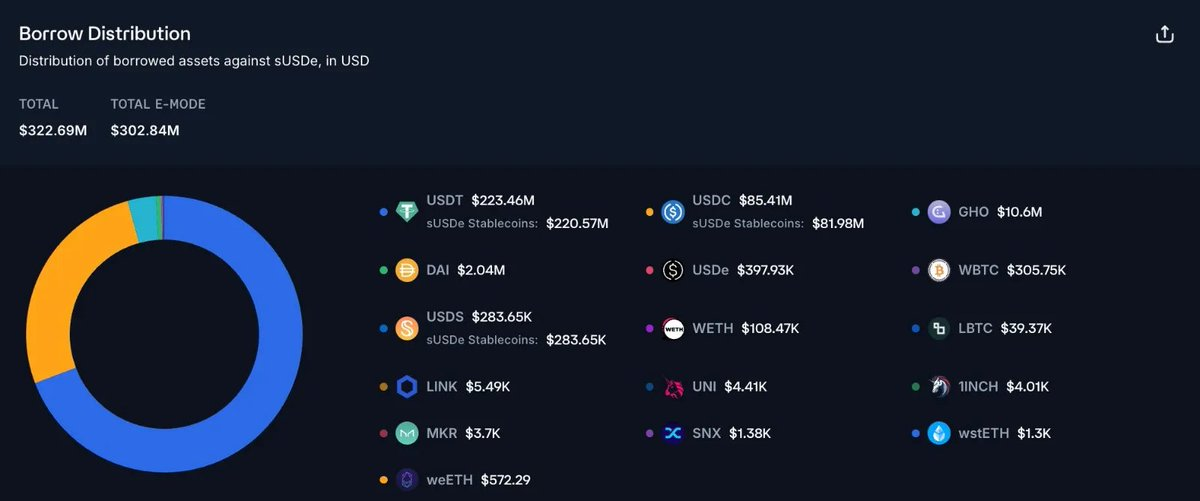

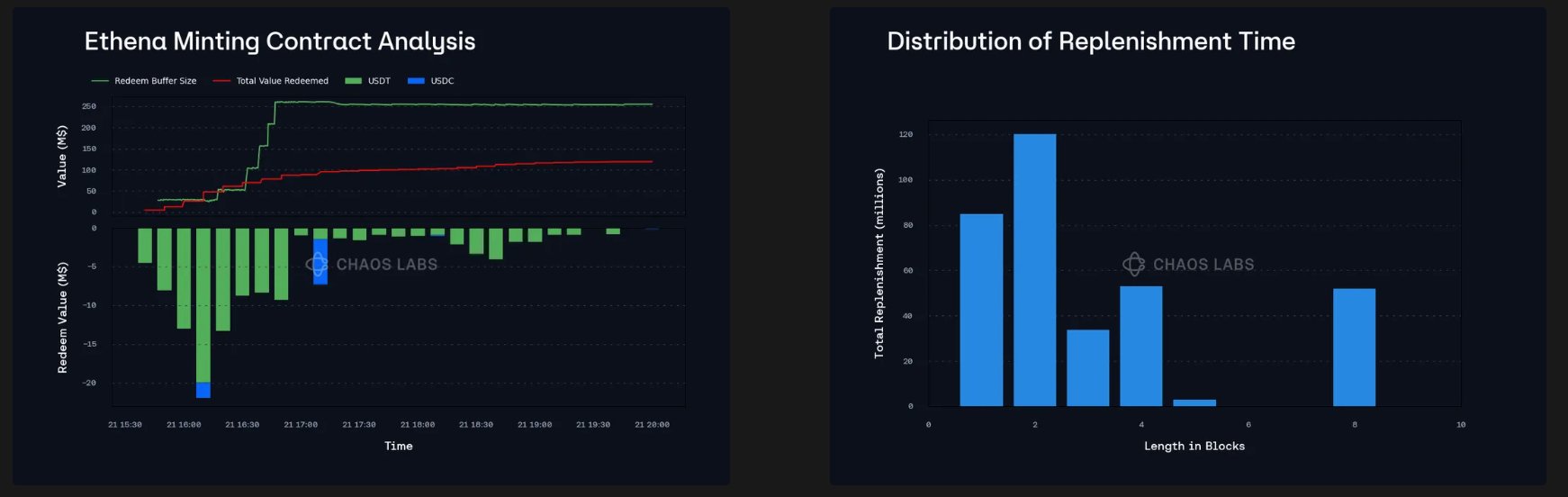

Unlike CeFi, USDe redemptions can be performed continuously and atomically on-chain through the Mint and Redeem contract. USDe's on-chain redemption mechanism worked smoothly, completing $117 million in redemptions in a few hours. Ethena Labs also increased the redemption buffer to $250 million and maintained price stability through continuous replenishment until USDe regained its peg. Due to the atomic nature of USDe redemptions, whitelisted redeemers quickly closed the price gap on Curve.

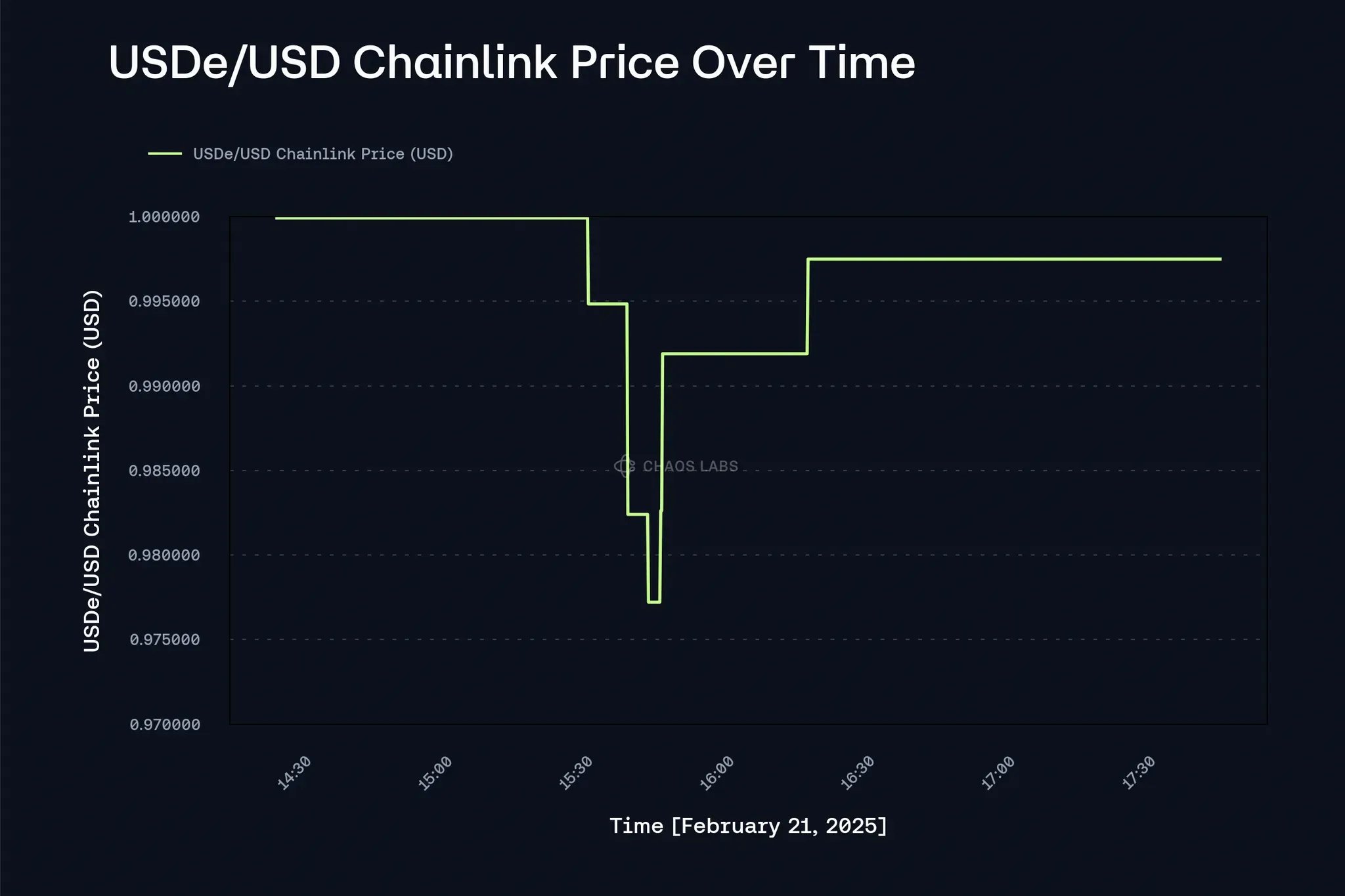

However, the anomaly of the oracle amplified the market risk. Chainlink’s USDe/USD price oracle deviated from the on-chain price and fell to $0.977, although the redemption mechanism was still operating normally.

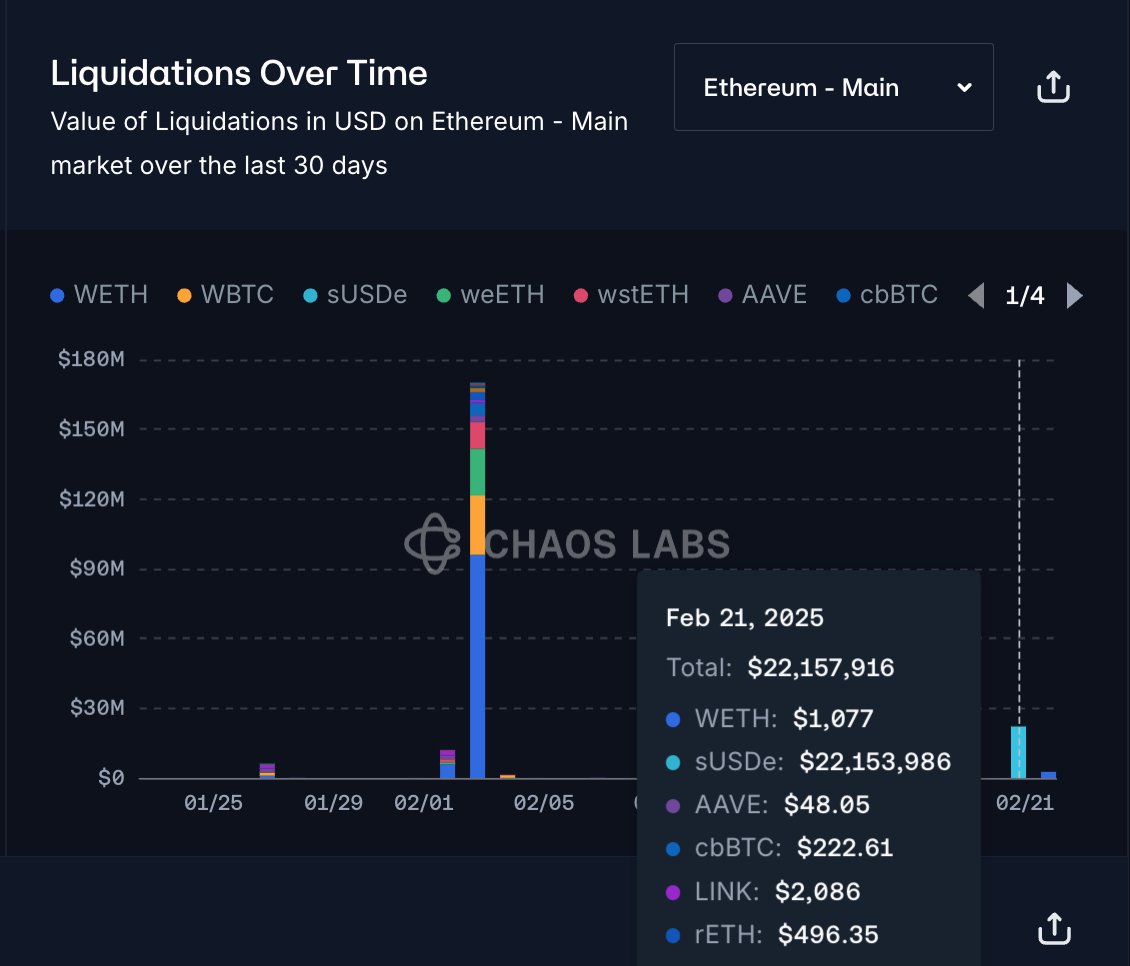

This deviation resulted in $22 million in liquidations on Aave, with traders being liquidated due to secondary market price fluctuations despite the fact that their USDe assets were well collateralized.

This highlights the room for improvement in the oracle mechanism. A smart data source that integrates proof of reserves may be able to provide a more accurate valuation of USDe and avoid unnecessary liquidations. Considering real-time redemption, rather than relying solely on the weighted average transaction price. Such a smart oracle can:

- Prevent unnecessary liquidations;

- Maintaining capital efficiency;

- Reduce market pressure

What can be improved?

Risk, price, and proof-of-reserve data must work together, not in isolation, to ensure value and maintain the resilience of DeFi systems under stress. Price oracles should reflect true collateral backing, not just secondary market prices.

Overall, the DeFi ecosystem withstood this stress test. The Bybit team stabilized the market by maintaining transparent communication, the Ethena Labs team quickly eliminated risk exposure and ensured smooth redemption, and Aave effectively controlled risks without generating bad debts.

This incident shows that in order to build a more resilient system, the industry needs smarter oracles and risk-aware infrastructure to improve capital efficiency while ensuring security. It is only a matter of time before the next major stress test comes, and the industry needs to prepare for it.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates