Solana's 2026 Breakout: $873M RWA Surge and ETF Momentum Signal New Highs

Tokenized Real-World Assets Drive Solana's Institutional Transformation

Solana is entering 2026 with unprecedented momentum in real-world asset (RWA) tokenization, achieving a record $873 million in tokenized assets on its blockchain according to Bitwise, a leading cryptocurrency asset manager. This milestone, combined with growing ETF inflows, positions Solana for potential new price highs as institutional adoption accelerates beyond its traditional DeFi and NFT use cases.

The $873 million in tokenized real-world assets represents a dramatic evolution for Solana, which has historically been associated with decentralized finance protocols, NFT marketplaces, and meme coin trading. The emergence of substantial RWA activity demonstrates Solana's technical capabilities are attracting serious institutional use cases requiring high throughput, low costs, and reliable settlement—precisely the characteristics that distinguish Solana from competing blockchain platforms.

Understanding Real-World Asset Tokenization on Solana

Real-world asset tokenization involves representing traditional financial assets—such as government bonds, corporate debt, real estate, commodities, or private credit—as blockchain-based tokens. This process creates digital representations of physical or traditional financial assets, enabling 24/7 trading, fractional ownership, programmable compliance, and reduced settlement friction compared to legacy financial infrastructure.

Solana's technical architecture makes it particularly suitable for RWA tokenization. The network's high transaction throughput (theoretically capable of processing 65,000 transactions per second) ensures that tokenized assets can trade with minimal latency. Transaction costs averaging fractions of a cent make frequent trading and rebalancing economically viable, unlike high-fee blockchains where transaction costs create significant friction for active asset management.

The $873 million in tokenized assets on Solana encompasses several categories. Tokenized U.S. Treasury securities represent a significant portion, with multiple protocols offering Treasury-backed tokens providing yield to stablecoin holders and institutional investors. Private credit tokenization has emerged as another major category, with lending platforms tokenizing loan portfolios to create liquid secondary markets. Real estate tokenization, while smaller in absolute terms, is growing as property developers and investment funds explore fractional ownership models.

Bitwise's Analysis: Why Solana for Institutional RWA?

Bitwise's highlighting of Solana's RWA momentum reflects the asset manager's view that Solana offers optimal infrastructure for institutional tokenization projects. Several factors support this assessment beyond basic technical performance metrics.

Cost efficiency is paramount for RWA applications where margins may be thin and frequent transactions occur. Tokenizing a $100 million bond portfolio on Ethereum might incur tens of thousands of dollars in transaction costs during initial issuance and subsequent trading activity. The same operations on Solana cost mere hundreds of dollars, fundamentally changing the economics of tokenization.

Settlement finality is critical for financial institutions requiring regulatory compliance and risk management certainty. Solana's proof-of-stake consensus provides rapid finality, with transactions achieving practical irreversibility within seconds rather than minutes or hours required on some competing platforms.

Developer ecosystem maturity has accelerated dramatically over the past two years. Despite network outages that plagued Solana in 2022-2023, the platform has achieved remarkable stability throughout 2024-2025, with uptime exceeding 99.9%. This reliability record has restored institutional confidence necessary for hosting mission-critical financial applications.

Composability with existing Solana DeFi infrastructure creates unique advantages for RWA issuers. Tokenized assets can immediately integrate with Solana's extensive decentralized exchange, lending, and derivatives protocols, creating instant liquidity and financial product innovation impossible in traditional markets.

Major RWA Projects Driving Solana's Growth

Several prominent projects contribute to Solana's $873 million RWA total. Ondo Finance has emerged as a leader in tokenized Treasury products, offering institutional-grade, blockchain-based access to short-duration Treasury securities. Ondo's OUSG token, backed by short-term U.S. government obligations, has attracted substantial institutional capital seeking yield on stablecoin reserves.

Maple Finance represents another significant RWA presence on Solana, focusing on undercollateralized lending to institutional borrowers. Maple's tokenization model creates liquidity for private credit markets traditionally characterized by illiquidity and long holding periods. By tokenizing loan portfolios, Maple enables lenders to exit positions before maturity, improving capital efficiency.

Credix has built a platform for emerging market credit tokenization on Solana, partnering with fintech companies in Latin America and other developing regions to tokenize loan portfolios. This model brings institutional capital to underserved credit markets while providing diversified exposure to higher-yielding assets.

Real estate tokenization projects like Homebase and RealT have expanded Solana presence, offering fractional ownership in properties ranging from residential rentals to commercial real estate. While individual projects remain modest in scale, the aggregated real estate tokenization activity contributes meaningfully to Solana's RWA total.

ETF Inflows: Building the Case for New Highs

Beyond RWA momentum, Bitwise highlights growing ETF inflows as evidence supporting potential new highs for Solana. While Solana spot ETFs have not yet received SEC approval in the United States, several factors suggest approval may be forthcoming and institutional preparation is underway.

Multiple asset managers, including Bitwise itself, have filed applications for spot Solana ETFs with the SEC. Following the successful launch of Bitcoin and Ethereum spot ETFs in 2024, industry participants widely anticipate the SEC will eventually approve additional cryptocurrency ETF products, with Solana representing the most logical next candidate given its market capitalization, liquidity, and institutional adoption.

Grayscale's Solana Trust has experienced significant inflows throughout 2025, despite trading at varying premiums or discounts to net asset value due to its closed-end structure. These inflows demonstrate institutional demand for regulated Solana investment vehicles, suggesting substantial appetite exists for a spot ETF should regulators grant approval.

International Solana ETF products have already launched in several jurisdictions. Canadian regulators approved Solana ETFs in 2024, and these products have attracted steady inflows. European and Asian crypto investment products including Solana exposure have similarly shown strong demand, validating the global institutional interest that would likely translate to substantial U.S. ETF inflows upon approval.

The anticipation of ETF approval itself creates positive momentum for Solana prices. Investors familiar with the dramatic Bitcoin and Ethereum price appreciation following spot ETF launches naturally speculate that Solana could experience similar dynamics, creating self-fulfilling buying pressure in advance of potential approval.

Technical Performance Improvements Supporting Institutional Adoption

Solana's ability to attract $873 million in RWA tokenization reflects dramatic technical improvements implemented over the past two years. Network stability has improved remarkably, with Solana operating without major outages throughout 2024 and 2025 after experiencing several high-profile downtime incidents in 2022 and early 2023.

The Firedancer validator client, developed by Jump Crypto, represents a major technical milestone. This independent validator implementation, written in C rather than Rust like the original Solana validator, improves network resilience through client diversity while potentially increasing throughput beyond current levels. Firedancer testing throughout 2025 has demonstrated the client can process over 1 million transactions per second under laboratory conditions.

State compression improvements have dramatically reduced the cost of creating and managing large numbers of tokens or NFTs on Solana. For RWA applications requiring thousands of individual token instances representing fractional ownership positions, state compression reduces storage costs by up to 1,000x compared to traditional token standards, making previously impractical use cases economically viable.

Solana's validator community has expanded and decentralized substantially, with over 2,000 active validators securing the network as of early 2026. This decentralization addresses previous criticisms about Solana's validator concentration and increases institutional confidence in the network's long-term sustainability and censorship resistance.

Trading Strategies for Solana's RWA and ETF Momentum

The confluence of record RWA adoption and building ETF momentum creates multiple trading opportunities for investors seeking Solana exposure. For those interested in participating in Solana's potential appreciation, platforms like MEXC offer sophisticated trading infrastructure supporting various strategies.

MEXC's SOL/USDT perpetual contract, available at https://www.mexc.com/futures/SOL_USDT, provides leveraged exposure to Solana price movements. This instrument allows traders to establish long positions capitalizing on institutional momentum while maintaining capital efficiency through leverage. For traders analyzing RWA growth and ETF approval catalysts, perpetual contracts offer flexible position management without the complexity of direct token custody.

Spot Solana accumulation represents another approach for investors with longer time horizons who believe RWA growth and eventual ETF approval will drive sustained appreciation. MEXC's spot trading platform offers deep liquidity and competitive fees for building SOL positions gradually through dollar-cost averaging or tactical purchases during price weakness.

Options strategies, once available on Solana, may offer sophisticated approaches to capitalize on volatility around potential ETF approval announcements. Long call options provide leveraged upside exposure while limiting downside risk to the premium paid, potentially suitable for trading ETF approval speculation.

Comparing Solana's RWA Growth to Competing Blockchains

To contextualize Solana's $873 million RWA achievement, comparison with competing blockchain platforms provides valuable perspective. Ethereum remains the dominant blockchain for RWA tokenization, with over $2 billion in tokenized real-world assets according to various blockchain analytics providers. However, Solana's $873 million represents remarkable growth considering the platform's relative youth and technical challenges in previous years.

Ethereum's RWA dominance reflects first-mover advantages, established institutional relationships, and the extensive DeFi ecosystem providing liquidity for tokenized assets. However, Ethereum's higher transaction costs create economic friction that limits certain RWA use cases, particularly those involving frequent trading or rebalancing of tokenized positions.

Stellar and Algorand, blockchains specifically designed for financial applications, have attracted RWA projects but remain well behind Solana in absolute tokenized value. Stellar's focus on cross-border payments and remittances has attracted some tokenization activity, particularly for stablecoins and payment tokens, but broader RWA adoption has been limited. Algorand has pursued institutional partnerships aggressively but has not yet achieved tokenized asset volumes comparable to Solana.

Polygon and other Ethereum Layer 2 solutions represent emerging competition for RWA tokenization. These platforms offer lower costs than Ethereum mainnet while maintaining some degree of Ethereum ecosystem compatibility. However, Polygon's RWA volumes remain modest compared to Solana, suggesting Solana's high-performance architecture provides advantages beyond simple cost reduction.

Regulatory Considerations for RWA Growth and ETF Approval

Solana's RWA momentum and ETF prospects both depend significantly on regulatory developments. Tokenized real-world assets exist in complex regulatory territory, with multiple agencies potentially claiming jurisdiction depending on the specific asset type and offering structure.

The SEC's treatment of RWA tokens varies based on how they're structured and marketed. Tokens representing ownership in traditional securities must typically comply with existing securities laws, including registration requirements or exemption eligibility. Many Solana RWA projects structure offerings under Regulation D or Regulation S exemptions limiting participation to accredited investors or non-U.S. persons.

The Office of the Comptroller of the Currency (OCC) and Federal Reserve have issued guidance about bank participation in blockchain-based asset custody and tokenization activities. This evolving regulatory framework affects how traditional financial institutions can interact with Solana RWA projects, influencing the potential scale of institutional participation.

Solana ETF approval depends on the SEC's evolving cryptocurrency policy. The approval of Bitcoin and Ethereum spot ETFs established important precedents, but the SEC has historically required extensive analysis before approving ETFs for additional crypto assets. Factors affecting Solana ETF approval likelihood include market manipulation concerns, custody solutions, liquidity metrics, and correlation with Bitcoin prices.

International regulatory approaches vary significantly. The European Union's Markets in Crypto-Assets (MiCA) regulation provides comprehensive framework for cryptocurrency products including tokenized assets and investment funds. This regulatory clarity has positioned Europe as potentially friendlier to Solana RWA and ETF products than the United States currently.

Institutional Use Cases Beyond Traditional RWA

While the $873 million figure focuses on traditional real-world asset tokenization, Solana's institutional adoption extends into additional use cases that blur boundaries between conventional RWA and blockchain-native applications.

Central bank digital currency (CBDC) experimentation has included Solana-based pilot projects. Several nations exploring CBDC implementations have tested Solana's infrastructure for retail or wholesale digital currency systems, attracted by the platform's throughput capabilities and low transaction costs.

Supply chain tokenization represents emerging institutional use case where physical goods are tracked through blockchain-based tokens throughout their lifecycle. Solana's speed and cost characteristics make it suitable for high-frequency supply chain updates tracking inventory movements, quality certifications, or provenance documentation.

Loyalty program tokenization has attracted corporate interest, with companies exploring blockchain-based loyalty points that can trade across programs or convert to other assets. Solana's low costs make frequent small-value loyalty transactions economically viable compared to higher-fee blockchains.

Intellectual property tokenization is emerging as novel use case where patents, copyrights, or other IP rights are represented as tradable tokens enabling fractional ownership or licensing. While early-stage, this application demonstrates how RWA concepts extend beyond traditional financial assets.

Risks and Challenges Despite Positive Momentum

Despite impressive RWA growth and ETF momentum, Solana faces significant risks that could derail bullish scenarios. Network stability, while dramatically improved, remains concern given historical outages. Any future significant downtime could severely damage institutional confidence and trigger RWA project migrations to competing platforms.

Regulatory risk represents perhaps the most significant uncertainty. Negative SEC actions regarding Solana's token status, RWA project enforcement actions, or ETF application rejections could substantially impact both institutional adoption and token prices. The SEC has previously suggested that many cryptocurrencies beyond Bitcoin and Ethereum may qualify as securities requiring registration.

Competition from established blockchain platforms and emerging competitors creates ongoing pressure. Ethereum's dominance in DeFi and institutional relationships provides significant network effects difficult for Solana to overcome. New blockchain platforms optimized specifically for RWA tokenization could fragment institutional adoption.

Smart contract vulnerabilities represent constant risk in DeFi and RWA applications. High-profile hacks or exploits affecting major Solana RWA projects could trigger institutional flight to safety on more established platforms. While Solana's code auditing practices have improved, complex smart contract systems inevitably contain potential vulnerabilities.

Conclusion: Fundamentals Align for Potential Breakout

Solana's entrance into 2026 with record $873 million in tokenized real-world assets and building ETF momentum represents significant fundamental improvement compared to the network's troubled 2022-2023 period. Bitwise's analysis highlighting these developments as supporting potential new highs reflects legitimate case that institutional adoption is accelerating beyond speculative trading into serious financial infrastructure use cases.

For traders and investors seeking to participate in Solana's potential appreciation, platforms like MEXC provide essential trading infrastructure. The platform's SOL/USDT perpetual contract (https://www.mexc.com/futures/SOL_USDT) offers flexible exposure management while spot trading enables direct accumulation strategies.

However, substantial risks remain, including regulatory uncertainties, competitive pressures, and technical challenges. The path to new all-time highs depends not only on continued RWA growth and eventual ETF approval but also on sustained positive sentiment in broader cryptocurrency markets and successful navigation of regulatory complexity.

The coming months will reveal whether Solana's institutional momentum can translate into sustained price appreciation and genuine transformation into institutional financial infrastructure. The $873 million RWA milestone and growing ETF anticipation provide compelling fundamental narrative supporting bullish scenarios, positioning Solana as one of 2026's most closely watched cryptocurrency assets.

You May Also Like

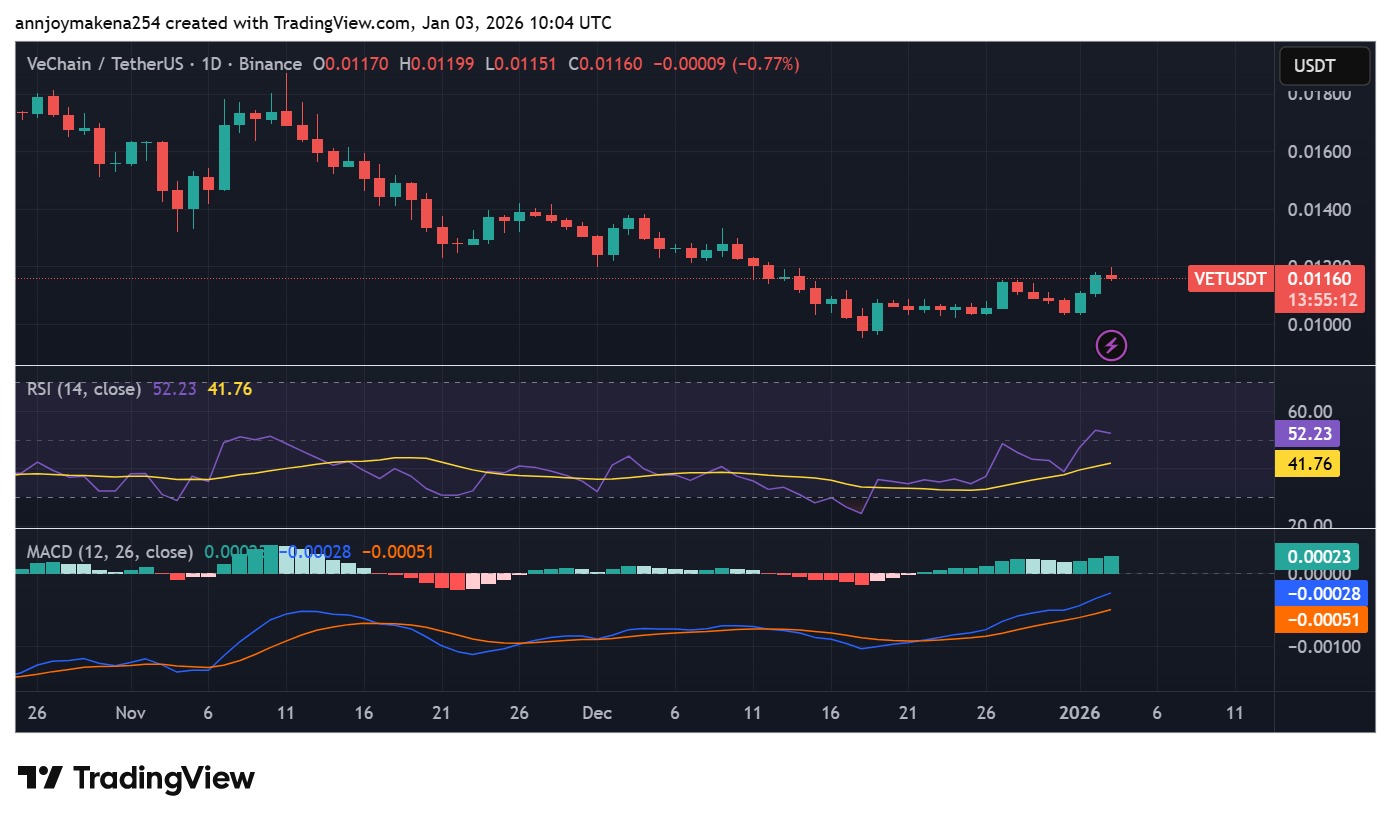

VeChain Blockchain Gains Traction as VET Hits Kraken

Why Is MYX Finance (MYX) Price Pumping?